Environmental, social and governance issues have grown increasingly pressing over the past few years as investors and government entities urge organizations to measure and disclose ESG metrics. I’ve already covered the broader topic as it relates to external reporting and how financial planning and analysis groups are likely to own this mandate going forward. (It’s mainly been a marketing and public relations effort up to now.) FP&A departments are also likely to be charged with responsibility...

Read More

Topics:

FP&A,

Office of Finance,

ESG

ESG reporting is a matter that organizations – and especially publicly held corporations – will be confronting over the next several years. Ventana Research asserts that by 2025, one-half of corporations with 1,000 or more employees will have a formal ESG reporting process in place to address legal mandates or shareholder demand. The roots of ESG investing go back many decades but it has gained significant attention recently as demand in the investment world for non-accounting measures to guide...

Read More

Topics:

FP&A,

Governance,

Office of Finance,

Reporting,

CFO,

ESG

As a result of the rapidly changing business landscape in 2020 and the need to quickly – and intelligently – change business plans and budgets, many more companies have been deciding to adopt a continuous planning approach to be able to add speed and flexibility. Transforming how organizations plan and budget has become a top-of-mind issue for CFO and even CEOs. Ventana Research has been advocating what we call continuous planning to improve organizational performance. In this multimedia...

Read More

Topics:

FP&A,

Office of Finance,

budget,

CFO,

financial planning

Profitability management produces a sustainable competitive advantage but by 2025 only one-third of companies will have implemented a profitability management initiative, explains Ventana Research SVP and Research Director Robert Kugel. This brief video shows why FP&A organizations must be part of a profitability management approach to pricing and costing.

{% video_player "embed_player" overrideable=False, type='scriptV4', hide_playlist=True, viral_sharing=False, embed_button=False,...

Read More

Topics:

FP&A,

Office of Finance,

Sales Operations,

CFO,

financial planning,

Price Optimization,

Price and Revenue Management

In this Analyst Perspective from Robert Kugel, learn how FP&A can redefine its mission to achieve the long-stated goal of making it more of a strategic partner with the rest of the organization. This means fully adopting integrated business planning, a high participation, collaborative, action-oriented approach to planning and budgeting built on frequent, short planning sprints. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes, and...

Read More

Topics:

FP&A,

Office of Finance,

Budgeting,

Business Planning,

CFO,

financial planning,

forecasting

FP&A and business analysts can make reporting more effective by reimagining how, what and when their company does its reporting. They should provide the users of their reports the information they want in a form they want it. They should be thinking about how they can make reporting more effective by rethinking how data is presented, how interactive it is, and what visualizations are used. Rethinking how to combine narratives, data, charts and graphics to everyday communications. How to add...

Read More

Topics:

FP&A,

Office of Finance,

CFO,

financial regulation,

financial reporting,

financial risk management,

financial standards,

tax planning

The use of blockchain distributed ledgers in business processes is now a common theme in many business software vendors’ presentations. The technology has a multitude of potential uses. However, presentations about the opportunities for digital transformation always leave me wondering: How is this magic going to happen? I wonder this because the details about how data flows from point A to point B via a blockchain are critically important to blockchain utility and therefore the pace of its...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

Ventana Research uses the term “predictive finance” to describe a forward-looking, action-oriented finance organization that places emphasis on advising its company rather than fulfilling the traditional roles of a transactions processor and reporter. Technology is driving the shift away from the traditional bean-counting role. The cumulative evolution of software advances will substantially reduce finance and accounting workloads by automating most of the mechanical, rote functions in...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

Ventana Research defines financial performance management (FPM) as the process of addressing often overlapping issues involving people, process, information and technology that affect how well finance organizations operate and support the activities of the rest of their organization. FPM software supports and automates the full cycle of finance department activities, which include planning and budgeting, analysis, assessment and review, closing and consolidation, internal financial reporting...

Read More

Topics:

Performance Management,

ERP,

FP&A,

Human Capital Management,

Office of Finance,

Consolidation,

Financial Performance Management,

FPM

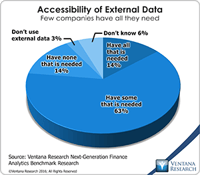

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Social Media,

FP&A,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Human Capital,

Kofax,

Statistics,

Analytics,

Business Analytics,

Business Intelligence,

Customer Performance Management (CPM),

Data,

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Strata+Hadoop