Workiva’s Wdesk, a cloud-based productivity application for handling composite documents, will have a larger role to play as companies adopt new revenue recognition standards governing accounting for contracts. The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP), has issued ASC 606 and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most...

Read More

Topics:

close,

closing,

XBRL,

CFO,

Document Management,

SEC,

Composite document,

10K

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

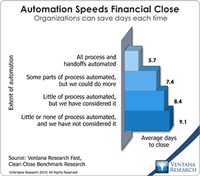

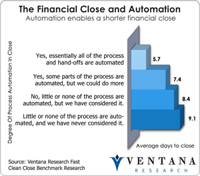

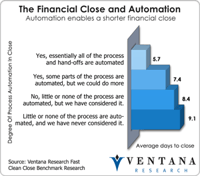

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

What’s a fast, free and reasonably reliable way of gauging the effectiveness of a finance department’s management? It’s the number of days it takes it to close the books. Companies that take six days or fewer after the end of the period to close their monthly, quarterly or semiannual accounts demonstrate a basic level of effectiveness that those that take longer do not. In my judgment, finance executives should regard a slow close as a negative key performance indicator pointing to...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Financial Performance Management

For at least a couple of decades completing the financial close within five or six business days after the end of the period has been accepted as a best practice. As such, that creates an expectation that finance organizations that take longer should work to reduce their closing intervals. In updating our last benchmark research on the closing process, Ventana Research has found this not to be the case. In fact, the latest research shows that many companies are taking longer to close today than...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Information Management (IM),

Financial Performance Management

Ventana Research recently completed an update to our last benchmark research on the financial closing process. It shows that many companies are taking longer to close today than they did five years ago. Whereas nearly half (47%) were able to close their quarter or half-year period within six business days five years ago, just 38 percent are able to do so in our latest benchmark. Similarly, five years ago 70 percent of companies were able to complete their monthly close in six days; today only...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Mobility,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management