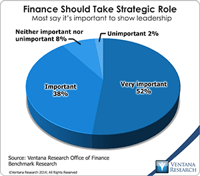

Finance transformation” refers to a longstanding objective: shifting the focus of CFOs and finance departments from transaction processing to more strategic, higher-value functions. Our upcoming Office of Finance benchmark research confirms that most of organizations want their finance department to take a more strategic role in management of the company: nine in 10 participants said that it’s important or very important. (We are using “finance” in its broadest sense, including, for example,...

Read More

Topics:

Big Data,

Mobile,

Performance Management,

Predictive Analytics,

Social Media,

ERP,

FP&A,

Office of Finance,

Reporting,

Management,

close,

closing,

computing,

Controller,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

finance,

Financial Performance Management (FPM),

Tagetik,

FPM

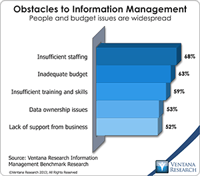

When applying information technology to drive better business performance, companies and the systems integrators that assist them often underestimate the importance of organizing data management around processes. For example, companies that do not execute their quote-to-cash cycle as an end-to-end process often experience a related set of issues in their sales, marketing, operations, accounting and finance functions that stem from entering the same data into multiple systems. The inability to...

Read More

Topics:

Big Data,

Mobile,

ERP,

Office of Finance,

Operational Performance Management (OPM),

Operations,

Management,

close,

closing,

computing,

end-to-end,

Analytics,

Cloud Computing,

Data Management,

Business Performance Management (BPM),

CRM,

Data,

finance,

Information Applications (IA),

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

FPM

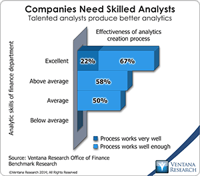

Finance and accounting departments are staffed with numbers-oriented, naturally analytical people. Strong analytic skills are essential if a finance department is to deliver deep insights into performance and visibility into emerging opportunities and challenges. The conclusions of analyses enable fast, fully informed business decisions by executives and managers. Conversely, flawed analyses undermine the performance of a company. So it was good news that in our Office of Finance benchmark...

Read More

Topics:

Big Data,

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Tagetik,

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets