SAP recently held a teleconference to highlight its blockchain strategy. Lately, the major business software vendors have been calling attention to their blockchain initiatives. While the focus on this technology might seem premature to those who still equate it with cryptocurrencies, evidence is pointing to a future pace of adoption similar to the rapid take-up of the internet in the 1990s. That blockchain is useful for a wide range of business functions isn’t news – just google “blockchain...

Read More

Topics:

Machine Learning,

Office of Finance,

finance transformation,

Robotic Process Automation,

Artificial intelligence,

blockchain,

AI,

bots,

robotic finance

In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

legal,

tax optimization,

tax data warehouse Thomson-Reuters multinational,

international tax,

tax compliance

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Human Capital,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

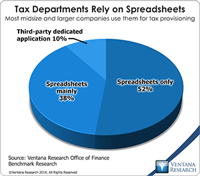

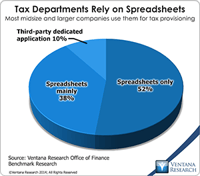

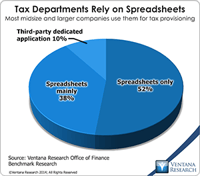

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

I’ve written before about the increasing importance of having a solid technology base for a company’s tax function, and it’s important enough for me to revisit the topic. Tax departments are entrusted with a highly sensitive and essential task in their companies. Taxes usually are the second largest corporate expense, after salaries and wages. Failure to understand this liability is expensive – either because taxes are overpaid or because of fines and interest levied for underpayment. Moreover,...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Oracle,

Uncategorized,

CFO,

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

Longview Solutions has a longstanding presence in the financial performance management (FPM) software market and was rated a Hot vendor in our most recent FPM Value Index. Several years ago it began offering a tax provision and planning application. I think it’s worthwhile to focus on the tax category because it’s less well known than others in finance and is an engine of growth for Longview. We expect larger corporations increasingly to adopt software to manage direct (income) taxes to improve...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

FPM,

Innovation Awards

Technology for the Office of Finance can have transformative power. Although progress has been slow at times, today’s finance organizations are fundamentally different from those of 50 years ago. For one thing, they require far fewer resources (chiefly people) to perform basic accounting, treasury and corporate finance tasks. In addition, public corporations report results sooner – sometimes weeks sooner – than they could in the mid-20th century. And finance departments are able to harness...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards

Taxes – both indirect (sales or value added taxes, for example) and direct (income taxes) – are one the largest expense items on the corporate income statement. In recent years it has become common for large and even midsize companies to automate their indirect tax management process, but direct tax management has remained a bastion of manual processes built on a heap of desktop spreadsheets. In previous blog posts I discussed this issue and the role of the tax data warehouse as a necessary...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM

I recently had a briefing from Vertex on its tax data warehouse (TDW), a key component of its tax technology platform Vertex Enterprise. The TDW concept has been around for decades, but the earliest versions were custom-built and hampered by the technology limitations of their day. This made them expensive to deploy and maintain and constrained their ability to adapt to changing corporate requirements. The basic idea behind a TDW is straightforward: a data store that makes all tax data readily...

Read More

Topics:

Master Data Management,

Performance Management,

Office of Finance,

finance transformation,

Tax,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM)