Like many other industry observers I’ve heard overblown claims for information technology for decades. However, I’ve also observed that – eventually – reality catches up with vision. Finance and accounting departments are particularly resistant to change, yet because almost no corporations use adding machines or typewriters any more, it’s clear that transformative change can happen. Nonetheless, because users of business computing systems are inundated with “it’s better than ever” promotions by...

Read More

Topics:

Social Media,

Mobile Technology,

Office of Finance,

Operational Performance Management (OPM),

Human Capital,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM)

Infor recently held its annual Innovation Summit at its New York City headquarters. The company has shown leadership and creativity in business applications on two fronts: focusing its development efforts on enhancing the user experience and collaboration and building an application architecture that will deliver a rich set of functionality for ERP, financial management, CRM and HRMS and business analytics in a multitenant cloud environment. All of these advances were necessary to remake a...

Read More

Topics:

Mobile Technology,

Operational Performance Management (OPM),

accounting, analytics, ERP, EAM, CRM, HCM, innovat,

Human Capital,

Business Analytics,

Cloud Computing,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM)

The evolutionary pace of technologies that shape the design of ERP systems has been accelerating over the last couple of years. In addition to cloud computing there is the increasing availability of analytics and reporting integrated into transaction processing systems, which I have noted; support for mobile users; in-context collaboration; and more intuitive user interface (UI) design. Each of these features enhances productivity and the usefulness of ERP software in managing a business. The...

Read More

Topics:

Human Capital,

Business Collaboration,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM)

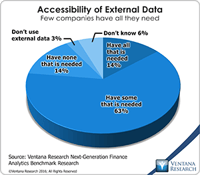

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Social Media,

FP&A,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Human Capital,

Kofax,

Statistics,

Analytics,

Business Analytics,

Business Intelligence,

Customer Performance Management (CPM),

Data,

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Strata+Hadoop

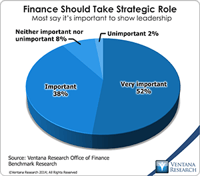

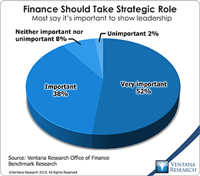

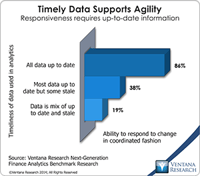

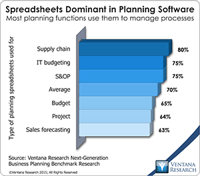

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments totake a strategic role in running...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Human Capital,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Uncategorized,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

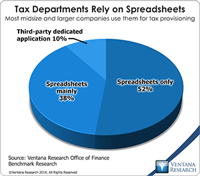

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Human Capital,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

The ERP market is set to undergo a significant transformation over the next five years. At the heart of this transformation is the decade-long evolution of a set of technologies that are enabling a major shift in the design of ERP systems – the most significant change since the introduction of client/server systems in the 1990s. Some ERP software vendors increasingly are utilizing in-memory computing, mobility, in-context collaboration and user interface design to differentiate their...

Read More

Topics:

Performance Management,

ERP,

FP&A,

Office of Finance,

Reporting,

Consolidation,

Human Capital,

Business Analytics,

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Financial Performance Management,

FPM

Supply and demand chain planning and execution have grown in importance over the past decade as companies have recognized that software can meaningfully enhance their competitiveness and improve their financial performance. Sales and operations planning (S&OP) is an integrated business management process first developed in the 1980s aimed at achieving better alignment and synchronization between the supply chain, production and sales functions. A properly implemented S&OP process routinely...

Read More

Topics:

Planning,

SaaS,

Sales,

Forecast,

Mobile Technology,

Operational Performance Management (OPM),

Human Capital,

Supply Chain Planning,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Sales Planning,

Supply Chain,

Supply Chain Performance Management (SCPM),

Demand Chain,

Integrated Business Planning,

SCM Demand Planning,

S&OP

Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

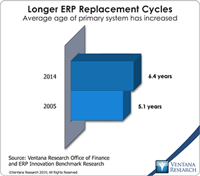

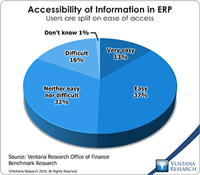

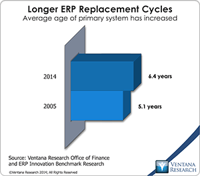

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct