Value-added tax is a consumption tax levied at every point in a supply chain—from production to final sale. It’s based on the difference between the cost of production and the selling price of a product or service, or the value added. Sales taxes are different in that they are generally collected only at the final point of sale to the ultimate consumer. Enterprises collect the value-added tax from customers when they sell goods or services and remit the collected VAT to the relevant national or...

Read More

Topics:

Office of Finance,

Tax,

tax compliance,

digital finance,

Order-to-Cash,

Value-Added Tax,

Sales Tax

Value-added tax is a type of levy that is applied at each step of a transaction chain, from basic inputs to the final good or service. The amount assessed is based on the value added by an organization (hence the name) when a transaction occurs. VAT is used throughout the world because, historically, it has been harder to evade compared to income taxes. VAT is a common method of national taxation: Approximately 85% of countries impose it worldwide. A notable exception is the United States,...

Read More

Topics:

Office of Finance,

Tax,

VAT

In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

legal,

tax optimization,

tax data warehouse Thomson-Reuters multinational,

international tax,

tax compliance

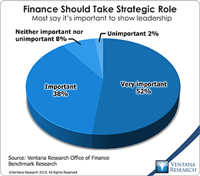

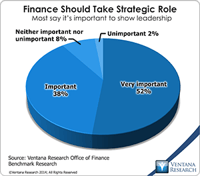

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments totake a strategic role in running...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Human Capital,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Uncategorized,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Human Capital,

LongView,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Oracle,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Reconciliation,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Uncategorized,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

SAP,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Tax,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Data,

finance,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

Many senior finance executives say they want their department to play a more strategic role in the management and operations of their company. They want Finance to shift its focus from processing transactions to higher-value functions in order to make more substantial contributions to the success of the organization. I use the term “continuous accounting” to represent an approach to managing the accounting cycle that can facilitate the shift by improving the performance of the accounting...

Read More

Topics:

ERP,

FP&A,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Spreadsheets

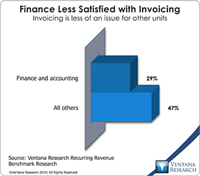

Revenue recognition standards for companies that use contracts are in the process of changing, as I covered in an earlier perspective. As part of managing their transition to these standards, CFOs and controllers should initiate a full-scale review of their order-to-cash cycle. This should include examination of their company’s sales contracts and their contracting process. They also should examine how well their contracting processes are integrated with invoicing and billing and any other...

Read More

Topics:

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Revenue Performance,

Budgeting,

Tax,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

For most of the past decade businesses that decided not to pay attention to proposed changes in revenue recognition rules have saved themselves time and frustration as the proponents’ timetables have slipped and roadmaps have changed. The new rules are the result of a convergence of US-GAAP (Generally Accepted Accounting Principles – the accounting standard used by U.S.-based companies) and IFRS (International Financial Reporting Standards – the system used in much of the rest of the world)....

Read More

Topics:

Planning,

Customer Experience,

Office of Finance,

Reporting,

Revenue Performance,

Budgeting,

Tax,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

commission,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)