Today’s proponents of artificial intelligence (AI) tend to focus on its spectacular uses such as self-driving cars and uplifting ones such as medical treatment. AI also has the potential to aid humanity in more modest ways such as eliminating the need for individuals to do tedious repetitive work in white-collar areas. Along these lines, at its recent Vision users conference, IBM displayed an application of its Watson cognitive computing technology designed to automate important aspects of...

Read More

Topics:

Big Data,

Operational Performance Management (OPM),

Cloud Computing,

Governance, Risk & Compliance (GRC),

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM),

GRC, governance, risk, compliance, risk management

Workiva offers Wdesk, a cloud-based productivity application for handling composite documents. I use the term “composite document” to refer to those in which text is created and edited collaboratively by multiple contributors and which incorporates tabular and numerical data from multiple sources in a controlled process. Composite documents often have formats defined by law, regulation or contract and must be created at periodic intervals. To comply with the requirement by the United States...

Read More

Topics:

Mobile Technology,

Business Collaboration,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Uncategorized,

Business Performance Management (BPM),

Composite Software,

Financial Performance Management (FPM)

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Human Capital,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

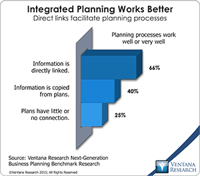

Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Predictive Analytics,

Customer Experience,

Marketing Planning,

Reporting,

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Demand Planning,

Integrated Business Planning,

Project Planning

IBM’s Vision user conference brings together customers who use its software for financial and sales performance management (FPM and SPM, respectively) as well as governance, risk management and compliance (GRC). Analytics is a technology that can enhance each of these activities. The recent conference and many of its sessions highlighted IBM’s growing emphasis on making more sophisticated analytics easier to use by – and therefore more useful to – general business users and their organizations....

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Operational Performance Management (OPM),

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

For most of the past decade businesses that decided not to pay attention to proposed changes in revenue recognition rules have saved themselves time and frustration as the proponents’ timetables have slipped and roadmaps have changed. The new rules are the result of a convergence of US-GAAP (Generally Accepted Accounting Principles – the accounting standard used by U.S.-based companies) and IFRS (International Financial Reporting Standards – the system used in much of the rest of the world)....

Read More

Topics:

Planning,

Customer Experience,

Office of Finance,

Reporting,

Revenue Performance,

Budgeting,

Tax,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

commission,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

There’s a long history of companies not paying close enough attention to the contractual elements of acquiring software. Today, this extends into the world of cloud computing. Many companies are choosing to acquire software services through cloud-based providers and increasingly rely on access to cloud-based data, as is shown by our forthcoming benchmark research, in which a large majority of participating companies said that having access to data in the cloud is important or very important. As...

Read More

Topics:

SaaS,

Operational Performance Management (OPM),

contract,

e-discovery,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM)

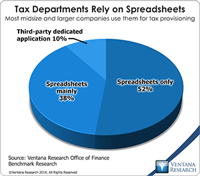

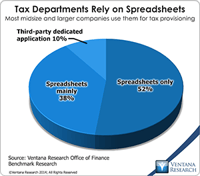

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

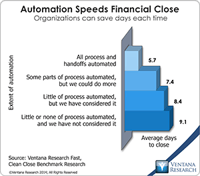

Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software