Ventana Research uses the term “data pantry” to describe a method of data storage (and the technology and process blueprint for its construction) created for a specific set of users and use cases in business-focused software. It’s a pantry because all the data one needs is readily available and easily accessible, with labels that are immediately recognized and understood by the users of the application. In tech speak, this means the semantic layer is optimized for the intended audience. It is...

Read More

Topics:

Continuous Planning,

Business Intelligence,

Data Management,

Business Planning,

Data,

Financial Performance Management,

Enterprise Resource Planning,

continuous supply chain,

data operations,

digital finance,

AI & Machine Learning,

profitability management,

Analytics & Data,

Streaming Data & Events

The need for a COVID-19 vaccination “passport” has prompted some to suggest using blockchain technology as a means of reliably verifying an individual’s status at an international level. There are precedents: for example, until smallpox was eradicated, all international travelers were obliged to carry an immunization record for that disease on a standard paper form to gain entrance to a country. With the likelihood that COVID-19 will remain endemic for many years, a reliable digital record with...

Read More

Topics:

Data Governance,

Information Management,

Data,

blockchain

Environmental, social and governance reporting by public corporations has become a top-of-mind issue for senior executives and boards of directors as countries increasingly consider or mandate its implementation in some form. The fundamental rationale for ESG reporting is rooted in the inability of purely financial measures to capture externalities (such as greenhouse gas emissions) or provide metrics that enable an objective assessment of management’s ability to properly determine trade-offs...

Read More

Topics:

Human Capital Management,

Office of Finance,

Business Intelligence,

Data Governance,

Data Preparation,

Data,

Financial Performance Management,

ERP and Continuous Accounting

An important recent development in software designed for the Office of Finance is the addition of what we’re calling a data aggregation device (DAD) for analytical applications. A DAD automates the collection of data from disparate sources using, for example, application programming interfaces (APIs) and robotic process automation (RPA). With a DAD, users of the analytical application have immediate access to a much broader data set; one that incorporates operational as well as financial data...

Read More

Topics:

Office of Finance,

Analytics,

Business Intelligence,

Data,

Financial Performance Management,

Price and Revenue Management,

robotic finance,

Predictive Planning,

AI & Machine Learning

I’ve written before about blockchain’s significant potential. A lot of the current discussion on the topic centers on cryptocurrencies and financial trading platforms, both of which are already in operation. However, my focus is on its applicability to business generally, especially in B2B commerce, where I believe there is significant potential for it to serve as a universal data connector. There’s also a great deal of potential for blockchain to provide individuals with greater power in ...

Read More

Topics:

Sales,

Human Capital Management,

business intelligence,

Business Collaboration,

Internet of Things,

Data,

Product Information Management,

Digital Commerce,

Enterprise Resource Planning,

blockchain,

candidate engagement,

collaborative computing,

continuous supply chain

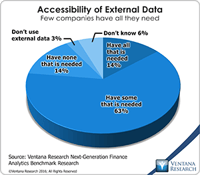

By itself, data isn’t useful for business; the application of analytics is necessary to transform data into actionable information. Data analysis of one sort or another has long been a core competence of finance departments, applied to balance sheets, income statements or cash flow statements. Today, however, Finance must go beyond these basics by expanding the scope of the data being examined to include all financial and operational information that can yield actionable insights. Analysis thus...

Read More

Topics:

Customer Experience,

Human Capital Management,

Marketing,

Voice of the Customer,

business intelligence,

embedded analytics,

Learning Management,

Analytics,

Collaboration,

Data Governance,

Data Lake,

Data Preparation,

Information Management,

Internet of Things,

Contact Center,

Data,

Product Information Management,

Sales Performance Management,

Workforce Management,

Financial Performance Management,

Price and Revenue Management,

Digital Technology,

Digital Marketing,

Digital Commerce,

ERP and Continuous Accounting,

blockchain,

natural language processing,

robotic finance,

Predictive Planning,

candidate engagement,

Intelligent CX,

Conversational Computing,

Continuous Payroll,

revenue and lease accounting,

collaborative computing,

mobile computing,

Subscription Management,

agent management,

extended reality,

AI & Machine Learning

What’s the easiest way to completely immobilize a 500,000-ton ship?

Lose a sheet of paper.

The paperwork that accompanies international trade is a serious source of friction, inefficiency — and therefore cost — in supply chain execution. Trade documentation requires massive amounts of paper that today can be replaced by digital data. In 2018, Maersk, the world’s largest shipping company, teamed up with IBM to create TradeLens, a digital platform that utilizes blockchain technology as a...

Read More

Topics:

Office of Finance,

Continuous Planning,

Internet of Things,

Data,

Operations & Supply Chain,

Enterprise Resource Planning,

blockchain,

continuous supply chain

Identity management is an old problem that has taken on new dimensions in the digital world. In 1993, at the dawn of the World Wide Web (WWW),The New Yorkerran a cartoon featuring two dogs talking, one perched in front of a computer. The caption reads: “On the Internet, nobody knows you’re a dog.” The phrase quickly evolved into a meme highlighting the issue of identity uncertainty in the new digital environment.

Read More

Topics:

Human Capital Management,

Office of Finance,

Learning Management,

Internet of Things,

Data,

Workforce Management,

Digital Technology,

ERP and Continuous Accounting,

blockchain,

candidate engagement

I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

reconcile

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Social Media,

FP&A,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Human Capital,

Kofax,

Statistics,

Analytics,

Business Analytics,

Business Intelligence,

Customer Performance Management (CPM),

Data,

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Strata+Hadoop