Revenue recognition standards for companies that use contracts are in the process of changing, as I covered in an earlier perspective. As part of managing their transition to these standards, CFOs and controllers should initiate a full-scale review of their order-to-cash cycle. This should include examination of their company’s sales contracts and their contracting process. They also should examine how well their contracting processes are integrated with invoicing and billing and any other...

Read More

Topics:

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Revenue Performance,

Budgeting,

Tax,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

For most of the past decade businesses that decided not to pay attention to proposed changes in revenue recognition rules have saved themselves time and frustration as the proponents’ timetables have slipped and roadmaps have changed. The new rules are the result of a convergence of US-GAAP (Generally Accepted Accounting Principles – the accounting standard used by U.S.-based companies) and IFRS (International Financial Reporting Standards – the system used in much of the rest of the world)....

Read More

Topics:

Planning,

Customer Experience,

Office of Finance,

Reporting,

Revenue Performance,

Budgeting,

Tax,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

commission,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

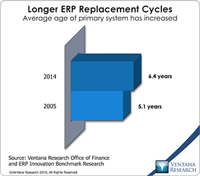

Recently, Infor held its second innovation conference with industry analysts at its New York City headquarters. Infor’s products include the major categories of ERP, human capital management and financial performance management applications. Behind the marketing aspects of its use of “innovation” is a business strategy for retaining existing customers, migrating a sizable percentage of those customers to the cloud and gaining new customers. (Because of the relative size of the installed base,...

Read More

Topics:

Social Media,

Office of Finance,

Human Capital,

UX,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM)