Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Predictive Analytics,

Customer Experience,

Marketing Planning,

Reporting,

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Demand Planning,

Integrated Business Planning,

Project Planning

For most of the past decade businesses that decided not to pay attention to proposed changes in revenue recognition rules have saved themselves time and frustration as the proponents’ timetables have slipped and roadmaps have changed. The new rules are the result of a convergence of US-GAAP (Generally Accepted Accounting Principles – the accounting standard used by U.S.-based companies) and IFRS (International Financial Reporting Standards – the system used in much of the rest of the world)....

Read More

Topics:

Planning,

Customer Experience,

Office of Finance,

Reporting,

Revenue Performance,

Budgeting,

Tax,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

commission,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

Read More

Topics:

SaaS,

Customer Experience,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Recurring Revenue,

Zuora,

Cloud Computing,

Customer Service,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

billing software,

Intacct

Recurring revenue is a term applied to business models that involve three types of selling and billing structures: a one-time transaction plus a periodic service charge; subscription-based services involving periodic charges; or a contractual relationship that charges periodically for goods and services. Telecommunications was the first major industry to use it, but recently the model has gained popularity in others. It is a major trend in information technology as an increasing number of...

Read More

Topics:

SaaS,

Customer Experience,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Recurring Revenue,

Zuora,

Cloud Computing,

Customer Service,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

billing software,

Intacct

Like other vendors of cloud-based ERP software, NetSuite offers the key benefits of software as a service (SaaS): a smaller upfront investment, faster time to value and potentially lower operating costs. Beyond that NetSuite’s essential point of competitive differentiation from is broad functionality beyond financial management, including capabilities for customer relationship management (CRM), professional services automation (PSA) and human capital management (HCM). These components make it...

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Customer Experience,

ERP,

HCM,

Human Capital,

Office of Finance,

Operational Performance Management (OPM),

communications,

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

PSA,

Sage Software,

UI,

Unit4,

Analytics,

Business Analytics,

Cloud Computing,

Business Performance Management (BPM),

CFO,

CRM,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

FinancialForce,

HR,

Infor,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Social,

Financial Performance Management,

FPM,

Plex,

Professional Services Automation,

Workday Collaboration

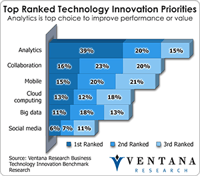

The developed world has an embarrassment of riches when it comes to information technology. Individuals walk around with far more computing power and data storage in their pockets than was required to send men to the moon. People routinely hold on their laps what would have been considered a supercomputer a generation ago. There is a wealth of information available on the Web. And the costs of these information assets are a tiny fraction of what they were decades ago. Consumer products have...

Read More

Topics:

Big Data,

Mobile,

Predictive Analytics,

Social Media,

Customer Experience,

Operational Performance Management (OPM),

Performance,

Analytics,

Business Analytics,

Business Collaboration,

IBM,

Business Performance Management (BPM),

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Sales Performance Management,

Sales Performance Management (SPM),

Social,

Financial Performance Management,

SPSS

Epicor used its recent user group conference to explain its strategic direction and product roadmap. The company is the result of multiple mergers of business software corporations over the past 15 years; its target customers are midsize companies and midsize divisions of larger organizations. Its most significant products are Epicor (ERP software aimed mainly at manufacturing and distribution companies) and Activant Solutions (software for small and midsize retailers, including a point-of-sale...

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Customer Experience,

ERP,

HCM,

Human Capital,

Office of Finance,

Operational Performance Management (OPM),

communications,

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

Epicor,

Sage Software,

UI,

Unit4,

Analytics,

Business Analytics,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

FinancialForce,

HR,

Infor,

Supply Chain Performance Management (SCPM),

Workday,

Workforce Performance Management (WPM),

Social,

Financial Performance Management,

FPM,

Plex

From my perspective, Infor’s strategy to accelerate revenue growth is to offer companies more innovation and a lower and more predictable cost of ownership than its rivals in the business software market; its products include the major categories of ERP, human resources and financial performance management. It aims to innovate by focusing on improving the user experience and to lower costs by redesigning its software architecture. The innovation stems from a fresh approach to designing...

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Customer Experience,

ERP,

HCM,

Human Capital,

Office of Finance,

Operational Performance Management (OPM),

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

Sage Software,

UI,

Unit4,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

FinancialForce,

HR,

Infor,

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workday,

Workforce Performance Management (WPM),

Financial Performance Management,

FPM,

Plex

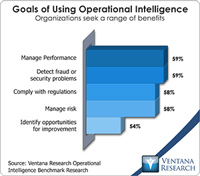

All the hubbub around big data and analytics has many senior finance executives wondering what the big deal is and what they should do about it. It can be especially confusing because much of what’s covered and discussed on this topic is geared toward technologists and others working outside of Finance, in areas such as sales, marketing and risk management. But finance executives need to position their organization to harness this technology to support the strategic goals of their company. To...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Controller,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

CFO,

compliance,

finance,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

Financial Performance Management,

financial risk management

Finance departments don’t immediately come to mind in conversations about social collaboration technology. Most of the software used for social collaboration that I’ve seen demonstrated focuses on the sales process or for broader employee engagement. The Facebook-style interface may cause finance department managers and executives to roll their eyes, especially if they’re over 40 years old. Yet business and social collaboration is an important set of capabilities that has been taking hold in...

Read More

Topics:

Customer Experience,

ERP,

Operational Performance Management (OPM),

communications,

Business Collaboration,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CRM,

Financial Performance Management (FPM),

Workforce Performance Management (WPM),

Social,

FPM