The idea of devising and using maturity assessments to improve business performance has been a staple of management, functional and strategic consultants for decades. It’s based on two unassailable principles. One is the general assertion that companies differ in their ability to do anything along a range from nonexistent to advanced. The second is that at any time it’s possible for a knowledgeable individual to construct a scale of competence for some business function from least to most...

Read More

Topics:

Performance Management,

Social Media,

Customer Experience,

Governance,

Operational Performance Management (OPM),

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

IT Performance Management (ITPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

FPM

SAP has inaugurated a new series of business applications it calls Enterprise Performance Management (EPM) OnDemand as a cloud-based subscription service. The applications are part of SAP’s EPM version 10 suite, which it introduced last year. It’s a first step in what is likely to be a portfolio of general-purpose, lightweight and relatively low-cost apps designed to be used on mobile devices. Using HANA on the back end, the applications can deliver high performance in accessing masses of...

Read More

Topics:

Big Data,

Performance Management,

SAP,

Office of Finance,

Operational Performance Management (OPM),

expense,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Applications,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

FPM,

HANA

There weren’t any headlines (or even many tweets) about Oracle Fusion Financials emanating from this year’s Oracle OpenWorld (#OOW12) conference. Maybe that’s by design, because it’s not in Oracle’s best interest to kick up a lot of dust about ERP migration. The financial applications software market is mature, and market share leaders such as Oracle have less interest in getting customers to upgrade than they did a decade ago. For a software vendor with a large installed base, cashing rich...

Read More

Topics:

Performance Management,

ERP,

Office of Finance,

financial,

Cloud Computing,

Oracle,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Workday,

JD Edwards,

PeopleSoft

Unless you have some combination of a very strong credit rating, a high income-to-debt payment ratio and a relatively low loan-to-value ratio, it’s not especially easy to refinance a mortgage these days. That’s a shame, because there are plenty of people who have stayed current in meeting their credit obligations and whose mortgages are comfortably below current market value who could benefit from today’s record low interest rates. One major reason they can’t refinance is the collapse of...

Read More

Topics:

Office of Finance,

XBRL,

Analytics,

Business Analytics,

Business Performance Management (BPM),

finance,

Financial Performance Management (FPM),

capital markets

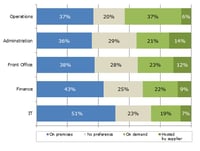

Salesforce.com’s recent Dreamforce user conference got me wondering about how far the market for cloud-based software has come. To answer that question, I looked to our own research. For the past several years Ventana Research has routinely asked participants in its benchmark research what preference, if any, they have for deploying software they use to support the activity we are benchmarking. The choices we offer are on-premises, software as a service (SaaS – that is, in the cloud), hosted on...

Read More

Topics:

SaaS,

Sales,

Salesforce.com,

Operational Performance Management (OPM),

Cloud Computing,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Software

Two key themes that emerged from Larry Ellison’s Sunday night keynote at this year’s Oracle OpenWorld were faster processing speed and cheaper storage. An underlying purpose to these themes was to assert the importance of Oracle’s strategic vertical integration of hardware and software with the acquisitions of Sun. I try to view technology keynotes like this from the perspective of a practical business user. Advancements such of these are important because enhancing the performance and...

Read More

Topics:

Big Data,

Customer Experience,

executive,

Business Analytics,

Data Management,

In-Memory Computing,

Information Management,

Business Performance Management (BPM),

Business Process Management,

Data,

Financial Performance Management (FPM),

IT Performance Management (ITPM),

FPM