Longview Solutions has a longstanding presence in the financial performance management (FPM) software market and was rated a Hot vendor in our most recent FPM Value Index. Several years ago it began offering a tax provision and planning application. I think it’s worthwhile to focus on the tax category because it’s less well known than others in finance and is an engine of growth for Longview. We expect larger corporations increasingly to adopt software to manage direct (income) taxes to improve...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

FPM,

Innovation Awards

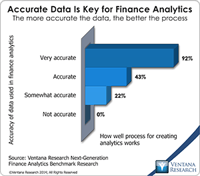

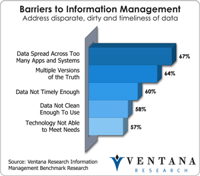

Our research consistently finds that data issues are a root cause of many problems encountered by modern corporations. One of the main causes of bad data is a lack of data stewardship – too often, nobody is responsible for taking care of data. Fixing inaccurate data is tedious, but creating IT environments that build quality into data is far from glamorous, so these sorts of projects are rarely demanded and funded. The magnitude of the problem grows with the company: Big companies have more...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Applications (IA),

Risk,

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

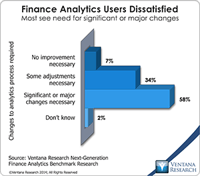

Business computing has undergone a quiet revolution over the past two decades. As a result of having added, one-by-one, applications that automate all sorts of business processes, organizations now collect data from a wider and deeper array of sources than ever before. Advances in the tools for analyzing and reporting the data from such systems have made it possible to assess financial performance, process quality, operational status, risk and even governance and compliance in every aspect of a...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

CEO,

Financial Performance Management,

FPM

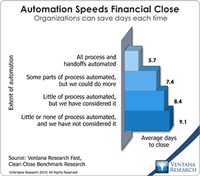

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

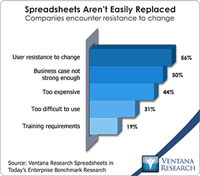

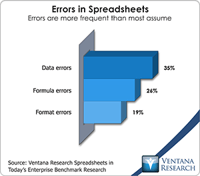

Our benchmark research on enterprise spreadsheets explores the pitfalls that await companies that use desktop spreadsheets such as Microsoft Excel in repetitive, collaborative enterprise-wide processes. Because people are so familiar with Excel and therefore are able to quickly transform their finance or business expertise into a workable spreadsheet for modeling, analysis and reporting, desktop spreadsheets became the default choice. Individuals and organizations resist giving up their...

Read More

Topics:

GRC,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

enterprise spreadsheet,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

Financial Performance Management

Senior finance executives and finance organizations that want to improve their performance must recognize that technology is a key tool for doing high-quality work. To test this premise, imagine how smoothly your company would operate if all of its finance and administrative software and hardware were 25 years old. In almost all cases the company wouldn’t be able to compete at all or would be at a substantial disadvantage. Having the latest technology isn’t always necessary, but even though...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

Integrated risk management (IRM) was a major theme at IBM’s recent Smarter Risk Management analyst summit in London. In the market context, IBM sees this topic as a means to differentiate its product and messaging from those of its competitors. IRM includes cloud-based offerings in operational risk analytics, IT risk analytics and financial crimes management designed for financial institutions and draws on component elements of software that IBM acquired over the past five years, notably from ...

Read More

Topics:

GRC,

Office of Finance,

Operational Performance Management (OPM),

Chief Risk Officer,

CRO,

ERM,

OpenPages,

Business Analytics,

Business Collaboration,

Cloud Computing,

Data Governance,

Governance, Risk & Compliance (GRC),

IBM,

Business Performance Management (BPM),

compliance,

Customer Performance Management (CPM),

Data,

Information Applications (IA),

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Supply Chain Performance Management (SCPM),

Financial Services,

FPM

All the hubbub around big data and analytics has many senior finance executives wondering what the big deal is and what they should do about it. It can be especially confusing because much of what’s covered and discussed on this topic is geared toward technologists and others working outside of Finance, in areas such as sales, marketing and risk management. But finance executives need to position their organization to harness this technology to support the strategic goals of their company. To...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Controller,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

CFO,

compliance,

finance,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

Financial Performance Management,

financial risk management

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

eDiscovery,

Exterro,

Data Governance,

Data Management,

Governance, Risk & Compliance (GRC),

Informatica,

Business Performance Management (BPM),

compliance,

Data,

Financial Performance Management (FPM),

Information,

Information Applications (IA),

Information Management (IM),

Risk,

Sales Performance Management (SPM),

Workforce Performance Management (WPM)

Because of its impact on the Office of Finance, I’ve written in the past about the proposed timeline and IT implications of the convergence of U.S. Generally Accepted Accounting Principles (U.S. GAAP) and the International Financial Reporting Standards (IFRS). While the bottom-line differences between U.S. GAAP and IFRS are likely to be minimal for most businesses, some aspects of the convergence promise to be significant and problematic. One important change is how companies account for...

Read More

Topics:

GRC,

Office of Finance,

control,

error,

IFRS,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Financial Performance Management,

GAAP