New Revenue Recognition Rules Require Software

For most of the past decade businesses that decided not to pay attention to proposed changes in revenue recognition rules have saved themselves time and frustration as the proponents’ timetables have slipped and roadmaps have changed. The new rules are the result of a convergence of US-GAAP (Generally Accepted Accounting Principles – the accounting standard used by U.S.-based companies) and IFRS (International Financial Reporting Standards – the system used in much of the rest of the world). Now, however, it’s time for everyone to pay close attention. Last year the U.S.-based Financial Accounting Standards Board (FASB, which manages US-GAAP) and the Brussels-based International Accounting Standards Board (IASB, which manages IFRS) issued “Topic 606” and “IFRS 15,” respectively, which express their harmonized approach to governing revenue recognition. A major objective of the new standards is to provide investors and other stakeholders with more accurate and consistent depictions of companies’ revenue across multiple types of business as well as make the standard consistent between the major accounting regimes.

The impact of the new standards will vary greatly depending on the nature of the business. The rules cover companies that enter into contracts with their customers to transfer goods or services or enter into contracts for the transfer of nonfinancial assets – unless those contracts are within the scope of other standards (for example, insurance or lease contracts). Their scope includes most industrial and business services as well as many that have direct-to-consumer relationships. Specifically, aerospace and defense, automotive, communications, engineering and construction, entertainment, media, pharmaceuticals and technology industries are likely to feel the greatest impact. Investment management companies that receive performance-based incentive fees will also be affected. However, it’s likely that some “contracts” covered by the new standards are informal. For instance, there is an implied contract when the seller of a video console ships a product with a game that has only half of the levels but promises to provide the remaining levels at a later date.

It has taken years to reach agreement because creating a codified approach to revenue recognition across all industries was a complex undertaking. It has required the standards bodies to go to the conceptual heart of revenue recognition to devise a common, workable approach. Implementation has been delayed to provide the affected corporations additional time to address the often significant process and systems changes they must put in place to adapt to the new standard. As of now, it looks likely that publicly held companies will begin applying them for annual reporting periods beginning after Dec. 15, 2017, and private companies a year later. Software vendors have been preparing for the new revenue recognition rules, some for several years.

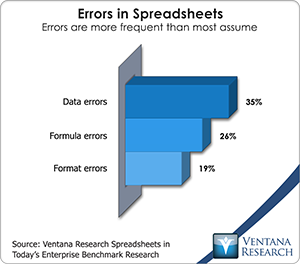

Another main objective of the new standards is to simplify preparation of financial statements. That is unlikely to happen as companies affected by the new standards deal with the transition. In the long run, how well a finance and accounting organization uses software to manage contracting, invoicing, billing and the revenue recognition process will have a significant impact on the amount of work involved. Here software can help; it is a natural fit for principles-based accounting standards. In the absence of prescriptive rules, auditors must be able to confirm that a corporation’s accounting treatments were appropriate and applied consistently. Because software codifies these treatments and automates their application, it functions as a high-level control that, in theory, should make governance and auditing of this aspect of a company’s books much easier to enforce. Moreover, while the new standards may be more useful for investors, they may make a company’s statutory accounting numbers less practical for managing the business. To address this issue, software can reduce the workload involved in preparing management accounting. It also can facilitate a planning process that must be able to view the pro-forma numbers for future income statements, balance sheets and cash flow in both statutory and management contexts. We urge organizations to avoid the use of spreadsheets for this and other enterprise purposes. Our benchmark research finds that various types of errors are common even in the most important spreadsheets; errors that relate to revenue are likely to be material.

codifies these treatments and automates their application, it functions as a high-level control that, in theory, should make governance and auditing of this aspect of a company’s books much easier to enforce. Moreover, while the new standards may be more useful for investors, they may make a company’s statutory accounting numbers less practical for managing the business. To address this issue, software can reduce the workload involved in preparing management accounting. It also can facilitate a planning process that must be able to view the pro-forma numbers for future income statements, balance sheets and cash flow in both statutory and management contexts. We urge organizations to avoid the use of spreadsheets for this and other enterprise purposes. Our benchmark research finds that various types of errors are common even in the most important spreadsheets; errors that relate to revenue are likely to be material.

For those not familiar with the accounting issue being discussed, here is a quick summary of what has been driving the change. Revenue recognition accounting issues have a long history in the U.S. because of the early rise of a market for publicly traded software companies in this country. Rules grew in scope and specificity in response to successive scams and frauds involving inflated sales numbers perpetrated on investors. Many software companies’ revenue recognition policies were extremely aggressive until 1991, when the first rules were put in place. Those first iterations proved too feeble, and further revisions attempted to prevent abuse, but in the process the rules have become highly detailed and unwieldy. From the standpoint of U.S. companies, replacing the increasingly complex and onerous rules became necessary. It’s easy to make mistakes trying to abide by regulations that include more than 100 requirements governing recognition of revenues and gains. The new approach is aimed at reducing this complexity. For its part, IFRS relied more on principles to guide accounting treatment. Although that approach was less complex, it was also less comprehensive and harder to interpret. Dissatisfaction grew because for different reasons, US-GAAP and IFRS each were failing to present a consistent picture of the economic health and performance of companies, which is a core purpose of accounting. And harmonizing revenue recognition rules between the two systems has been a major objective of eliminating differences between US-GAAP and IFRS.

The particulars of the new standards are so detailed that I will highlight only three key points. First, “Topic 606” and “IFRS 15” employ a novel customer-focused framework that represents a fundamental conceptual change in how revenue is measured. Under the new approach, revenue is recognized when the customer gains control of some combination of a good or a service and not necessarily (as has been the case) when the customer acquires title to or takes physical possession of the asset or when a service has been billed. This interjects a considerable amount of opinion into the process. Moreover, sellers are required to parse the sales contract (which may be formal or implied) to identify separate performance obligations (if any) to the customer and allocate the transaction price to these individual performance obligations. Auditors will have to agree that the approach is sound and applied consistently. Complications to the process arise when a contract even implicitly includes multiple performance obligations such as the correct installation of machinery or periodic updates to firmware needed for the machinery to operate properly. To be sure, a good deal of uncertainly will be resolved over the next three years during the phase-in period, but the change is likely to be a major distraction to many companies’ finance and accounting organizations over the next five years.

Second, it will be interesting to see to what extent the new rules improve transparency of financial statements. The new framework hews to an approach that has academic consistency on the revenue line but can bend accounting’s matching principle (matching revenue to related expenses). For example, at this stage in the evolution of the rules, companies that have multiyear contracts will recognize revenues in some ratable fashion over the life of the contract but – in contrast with past practices – will have to recognize some costs related to the contract immediately. Wireless communications vendors, for instance, might find that the handset subsidy they currently provide to customers would have to be expensed at the start of the contract rather than over the life of the contract because the matching principle would no longer apply to the way revenues are classified. In this respect, the new approach is a more accurate reflection of the cash flows of the transaction but not of the economics or the nature of the customer relationship. Professional investors will be able to see through the numbers because they have the training to do so; ordinary individuals will not. To the extent that the new standards create a gulf between reported results and those that are meaningful to running the business, they will proliferate the reporting of non-GAAP results to investors.

Third, while the objectives of the revised revenue recognition standards are laudable and will benefit some investors in some respects, they may complicate corporate financial management in companies materially affected by the new standards. Those that use written contracts or discover they have somewhat contractual relationships with their customers will experience a more complicated revenue recognition process that demands more stringent control of a more complex and detailed record-keeping regime. Importantly, the customer-first framework is divorced from longstanding internal processes, management reporting needs and tax management. So accounting and planning for taxes, commissions, bonus plans and debt covenants may require more attention. Because of this, almost all companies that adopt the new methods of revenue recognition will have to adapt their financial management software and accounting practices to handle the new rules. They will need to review contract wording and related processes as well.

Let me repeat that there is a natural relation between principles-based accounting standards and software. In addition to ensuring consistency in treatment and facilitating governance and control, software also is capable of automating the process of presenting a company’s results from multiple perspectives in a consistent fashion. This is important because many companies will find that their statutory books alone will not provide the right numbers to manage their business. Although public company managements will want to see how their numbers look to Wall Street, they may find that these figures are inconsistent with business practices required to achieve sustainable long-term objectives. Software can systematize the simultaneous translation of events into increasingly divergent financial and management accounting contexts.

Many ERP and financial management software vendors have been preparing for the new revenue recognition rules. I see three main requirements for such companies in preparing to handle the new revenue recognition rules.

- One is process management for the five-step process that determines when revenue can be recognized. That begins with identifying the “contract,” which may be formal or informal. After that it must identify the performance obligations established by the contract, determine the contract price, allocate that price to the individual performance requirements and recognize revenue when that obligation is satisfied.

- An integrated contract management system or tight integration with third-party contract management products (including sales force automation) can ensure that the data regarding the contract can pass back and forth easily between systems. Invoicing and billing software must be elastic enough to capture the full palette of transaction information in order to provide the appropriate treatment of the debits and credits for that specific transaction. And it is necessary to handle any subsequent events related to that transaction such as cancellations, adjustments and modification of contracts. Processes vary across industries, and even companies in similar businesses may have slightly different contracting processes. So accounting software vendors must provide customers with unlimited freedom to define the characteristics they need to capture in the invoice and the specific accounting treatment of all of the components of that record based on those characteristics.

- Finally vendors must have a method for instantly recasting results and plans accurately and consistently to satisfy financial and management accounting revenue requirements as well as cash flow for treasury management and a taxable view for tax management purposes. ERP and other software vendors will take different approaches in making this feasible depending on their software architectures. Thus it’s important for finance executives to understand that the approach a vendor might be touting is simply an adaptation to its existing architecture, rather than the best method for their company’s purposes.

It’s not clear at this point how much disruption the new revenue recognition standards will create in finance and accounting organizations. One reason is that it’s hard to know how external auditors will behave. In the United States, the shift to a principles-based methodology will challenge a generation of auditors who grew up in a rules-heavy environment. The framework is straightforward, but the implementation of the Sarbanes-Oxley Act is a cautionary tale of how unnecessary complications can needlessly disrupt the accounting function.

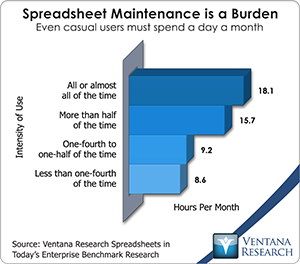

What should be abundantly clear, though, is that companies should avoid using desktop spreadsheets as much as possible in handling the revenue recognition process. Because of the complexity, it will be a nightmare to try use desktop spreadsheets for all but truly one-off calculations and prototyping work. Our research finds that in many situations spreadsheet maintenance is a burden, and this certainly will be the case here. Revenue recognition will be in a state of flux for years because of the highly predictable spate of rulemaking and “clarifications” of these treatments and maybe even requirements to recast numbers. Automating and controlling the flow of contract information from the negotiating phase all the way to invoicing can preclude the need for multiple adjustment, allocation and reconciliation steps. It can facilitate the process of creating statutory and management accounting statements and analysis of the difference between them as well as planning, budgeting and reviewing.

What should be abundantly clear, though, is that companies should avoid using desktop spreadsheets as much as possible in handling the revenue recognition process. Because of the complexity, it will be a nightmare to try use desktop spreadsheets for all but truly one-off calculations and prototyping work. Our research finds that in many situations spreadsheet maintenance is a burden, and this certainly will be the case here. Revenue recognition will be in a state of flux for years because of the highly predictable spate of rulemaking and “clarifications” of these treatments and maybe even requirements to recast numbers. Automating and controlling the flow of contract information from the negotiating phase all the way to invoicing can preclude the need for multiple adjustment, allocation and reconciliation steps. It can facilitate the process of creating statutory and management accounting statements and analysis of the difference between them as well as planning, budgeting and reviewing.

I recommend that companies that might be affected by the new revenue recognition standards review the adequacy of their ERP and financial management software to handle the new rules, including how it captures contract information in the sales process and passes it to the accounting system. They should examine their vendors’ plans for adapting to the new regulations to determine whether they are adequate for their specific needs. They should recognize that while software companies will be tempted to spread fear, uncertainty and doubt to generate business, some businesses really are in danger of being overwhelmed by the new rules.

Regards,

Robert Kugel – SVP Research

Authors:

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for Ventana Research, now part of ISG. His team covers technology and applications spanning front- and back-office enterprise functions, and he personally runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).