The developed world has an embarrassment of riches when it comes to information technology. Individuals walk around with far more computing power and data storage in their pockets than was required to send men to the moon. People routinely hold on their laps what would have been considered a supercomputer a generation ago. There is a wealth of information available on the Web. And the costs of these information assets are a tiny fraction of what they were decades ago. Consumer products have...

Read More

Topics:

Big Data,

Mobile,

Predictive Analytics,

Social Media,

Customer Experience,

Operational Performance Management (OPM),

Performance,

Analytics,

Business Analytics,

Business Collaboration,

IBM,

Business Performance Management (BPM),

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Sales Performance Management,

Sales Performance Management (SPM),

Social,

Financial Performance Management,

SPSS

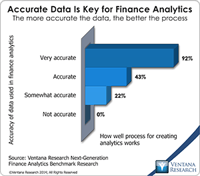

Our research consistently finds that data issues are a root cause of many problems encountered by modern corporations. One of the main causes of bad data is a lack of data stewardship – too often, nobody is responsible for taking care of data. Fixing inaccurate data is tedious, but creating IT environments that build quality into data is far from glamorous, so these sorts of projects are rarely demanded and funded. The magnitude of the problem grows with the company: Big companies have more...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Applications (IA),

Risk,

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

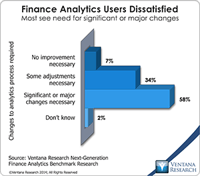

Business computing has undergone a quiet revolution over the past two decades. As a result of having added, one-by-one, applications that automate all sorts of business processes, organizations now collect data from a wider and deeper array of sources than ever before. Advances in the tools for analyzing and reporting the data from such systems have made it possible to assess financial performance, process quality, operational status, risk and even governance and compliance in every aspect of a...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

CEO,

Financial Performance Management,

FPM

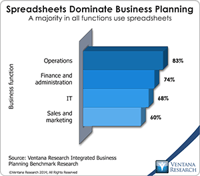

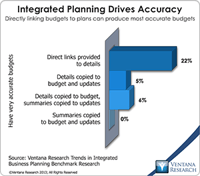

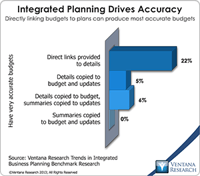

Anaplan, a provider of cloud-based business planning software for sales, operations, and finance and administration departments, recently implemented its new Winter ’14 Release for customers. This release builds on my colleagues analysis on their innovation in business modeling and planning in 2013. Anaplan’s primary objective is to give companies a workable alternative to spreadsheets for business planning. It is a field in which opportunity exists. Our benchmark research on this topic finds...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Operations,

Reporting,

Budgeting,

Controller,

Business Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Sales Planning,

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

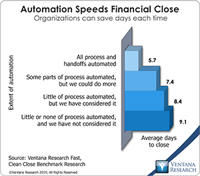

A core objective of my research practice and agenda is to help the Office of Finance improve its performance by better utilizing information technology. As we kick off 2014, I see five initiatives that CFOs and controllers should adopt to improve their execution of core finance functions and free up time to concentrate on increasing their department’s strategic value. Finance organizations – especially those that need to improve performance – usually find it difficult to find the resources to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

close,

dashboard,

PRO,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

CEO,

demand management,

Financial Performance Management,

FPM,

S&OP

Senior finance executives and finance organizations that want to improve their performance must recognize that technology is a key tool for doing high-quality work. To test this premise, imagine how smoothly your company would operate if all of its finance and administrative software and hardware were 25 years old. In almost all cases the company wouldn’t be able to compete at all or would be at a substantial disadvantage. Having the latest technology isn’t always necessary, but even though...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

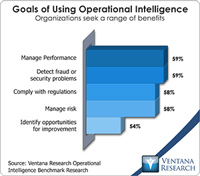

All the hubbub around big data and analytics has many senior finance executives wondering what the big deal is and what they should do about it. It can be especially confusing because much of what’s covered and discussed on this topic is geared toward technologists and others working outside of Finance, in areas such as sales, marketing and risk management. But finance executives need to position their organization to harness this technology to support the strategic goals of their company. To...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Controller,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

CFO,

compliance,

finance,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

Financial Performance Management,

financial risk management

Tidemark announced the release of the Fall 2013 version of its eponymous cloud-based application that my colleague assessed earlier in 2013. This new release adds capabilities for labor planning and expense management as well profitability modeling and analysis. These two areas of planning and analysis are common to all businesses. The new release adds features that enhance the software’s ability to do sales forecasting, initiative planning and IT department planning. The company continues to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

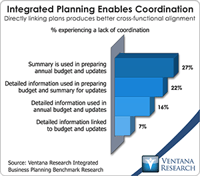

Business planning is a new software category. These applications enable senior executives to integrate all the plans of business units into a single, integrated view, which helps them have more accurate plans, do more insightful what-if planning, achieve greater agility in reacting to changing business and economic conditions, and execute plans in a more coordinated fashion than was possible. Business planning software is intended for CEOs and COOs, who are not well served by current...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Business Analytics,

Business Collaboration,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Workforce Performance Management (WPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

Business planning as practiced today is a relic, a process hemmed in by obsolete conceptions of what it should be. I use the term “business planning” to encompass all of the forward-looking activities in which companies routinely engage, including, for example, sales, production and head-count planning as well as budgeting. Companies need to take a fresh view of all these, adopting a new approach to business planning that while preserving continuity makes a substantial departure from what most...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning