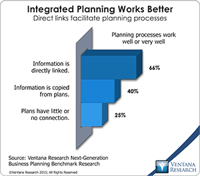

IBM Planning Analytics with Watson is a comprehensive, cloud-based business planning application that supports what Ventana Research calls integrated business planning. We coined this term in 2007 to describe a high-participation approach to business planning that integrates strategy, operations and finance. Our Next Generation Business Planning Benchmark Research demonstrated the value of IBP: Organizations that link planning processes get better results. Sixty-six percent of organizations...

Read More

Topics:

Predictive Analytics,

Office of Finance,

business intelligence,

embedded analytics,

Business Planning,

Financial Performance Management,

Watson,

Digital transformation,

AI & Machine Learning,

profitability management

The use of blockchain distributed ledgers in business processes is now a common theme in many business software vendors’ presentations. The technology has a multitude of potential uses. However, presentations about the opportunities for digital transformation always leave me wondering: How is this magic going to happen? I wonder this because the details about how data flows from point A to point B via a blockchain are critically important to blockchain utility and therefore the pace of its...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

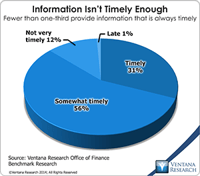

Ventana Research uses the term “predictive finance” to describe a forward-looking, action-oriented finance organization that places emphasis on advising its company rather than fulfilling the traditional roles of a transactions processor and reporter. Technology is driving the shift away from the traditional bean-counting role. The cumulative evolution of software advances will substantially reduce finance and accounting workloads by automating most of the mechanical, rote functions in...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

The treasury function in finance departments doesn’t get a lot of attention, but it’s a fundamentally important one: to ensure that all funds are accounted for and that there is sufficient cash on hand each day to meet operating requirements. Keeping track of and managing cash, especially in larger organizations, can be complicated because of multiple bank accounts, complex financing requirements and various methods of receiving and making payments; the complexity deepens when more than one...

Read More

Topics:

Predictive Analytics,

Office of Finance,

credit,

debt,

Analytics,

CFO,

cash management,

controller,

Financial Performance Management

There were two noteworthy themes in SAP CEO Bill McDermott’s keynote at this year’s Sapphire conference. One was customer assurance; that is, placing greater emphasis on making the implementation of even complex business software more predictable and less of an effort. This theme reflects the maturing of the enterprise applications business as it transitions from producing highly customized software to providing configurable, off-the-rack purchases. Implementing ERP will never be simple, as I...

Read More

Topics:

Predictive Analytics,

SAP,

Operational Performance Management (OPM),

Uncategorized,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM)

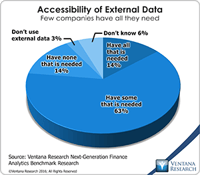

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Social Media,

FP&A,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Human Capital,

Kofax,

Statistics,

Analytics,

Business Analytics,

Business Intelligence,

Customer Performance Management (CPM),

Data,

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Strata+Hadoop

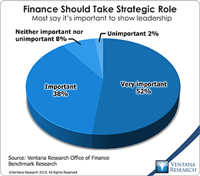

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments totake a strategic role in running...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Human Capital,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Uncategorized,

Business Performance Management (BPM),

CFO,

CPQ,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Predictive Analytics,

Customer Experience,

Marketing Planning,

Reporting,

Budgeting,

Human Capital,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Business Planning,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Demand Planning,

Integrated Business Planning,

Project Planning

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

SAP,

ERP,

FP&A,

Mobile Technology,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

close,

closing,

Controller,

dashboard,

Human Capital,

Tax,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Data,

finance,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

Unit4 is a global business software vendor focused on business and professional services, the public sector and higher education. Recently company executives met with industry analysts to provide an update of its strategic roadmap and to recap its accomplishments since being acquired by a private equity firm in 2014. Unit4 is the result of successive mergers of ERP and business software companies, notably CODA and Agresso. The company is also a part-owner (with salesforce.com and others) of...

Read More

Topics:

Predictive Analytics,

Office of Finance,

Operational Performance Management (OPM),

Human Capital,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

Financial Performance Management (FPM)