Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

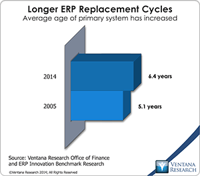

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

SAP,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Tax,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Data,

finance,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

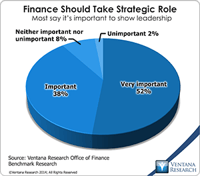

Many senior finance executives say they want their department to play a more strategic role in the management and operations of their company. They want Finance to shift its focus from processing transactions to higher-value functions in order to make more substantial contributions to the success of the organization. I use the term “continuous accounting” to represent an approach to managing the accounting cycle that can facilitate the shift by improving the performance of the accounting...

Read More

Topics:

ERP,

FP&A,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Spreadsheets

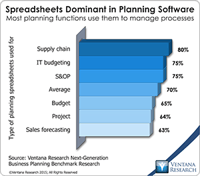

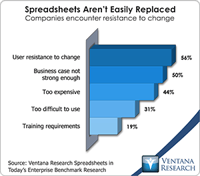

In our benchmark research at least half of participants that use spreadsheets to support a business process routinely say that these tools make it difficult for them to do their job. Yet spreadsheets continue to dominate in a range of business functions and processes. For example, our recent next-generation business planning research finds that this is the most common software used for performing 11 of the most common types of planning. At the heart of the problem is a disconnect between what...

Read More

Topics:

Planning,

ERP,

Forecast,

GRC,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

closing,

dashboard,

enterprise spreadsheet,

Excel,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Data,

Financial Performance Management (FPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

application,

benchmark,

Financial Performance Management

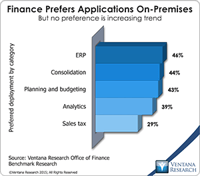

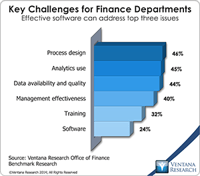

Our recently published Office of Finance benchmark research assesses a broad set of functions and capabilities of finance organizations. We asked research participants to identify the most important issues for a finance department to address in a dozen functional areas: accounting, budgeting, cost accounting, customer profitability management, external financial reporting, financial analysis, financial governance and internal audit, management accounting, product profitability management,...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

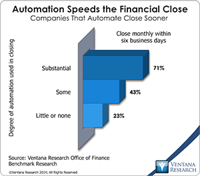

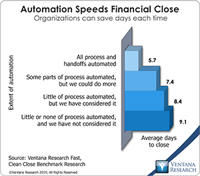

Our recent Office of Finance benchmark research demonstrates the importance of using automation to execute finance department functions. Information technology systems do at least two things very well that make better use of people’s time, and both of them can substantially improve organizational performance. First, they eliminate the need for people to do repetitive tasks, which frees them to spend time on more valuable work that requires judgment and skill. IT systems also can be programmed...

Read More

Topics:

Big Data,

Mobile,

Planning,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

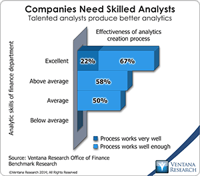

Finance and accounting departments are staffed with numbers-oriented, naturally analytical people. Strong analytic skills are essential if a finance department is to deliver deep insights into performance and visibility into emerging opportunities and challenges. The conclusions of analyses enable fast, fully informed business decisions by executives and managers. Conversely, flawed analyses undermine the performance of a company. So it was good news that in our Office of Finance benchmark...

Read More

Topics:

Big Data,

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Tagetik,

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets

One of the charitable causes to which I devote time puts on an annual vintage car show. The Concours d’Élegance dates back to 17th century France, when wealthy aristocrats gathered with judges on a field to determine who had the best carriages and the most beautiful horsepower. Our event serves as the centerpiece of a broader mission to raise money for several charitable organizations. One of my roles is to keep track of the cars entered in the show, and in that capacity I designed an online...

Read More

Topics:

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Self-service,

Budgeting,

dashboard,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Data,

Financial Performance Management (FPM),

Information Applications (IA),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management,

Microsoft Excel,

Spreadsheets

A core objective of my research practice and agenda is to help the Office of Finance improve its performance by better utilizing information technology. As we kick off 2014, I see five initiatives that CFOs and controllers should adopt to improve their execution of core finance functions and free up time to concentrate on increasing their department’s strategic value. Finance organizations – especially those that need to improve performance – usually find it difficult to find the resources to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

close,

dashboard,

PRO,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

CEO,

demand management,

Financial Performance Management,

FPM,

S&OP