Robotic process automation (RPA) relies on programming or the application of analytical algorithms to execute the most appropriate action in an automated workflow. RPA enables business users to configure a “robot” (actually, computer software) to interact with applications or data sources to process a transaction, move or manipulate data, communicate with other digital systems and manage machine-to-machine and man-to-machine interactions. This technology is gaining increasing notice by finance...

Read More

Topics:

Operations,

automation,

close,

closing,

Continuous Accounting,

finance,

banking,

Robotic Process Automation,

Accounting,

web crawler,

legacy systems,

bank

The application of artificial intelligence (AI) and machine learning (ML) to business computing will have a profound impact on white collar professions. This is especially true in heavily rules-based functions such as accounting. Companies recognize the transformational potential of AI and ML, but the progression and pace of the adoption of these technologies is unclear. Some applications of AI and ML are already in use but others are a decade or more away from replacing human tasks.

Read More

Topics:

Big Data,

Machine Learning,

Office of Finance,

Analytics,

CFO,

finance,

CEO,

AI,

AICPA,

natural language processing,

Accounting

Continuous planning is a term Ventana Research uses for a high participation, collaborative, action-oriented approach to planning built on frequent, short planning sprints. This enables organizations to enhance the accuracy of their plans because refinements are made at shorter intervals. Short planning cycles enable companies to achieve greater agility in responding to market or competitive changes. “Continuous” also means continuous across the entire organization – planning as an ongoing...

Read More

Topics:

Human Capital,

Business Collaboration,

finance,

Business

Kofax offers Kapow, robotic process automation (RPA) software used to acquire information from a range of sources without human intervention and without having to write code. These sources include websites, applications, unstructured documents, data stores and desktop spreadsheets. RPA software does repetitive, low-value work that otherwise may be performed by person. It saves time in these tasks, completing them sooner and freeing skilled individuals to concentrate on work that utilizes their...

Read More

Topics:

Office of Finance,

Operations,

close,

finance,

banking,

Digital Technology

Ventana Research awarded our Governance, Risk and Compliance (GRC) Business Innovation Award for 2016 to IBM for IBM Regulatory Compliance Analytics, powered by Watson (IRCA). This application of cognitive analytics is designed to streamline the identification of potential regulatory requirements and suggest methods for compliance. In so doing the cloud-based system can cut the time and cost of compliance while creating an effective means of ongoing management and control of compliance...

Read More

Topics:

GRC,

Machine Learning,

Office of Finance,

Dodd-Frank,

Risk Analytics,

compliance,

finance,

Financial Services,

Watson,

IBM Regulatory Compliance Analytics

Effective capital planning and capital investment are vital to a company’s long-term success. The choices a company makes in this regard – how much to invest and in which facilities or projects – almost always have a profound impact on its competitiveness and performance. Because they have limited financial resources, well-managed companies take pains to ensure that these decisions support their long-term strategies and are made as rationally as possible. To do this they must have a disciplined...

Read More

Topics:

Office of Finance,

finance,

Business

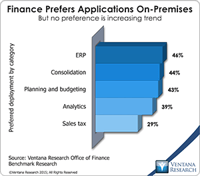

Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

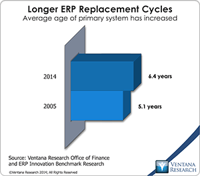

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

SAP,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Tax,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Data,

finance,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

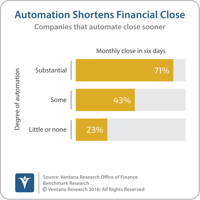

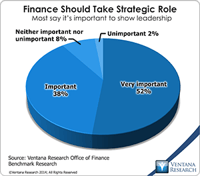

Many senior finance executives say they want their department to play a more strategic role in the management and operations of their company. They want Finance to shift its focus from processing transactions to higher-value functions in order to make more substantial contributions to the success of the organization. I use the term “continuous accounting” to represent an approach to managing the accounting cycle that can facilitate the shift by improving the performance of the accounting...

Read More

Topics:

ERP,

FP&A,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Spreadsheets