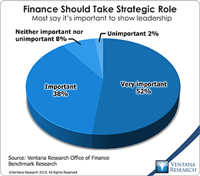

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments totake a strategic role in running...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Human Capital,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Uncategorized,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

Last year Ventana Research released our Office of Finance benchmark research. One of the objectives of the project was to assess organizations’ progress in achieving “finance transformation.” This term denotes shifting the focus of CFOs and finance departments from transaction processing toward more strategic, higher-value functions. In the research nine out of 10 participants said that it’s important or very important for the department to take a more strategic role. This objective is both...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

CIO,

In-memory,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

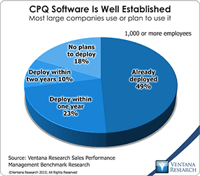

PROS Holdings, a provider of price and revenue optimization software, has an agreement in principle to acquire Cameleon Software, which offers configure, price and quote (CPQ) applications. The combined company is likely to benefit from a broader geographic presence (PROS is based in Houston while Cameleon is in Toulouse, France) for their sales and marketing efforts. However, the longer-term strategic value of the merger lies in the combination of the related categories of price optimization...

Read More

Topics:

Sales,

FP&A,

Operational Performance Management (OPM),

PRO,

PROS,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

CEO,

FPM,

Price Optimization,

Profitability