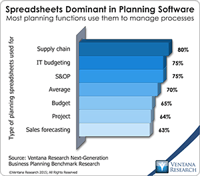

Ventana Research coined the term “enterprise spreadsheet” in 2004 to describe a variety of software applications that add a desktop spreadsheet’s user interface (usually that of Microsoft Excel) to components that address the issues that arise when desktop spreadsheets are used in repetitive, collaborative enterprise processes. Enterprise spreadsheets are designed to provide the best of both worlds in that they offer the ease of use and flexibility of desktop spreadsheets while overcoming their...

Read More

Topics:

Operational Performance Management (OPM),

Analytics,

Business Analytics,

Business Intelligence,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM)

Today’s proponents of artificial intelligence (AI) tend to focus on its spectacular uses such as self-driving cars and uplifting ones such as medical treatment. AI also has the potential to aid humanity in more modest ways such as eliminating the need for individuals to do tedious repetitive work in white-collar areas. Along these lines, at its recent Vision users conference, IBM displayed an application of its Watson cognitive computing technology designed to automate important aspects of...

Read More

Topics:

Big Data,

Operational Performance Management (OPM),

Cloud Computing,

Governance, Risk & Compliance (GRC),

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM),

GRC, governance, risk, compliance, risk management

The blockchain distributed database was invented to create the peer-to-peer digital cash called bitcoin in 2008. Although the future potential of bitcoin and other cryptocurrencies has been debated, the distributed ledger structure using a blockchain database that supports bitcoin is likely to be adopted for a range of commercial and governmental purposes. Distributed ledgers are a secure and transparent way to digitally track the ownership of assets while enabling faster transaction speeds and...

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

blockchain, distributed ledger, DLT, ERP, SCM, sup

I recently wrote about the challenge some companies will face in planning and budgeting when new revenue recognition rules go into effect in most countries in 2018. It’s important for companies that will be affected to be sure they have the appropriate systems, processes and training to handle the more difficult demands imposed by the new rules. With the change in accounting, the time lag between when a contract is signed and when a company recognizes revenue from it may be more variable and...

Read More

Topics:

Big Data,

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

New standards governing accounting for contracts will go into effect for most companies in 2018. The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP), has issued ASC 606, and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most other countries, has issued IFRS 15. The two are very similar, and both will enforce fundamental changes in this...

Read More

Topics:

Sales,

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

Workiva offers Wdesk, a cloud-based productivity application for handling composite documents. I use the term “composite document” to refer to those in which text is created and edited collaboratively by multiple contributors and which incorporates tabular and numerical data from multiple sources in a controlled process. Composite documents often have formats defined by law, regulation or contract and must be created at periodic intervals. To comply with the requirement by the United States...

Read More

Topics:

Mobile Technology,

Business Collaboration,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Uncategorized,

Business Performance Management (BPM),

Composite Software,

Financial Performance Management (FPM)

Information technology enables a data-driven management style that was not feasible until powerful, affordable computers became generally available. There’s no bright line marking when this became possible; the process is ongoing. People were using financial analytics long before ENIAC, the first general-purpose computer, appeared, but the metrics available were not especially timely, broadly applicable to day-to-day situations or comprehensive enough to inform most management decision-making....

Read More

Topics:

Big Data,

Office of Finance,

Operational Performance Management (OPM),

Business Analytics,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

There were two noteworthy themes in SAP CEO Bill McDermott’s keynote at this year’s Sapphire conference. One was customer assurance; that is, placing greater emphasis on making the implementation of even complex business software more predictable and less of an effort. This theme reflects the maturing of the enterprise applications business as it transitions from producing highly customized software to providing configurable, off-the-rack purchases. Implementing ERP will never be simple, as I...

Read More

Topics:

Predictive Analytics,

SAP,

Operational Performance Management (OPM),

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM)

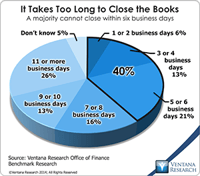

In our Office of Finance benchmark research 60 percent of participants said it takes their companies six or more business days to complete their quarterly close; that exceeds the best practice benchmark of five days. Consultants, academics and vendors have stressed the importance of shortening the close for almost a quarter of a century. The main reason for doing so is to provide executives and managers with timely information about the company’s performance. Yet our research shows that it’s...

Read More

Topics:

Office of Finance,

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM)

New rules governing revenue recognition for contracts will go into effect for most companies in 2018. The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP) has issued ASC 606, and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most other countries, has issued IFRS 15. The two are very similar and will enforce fundamental changes in this...

Read More

Topics:

Big Data,

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM)