For at least a couple of decades completing the financial close within five or six business days after the end of the period has been accepted as a best practice. As such, that creates an expectation that finance organizations that take longer should work to reduce their closing intervals. In updating our last benchmark research on the closing process, Ventana Research has found this not to be the case. In fact, the latest research shows that many companies are taking longer to close today than they did five years ago. Whereas nearly half (47%) were able to close their quarter or half-year period within six business days back then, just 38 percent are able to do so now. Similarly, five years ago 70 percent of companies were able to complete their monthly close in six days; today only half can. To be sure, closing quickly still gets lip service: The research confirms that most companies (83%) view closing their books quickly as important or very important. Yet far from demonstrating progress, the results show slow closers are regressing.

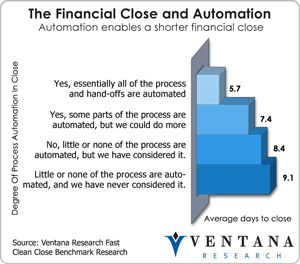

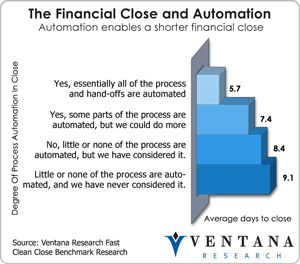

I believe one reason why it’s taking longer than it used to is that companies that take more than a week to close have too many manual or only partially automated processes. It’s likely that they reduced finance department staff in the economic downturn and therefore have fewer people to work on these processes. Moreover, I suspect that they don’t manage their processes as well as they should. Using the right software helps address these issues.

While many factors contribute to shrinking the closing period, in our experience the use of financial consolidation software is a prerequisite for larger and more complex companies seeking to minimize the time and resources needed to close their books. Many of these use ERP systems from multiple vendors, which is the condition that consolidation software initially was designed to address, but even those that have a single ERP vendor find that their ERP software does not have all of the capabilities they need to manage the close.

Our new research shows that just 37 percent of larger companies (those with 1,000 or more employees) use dedicated consolidation software to close their books. More than that (40%) use the consolidation capabilities of their ERP system, and 20 percent still use Excel or some other spreadsheet software to manage the process. We assert to companies that take longer than six business days to close their books that they should be using consolidation software.

The results show why spreadsheets especially are the wrong choice for managing the consolidation process in larger companies. On average companies that use consolidation software rather than spreadsheets save at least one day in their monthly and quarterly close. The findings also indicate that companies using consolidation software close their books 7 percent faster than companies using their ERP system.

The results show why spreadsheets especially are the wrong choice for managing the consolidation process in larger companies. On average companies that use consolidation software rather than spreadsheets save at least one day in their monthly and quarterly close. The findings also indicate that companies using consolidation software close their books 7 percent faster than companies using their ERP system.

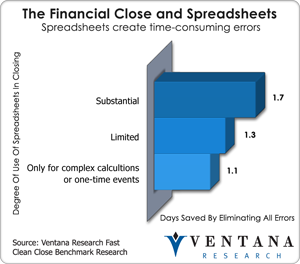

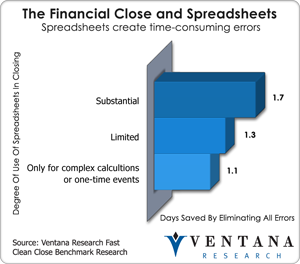

Even companies that use a dedicated consolidation system to manage their close often use desktop spreadsheets extensively in the closing process to do calculations, allocations or reconciliations. However, spreadsheets are notoriously prone to errors, and finding and resolving them is time-consuming. I calculate that companies that are heavy users of spreadsheets in the closing process could save an average of 1.6 days in their monthly or quarterly close if they could eliminate all errors.

The right software may also be a newer version of a company’s existing dedicated consolidation application or one from another vendor. Consolidation software is replaced infrequently – I estimate the replacement cycle is currently about once a decade. Older software may no longer perform well or it may lack capabilities that can help speed the financial close or make the process more efficient. Companies that are heavy users of spreadsheets because their existing software requires a considerable number of work-arounds should consider how much time they could save with more up-to-date software. Ideally, a newer application should enable a company to automate much of its reconciliation process and provide easy-to-configure workflows to promote consistency in process execution. In addition to ensuring faster handoffs and providing reminders to complete tasks, workflow also enables those managing the process to keep track of progress and get alerts of deadlines have been missed.

Using the right software is one of the key components to achieving a faster close, along with good execution of a well-designed process and managing the data component. It’s equally important for companies that take longer than six business days to complete their accounting close to give a faster close more than lip service. I think how quickly a company closes its books is a good indicator of its overall strength and competence. Well-organized and well-managed finance departments are able to finish the process within about a business week. Those that cannot do it are likely to have problems with the design of the process, how well the process is performed, the training of those who perform the process, the software they use to support the process and the timeliness and accessibility of the data that’s needed. In some cases it may be that only one of these issues is the main issue, but usually it’s a combination of people, process, information and technology. I recommend that finance departments that take more than week to close their monthly, quarterly or semi-annual books begin a process of identifying why it takes that long and then begin to implement a program to shorten their close.

Regards,

Robert Kugel – SVP Research