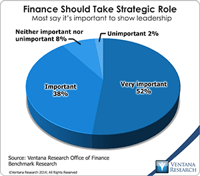

Finance transformation” refers to a longstanding objective: shifting the focus of CFOs and finance departments from transaction processing to more strategic, higher-value functions. Our upcoming Office of Finance benchmark research confirms that most of organizations want their finance department to take a more strategic role in management of the company: nine in 10 participants said that it’s important or very important. (We are using “finance” in its broadest sense, including, for example,...

Read More

Topics:

Big Data,

Mobile,

Performance Management,

Predictive Analytics,

Social Media,

ERP,

FP&A,

Office of Finance,

Reporting,

Management,

close,

closing,

computing,

Controller,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

finance,

Financial Performance Management (FPM),

Tagetik,

FPM

When applying information technology to drive better business performance, companies and the systems integrators that assist them often underestimate the importance of organizing data management around processes. For example, companies that do not execute their quote-to-cash cycle as an end-to-end process often experience a related set of issues in their sales, marketing, operations, accounting and finance functions that stem from entering the same data into multiple systems. The inability to...

Read More

Topics:

Big Data,

Mobile,

ERP,

Office of Finance,

Operational Performance Management (OPM),

Operations,

Management,

close,

closing,

computing,

end-to-end,

Analytics,

Cloud Computing,

Data Management,

Business Performance Management (BPM),

CRM,

Data,

finance,

Information Applications (IA),

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

FPM

“What’s next?” is the perennially insistent question in information technology. One common observation about the industry holds that cycles of innovation alternate between hardware and software. New types and forms of hardware enable innovations in software that utilize the power of that hardware. These innovations create new markets, alter consumer behavior and change how work is performed. This, in turn, sets the stage for new types and forms of hardware that complement these emerging product...

Read More

Topics:

Mobile,

Performance Management,

Predictive Analytics,

ERP,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Wearable Computing,

Management,

close,

closing,

computing,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

FPM

IBM’s Big Data and Analytics Analyst Insights conference started me thinking about the longer-term potential impact of big data and related technologies on business management. I covered some of the near-term uses of big data and analytics in an earlier perspective. There are numerous uses of big data that can provide incremental improvements to existing processes and practices. Some of these will have a significant impact on changing business models, enabling new classes of products and...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Operational Performance Management (OPM),

Management,

Budgeting,

Analytics,

Business Analytics,

Business Collaboration,

IBM,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Management (IM),

decision,

FPM,

Watson

I’ve frequently commented on the artificiality of the emerging software category of governance, risk and compliance (GRC). The term is used to a cover a combination of what were once viewed as stand-alone software categories, including IT governance, audit documentation and industry-specific compliance management, to name three examples. While it’s still common for specific types of software to be purchased piecemeal by different departments, these disparate areas have started a long...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

Risk,

financial risk management,

IT Risk Management,

Sarbanes Oxley,

SOX

One of the most important trends in business over the past 20 years has been the broadening use of information technology to manage and support activities. In the early decades of business computing, companies developed islands of automation for largely numeric functions such as billing, inventory management and accounting. Each ran on a proprietary system and engaged the time of a relative handful of employees. Today, just about everyone works with an IT system for at least some of their...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

IT Performance Management (ITPM),

Risk,

financial risk management,

IT Risk Management

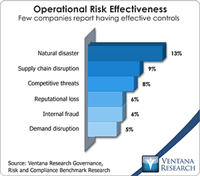

Risk has always been an integral part of business, but our recent Governance, Risk and Compliance (GRC) benchmark research shows that companies deal with risk with varying degrees of effectiveness – especially operational risk. A majority of companies lag in their overall GRC maturity, as I covered in a recent blog post. Operational risk management should be of greater interest to executives today because they can have greater control of it than before. The expansion of IT systems to automate...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

compliance,

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

financial risk management

Ventana Research recently completed benchmark research on governance, risk and compliance (GRC), three business activities that are naturally linked. Although managing them requires separate and sometimes very different processes, on the whole these activities affect each other: Effective corporate governance ensures compliances with laws, regulations and company policies, and without governance, there’s no way to control risk. Separately or considered together, managing governance, risk and...

Read More

Topics:

Big Data,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Business Analytics,

Business Collaboration,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Workforce Performance Management (WPM),

financial risk management