In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

legal,

tax optimization,

tax data warehouse Thomson-Reuters multinational,

international tax,

tax compliance

Like many other industry observers I’ve heard overblown claims for information technology for decades. However, I’ve also observed that – eventually – reality catches up with vision. Finance and accounting departments are particularly resistant to change, yet because almost no corporations use adding machines or typewriters any more, it’s clear that transformative change can happen. Nonetheless, because users of business computing systems are inundated with “it’s better than ever” promotions by...

Read More

Topics:

Social Media,

Mobile Technology,

Office of Finance,

Operational Performance Management (OPM),

Human Capital,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM)

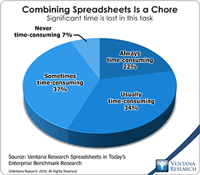

Ventana Research coined the term “enterprise spreadsheet” in 2004 to describe a variety of software applications that add a desktop spreadsheet’s user interface (usually that of Microsoft Excel) to components that address the issues that arise when desktop spreadsheets are used in repetitive, collaborative enterprise processes. Enterprise spreadsheets are designed to provide the best of both worlds in that they offer the ease of use and flexibility of desktop spreadsheets while overcoming their...

Read More

Topics:

Operational Performance Management (OPM),

Analytics,

Business Analytics,

Business Intelligence,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM)

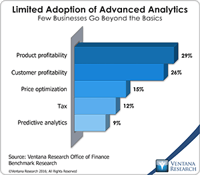

Vendavo is a vendor of business-to-business (B2B) price and revenue optimization software, which I have written about. A major focus of the conference sessions this year at the company’s annual user group meeting was on practical approaches to successful price optimization initiatives. While this category of software has been achieving increasing acceptance, penetration is still limited in the B2B segment, which includes, for example, industrial goods and services.

Read More

Topics:

Big Data,

Operational Performance Management (OPM),

Business Analytics,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Vendavo, price, pricing, optimization, revenue, cu

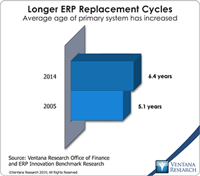

Unit4, a Netherlands-based vendor of financial management software focused mainly on midsize companies, recently acquired prevero, a German vendor of performance management and business intelligence software. The acquisition reflects a convergence of transactional and analytic business applications, which I have written about. ERP and financial management software vendors increasingly are adding analytic capabilities – especially in financial performance management (FPM) – to the core functions...

Read More

Topics:

Office of Finance,

Business Analytics,

Business Performance Management (BPM),

Financial Performance Management (FPM)

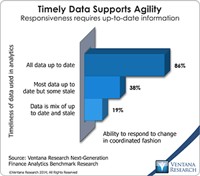

Information technology enables a data-driven management style that was not feasible until powerful, affordable computers became generally available. There’s no bright line marking when this became possible; the process is ongoing. People were using financial analytics long before ENIAC, the first general-purpose computer, appeared, but the metrics available were not especially timely, broadly applicable to day-to-day situations or comprehensive enough to inform most management decision-making....

Read More

Topics:

Big Data,

Office of Finance,

Operational Performance Management (OPM),

Business Analytics,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM)

Infor recently held its annual Innovation Summit at its New York City headquarters. The company has shown leadership and creativity in business applications on two fronts: focusing its development efforts on enhancing the user experience and collaboration and building an application architecture that will deliver a rich set of functionality for ERP, financial management, CRM and HRMS and business analytics in a multitenant cloud environment. All of these advances were necessary to remake a...

Read More

Topics:

Mobile Technology,

Operational Performance Management (OPM),

accounting, analytics, ERP, EAM, CRM, HCM, innovat,

Human Capital,

Business Analytics,

Cloud Computing,

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM)

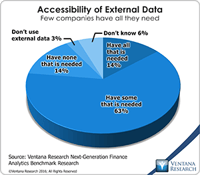

I coined the term “cryptic data” to mean information that isn’t easy to find or access by people who could make use of it. In one instance, cryptic data offers professional investors – portfolio managers and securities analysts – a source of proprietary information that can improve their ability to pick stocks and achieve superior performance relative to their benchmarks. Automation through technology now makes collecting cryptic data substantially more efficient than manual methods and thus...

Read More

Topics:

Big Data,

Analytics,

Business Analytics,

Uncategorized,

Business Performance Management (BPM),

Financial Performance Management (FPM)

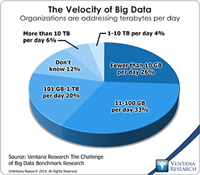

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Social Media,

FP&A,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Human Capital,

Kofax,

Statistics,

Analytics,

Business Analytics,

Business Intelligence,

Customer Performance Management (CPM),

Data,

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Strata+Hadoop

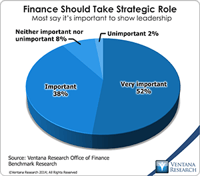

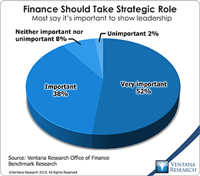

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments totake a strategic role in running...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Human Capital,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Uncategorized,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM