Usually, just figuring out how to start the process of change is a major barrier to improvement in business. I think that’s especially true when it comes to integrated business planning (IBP). I started using that term six years ago to differentiate that process from financial budgeting and the many other forward-looking activities used in companies. IBP applies to a longstanding objective: bringing together the disparate strands of forward-looking activities across a corporation to foster...

Read More

Topics:

Big Data,

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

driver-based,

Business Collaboration,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management,

Integrated Business Planning

Planning portfolio risk follows the same basic tenets as other sorts of business planning. It must be done in the context of a time dimension. In business, short-term plans are developed with a lot of givens or constraints. For example, capacities are fixed, because it’s impossible to wave a magic wand and bring a new factory on line, stuff more machine tools into already jammed facilities or source more raw materials in a capacity-limited supply chain. Short-term plans also incorporate...

Read More

Topics:

GRC,

Office of Finance,

Operational Performance Management (OPM),

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Business Planning,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

Sales Performance Management (SPM)

We recently issued our 2012 Value Index on Financial Performance Management (FPM). Ventana Research defines FPM as the process of addressing the often overlapping people, process, information and technology issues that affect how well finance organizations operate and support the activities of the rest of their organization. FPM deals with the full cycle of finance department activities, which includes planning and budgeting, analysis, assessment and review, closing and consolidation, internal...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

closing,

Consolidation,

contingency planning,

Analytics,

Business Analytics,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Value Index,

Financial Performance Management

CODA’s Financials has a specific target market, from companies in the upper half of the midsize range to the lower end of the large range (that is, companies with 500 to 2,500 employees) in services (not manufacturing) businesses. CODA, the company, started in the 1990s and differentiated itself by designing ERP and accounting software to run on a multidimensional database rather than the more common relational databases of the day. This has proven to be an elegant approach, because businesses...

Read More

Topics:

ERP,

Office of Finance,

Operational Performance Management (OPM),

CODA,

Analytics,

Business Analytics,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

FinancialForce,

Sales Performance Management (SPM),

financials

I’ve written frequently on issues that confront desktop spreadsheet users, such as business modeling and capital investment, as well as the risk and control issues spreadsheets pose and their contribution to paralysis by analysis. I focus mainly on the technology aspects of organizational challenges, and I usually recommend replacing stand-alone desktop spreadsheets with more appropriate tools. Yet there are many instances where spreadsheets work well, and in other cases people continue to use...

Read More

Topics:

GRC,

Office of Finance,

Operational Performance Management (OPM),

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

finance,

Financial Performance Management (FPM),

Training

One of the most important trends in business over the past 20 years has been the broadening use of information technology to manage and support activities. In the early decades of business computing, companies developed islands of automation for largely numeric functions such as billing, inventory management and accounting. Each ran on a proprietary system and engaged the time of a relative handful of employees. Today, just about everyone works with an IT system for at least some of their...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

IT Performance Management (ITPM),

Risk,

financial risk management,

IT Risk Management

It’s clear that certain customers generate more profits than others, just as some products offer greater economic returns than others, as I’ve noted before. For this reason, efforts to improve customer profitability are not a new trend. Good managers have always looked for ways to achieve the highest sustainable margins. However, at some point, almost all businesses realize that increasing sustainable profitability can’t be achieved simply through increasing revenue or cutting costs. Those...

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Analytics,

Business Analytics,

Business Intelligence,

Business Performance Management (BPM),

CRM,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Applications (IA),

Sales Performance Management (SPM),

Financial Performance Management,

Profitability

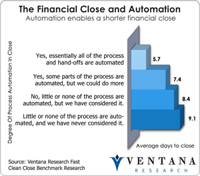

What’s a fast, free and reasonably reliable way of gauging the effectiveness of a finance department’s management? It’s the number of days it takes it to close the books. Companies that take six days or fewer after the end of the period to close their monthly, quarterly or semiannual accounts demonstrate a basic level of effectiveness that those that take longer do not. In my judgment, finance executives should regard a slow close as a negative key performance indicator pointing to...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Financial Performance Management