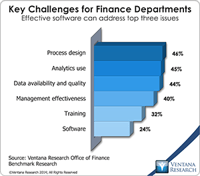

Our recently published Office of Finance benchmark research assesses a broad set of functions and capabilities of finance organizations. We asked research participants to identify the most important issues for a finance department to address in a dozen functional areas: accounting, budgeting, cost accounting, customer profitability management, external financial reporting, financial analysis, financial governance and internal audit, management accounting, product profitability management,...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

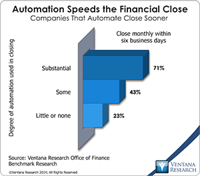

Our recent Office of Finance benchmark research demonstrates the importance of using automation to execute finance department functions. Information technology systems do at least two things very well that make better use of people’s time, and both of them can substantially improve organizational performance. First, they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires judgment and skill. IT systems also can be programmed...

Read More

Topics:

Big Data,

Mobile,

Planning,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

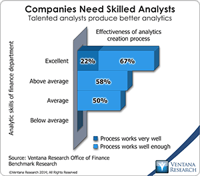

Finance and accounting departments are staffed with numbers-oriented, naturally analytical people. Strong analytic skills are essential if a finance department is to deliver deep insights into performance and visibility into emerging opportunities and challenges. The conclusions of analyses enable fast, fully informed business decisions by executives and managers. Conversely, flawed analyses undermine the performance of a company. So it was good news that in our Office of Finance benchmark...

Read More

Topics:

Big Data,

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Tagetik,

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

One of the charitable causes to which I devote time puts on an annual vintage car show. The Concours d’Élegance dates back to 17th century France, when wealthy aristocrats gathered with judges on a field to determine who had the best carriages and the most beautiful horsepower. Our event serves as the centerpiece of a broader mission to raise money for several charitable organizations. One of my roles is to keep track of the cars entered in the show, and in that capacity I designed an online...

Read More

Topics:

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Self-service,

Budgeting,

dashboard,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Data,

Financial Performance Management (FPM),

Information Applications (IA),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management,

Microsoft Excel,

Spreadsheets

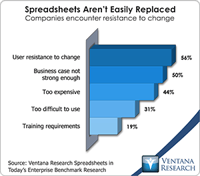

I’ve been advocating more intelligent use of spreadsheets for the better part of a decade. Ventana Research coined the term “enterprise spreadsheet” in 2004 to describe software applications that marry a Microsoft Excel user interface with a business rules server and a relational or multidimensional data store. This approach offers the best of both worlds in the sense of taking advantage of widespread familiarity and training with Excel while substantially reducing issues stemming from the...

Read More

Topics:

Planning,

Social Media,

Sustainability,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Customer Performance Management (CPM),

Data,

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

IT Performance Management (ITPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management,

Microsoft Excel,

Spreadsheets

Actuate held its annual customer day in San Francisco amid the happy chaos of the World Series champion Giants’ ticker-tape celebration, and on that day the company’s ticker symbol changed from ACTU to BIRT (a shift, incidentally, botched by NASDAQ). There was a great deal of focus on its ActuateOne platform (which my colleague reviewed here) and the advancements in using open source software like BIRT with now over ten million downloads, but the aspect I want to highlight is the BIRT...

Read More

Topics:

Microsoft,

Open Source Software,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Information Management (IM),

Microsoft Excel,

Spreadsheets