This is annual report season, the time of year that a majority of European and North American corporations issue glossy paper documents aimed at investors, customers, suppliers, existing and prospective employees as well as the public at large. (Some countries have different conventions; in Japan, for instance, most companies are on a March fiscal year.) In reviewing some of the annual reports that are available on the Web, I was struck by the absence of advanced reporting technology used on...

Read More

Topics:

Office of Finance,

extended close,

US-GAAP,

XBRL,

Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

financial reporting,

SEC,

Digital Technology

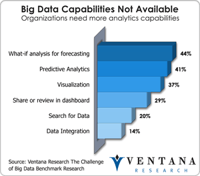

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

costing,

FPM,

Profitability

I’m wondering whether the rapid rise in earnings restatements by “accelerated filers” (companies that file their financial statements with the U.S. Securities and Exchange Commission that have a public float greater than $75 million) over the past three years is a significant trend or an interesting blip. According to a research firm, Audit Analytics, that number has grown from 153 restatements in 2009 to 245 in 2012, a 60 percent increase. What makes it a blip is that the total is still less...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

Tax,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

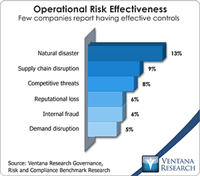

I’ve frequently commented on the artificiality of the emerging software category of governance, risk and compliance (GRC). The term is used to a cover a combination of what were once viewed as stand-alone software categories, including IT governance, audit documentation and industry-specific compliance management, to name three examples. While it’s still common for specific types of software to be purchased piecemeal by different departments, these disparate areas have started a long...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

Risk,

financial risk management,

IT Risk Management,

Sarbanes Oxley,

SOX

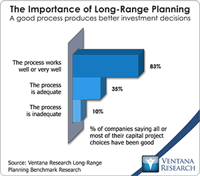

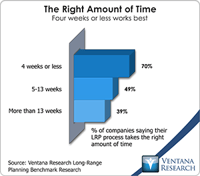

Ventana Research completed an in-depth benchmark research project on long-range planning recently. As I define it, long-range planning is the formal quantification of the strategic plan and how that strategy is expected to play out over a period of time. The benchmark demonstrated that there’s room for improvement in almost every aspect of the long-range planning process. Almost all (95%) of those participating in the research see the need to advance their process. The research confirmed that...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

Ventana Research recently completed an in-depth benchmark research project on long-range planning. As part of the research we had discussions with CFOs and those involved in financial planning and analysis about their company’s strategic and long-range planning processes, which pointed to the need for clarity in using the terms “strategic planning” and “long-range planning.”

Read More

Topics:

Big Data,

Performance Management,

Planning,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

I was discussing the United States Securities and Exchange Commission’s (SEC) eXtensible Business Reporting Language (XBRL) mandate with a former head of investor relations at a Fortune 100 company. His take on it is much the same as that of everyone else involved with corporate reporting: it doesn’t produce much value and costs a bundle to comply. I related to him my thoughts on the lack of progress I saw in making the XBRL mandate more useful to corporations and investors alike. Making XBRL...

Read More

Topics:

Office of Finance,

Reporting,

extended close,

US-GAAP,

XBRL,

Analytics,

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

financial reporting,

FPM,

SEC,

Digital Technology

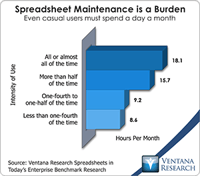

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Reporting,

enterprise spreadsheet,

Analytics,

Visualization,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

Financial Performance Management