Over the past three years, the Public Company Accounting Oversight Board (or PCAOB, sometimes pronounced “peekaboo”) has found an increasing prevalence of auditing deficiencies in its inspections of accounting firms. PCAOB was established as part of the Sarbanes-Oxley Act of 2002 in the wake of several major accounting scandals. The agency acts as the auditor of auditors with the objective of being a neutral arbiter of the quality of these inspections. It recently indicated that approximately...

Read More

Topics:

Office of Finance,

audit,

ERP and Continuous Accounting,

digital finance,

virtual audit,

Consolidate/Close/Report

For decades I’ve heard people talk about cutting audit costs to reduce administrative overhead but based on my observations, I was skeptical — mostly because, until recently, the documented success stories haven’t been about going from good to great so much as going from awful to average. That’s changing. I recently wrote about a company that had set out to cut its external auditor’s fees. The benefits it had accrued are significant, including a reduction in staff time devoted to the audit. I...

Read More

Topics:

Office of Finance,

audit,

Continuous Accounting,

financial performance,

CFO

In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

legal,

tax optimization,

tax data warehouse Thomson-Reuters multinational,

international tax,

tax compliance

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Human Capital,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

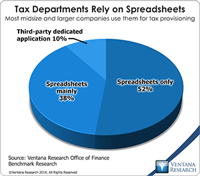

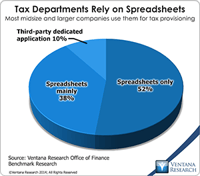

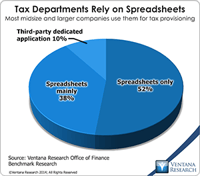

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

I’ve written before about the increasing importance of having a solid technology base for a company’s tax function, and it’s important enough for me to revisit the topic. Tax departments are entrusted with a highly sensitive and essential task in their companies. Taxes usually are the second largest corporate expense, after salaries and wages. Failure to understand this liability is expensive – either because taxes are overpaid or because of fines and interest levied for underpayment. Moreover,...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Oracle,

Uncategorized,

CFO,

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

Longview Solutions has a longstanding presence in the financial performance management (FPM) software market and was rated a Hot vendor in our most recent FPM Value Index. Several years ago it began offering a tax provision and planning application. I think it’s worthwhile to focus on the tax category because it’s less well known than others in finance and is an engine of growth for Longview. We expect larger corporations increasingly to adopt software to manage direct (income) taxes to improve...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

FPM,

Innovation Awards

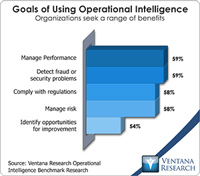

All the hubbub around big data and analytics has many senior finance executives wondering what the big deal is and what they should do about it. It can be especially confusing because much of what’s covered and discussed on this topic is geared toward technologists and others working outside of Finance, in areas such as sales, marketing and risk management. But finance executives need to position their organization to harness this technology to support the strategic goals of their company. To...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Controller,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

CFO,

compliance,

finance,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

Financial Performance Management,

financial risk management

Technology for the Office of Finance can have transformative power. Although progress has been slow at times, today’s finance organizations are fundamentally different from those of 50 years ago. For one thing, they require far fewer resources (chiefly people) to perform basic accounting, treasury and corporate finance tasks. In addition, public corporations report results sooner – sometimes weeks sooner – than they could in the mid-20th century. And finance departments are able to harness...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards