Artificial intelligence using machine learning has passed through the bright, shiny object stage and software vendors are well into the process of making the concept a reality in their offerings. Ventana Research defines AI as the use of technology to process information in much the way humans do, including improving accuracy in recommendations, actions and conclusions as more data is received. I like the alternative term “augmented intelligence” because it emphasizes that these systems enhance...

Read More

Topics:

Planning,

Machine Learning,

Budgeting,

Business Planning,

Financial Performance Management,

forecasting,

digital finance,

AI & Machine Learning,

profitability management

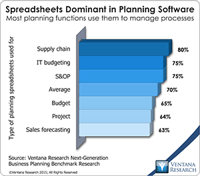

Having just completed the 2022 Ventana Research Value Index for Business Planning, I want to share some of my observations about the business planning software market and how it has advanced as an important part of our market coverage for almost two decades. Dedicated applications for planning and budgeting have been around since the 1980s and are, therefore, quite mature, with robust features and functionality as well as continual refinements in usability and performance. Outwardly, the...

Read More

Topics:

Planning,

Office of Finance,

Budgeting,

Business Planning

The use of blockchain distributed ledgers in business processes is now a common theme in many business software vendors’ presentations. The technology has a multitude of potential uses. However, presentations about the opportunities for digital transformation always leave me wondering: How is this magic going to happen? I wonder this because the details about how data flows from point A to point B via a blockchain are critically important to blockchain utility and therefore the pace of its...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

Ventana Research uses the term “predictive finance” to describe a forward-looking, action-oriented finance organization that places emphasis on advising its company rather than fulfilling the traditional roles of a transactions processor and reporter. Technology is driving the shift away from the traditional bean-counting role. The cumulative evolution of software advances will substantially reduce finance and accounting workloads by automating most of the mechanical, rote functions in...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

Prophix is an established provider of financial performance management (FPM) software for planning and budgeting, forecasting, analysis and reporting, and managing the financial close and consolidation process. Its eponymous software is designed specifically for midsize companies or midsize divisions of larger corporations. These organizations are a distinctive segment of the market in that they have almost all the functional requirements of large enterprises but have fewer resources to apply...

Read More

Topics:

Planning,

Office of Finance,

Reporting,

Budgeting,

Consolidation,

Continuous Planning,

Analytics,

Business Intelligence,

Collaboration,

Financial Performance Management,

Integrated Business Planning,

accounting close,

Price and Revenue Management,

Work and Resource Management,

Sales Planning and Analytics,

Midsize

Centage recently releasedBudget Maestro Version 9, a complete revamping of its longstanding budgeting application designed for midsize companies. The software, now offered as a multitenant cloud-based offering, delivers several structural improvements that can enhance the effectiveness of a company’s planning processes and at the same time is easier to use. Budget Maestro Version 9 is designed to support what Centage is calling a “Smart Budgets” approach to replace traditional budgeting. This...

Read More

Topics:

Planning,

Reporting,

Budgeting,

Consolidation,

Analytics,

Business Planning

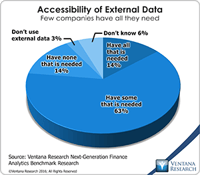

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Social Media,

FP&A,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Human Capital,

Kofax,

Statistics,

Analytics,

Business Analytics,

Business Intelligence,

Customer Performance Management (CPM),

Data,

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Strata+Hadoop

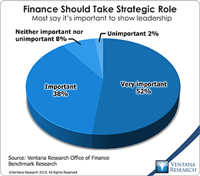

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments totake a strategic role in running...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Human Capital,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Uncategorized,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

Supply and demand chain planning and execution have grown in importance over the past decade as companies have recognized that software can meaningfully enhance their competitiveness and improve their financial performance. Sales and operations planning (S&OP) is an integrated business management process first developed in the 1980s aimed at achieving better alignment and synchronization between the supply chain, production and sales functions. A properly implemented S&OP process routinely...

Read More

Topics:

Planning,

SaaS,

Sales,

Forecast,

Mobile Technology,

Operational Performance Management (OPM),

Human Capital,

Supply Chain Planning,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Sales Planning,

Supply Chain,

Supply Chain Performance Management (SCPM),

Demand Chain,

Integrated Business Planning,

SCM Demand Planning,

S&OP

Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Predictive Analytics,

Customer Experience,

Marketing Planning,

Reporting,

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Demand Planning,

Integrated Business Planning,

Project Planning