All the hubbub around big data and analytics has many senior finance executives wondering what the big deal is and what they should do about it. It can be especially confusing because much of what’s covered and discussed on this topic is geared toward technologists and others working outside of Finance, in areas such as sales, marketing and risk management. But finance executives need to position their organization to harness this technology to support the strategic goals of their company. To...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Controller,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

CFO,

compliance,

finance,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

Financial Performance Management,

financial risk management

A recent news release by Robert Half, a staffing company that specializes in accounting and finance personnel, covered what it sees as the most important attributes required for auditors in the 21st century. “7 Attributes of Highly Effective Internal Auditors” covers the people dimension of the profession and focuses on the non-technical requirements of the role, including relationship-building, teamwork, and diversity. No doubt these skills are a must for just about anybody working in a modern...

Read More

Topics:

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Infor,

Risk,

HANA,

Oversight Systems

SAP recently announced its new Fraud Management analytic applications. Currently in “controlled” (limited) release, it’s a promising start for the product and a good example of the type of business process revolution that’s possible when companies can execute complex analytics on big data sets using in-memory and other advanced processing techniques. Over the next several years a wide swath of basic corporate processes will be transformed by the shift to in-memory processing and big data...

Read More

Topics:

SAP,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Risk,

HANA

Many people enjoy mystery stories or crime thrillers; in the same vein of savoring the whodunnit and howdunnit, I like a good accounting scandal. My fascination with cooking the books started when I was young with the “great salad oil swindle”, which wound up causing losses in excess of $1 billion in today’s money and even threatened a Wall Street collapse. This disaster was averted by the assassination of President Kennedy, which kept markets closed on Monday, November 25, 1963, and gave the...

Read More

Topics:

Fraud,

Governance,

GRC,

Office of Finance,

audit,

IFRS,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Financial Performance Management (FPM),

Hewlett Packard,

Meg Whitman,

SEC

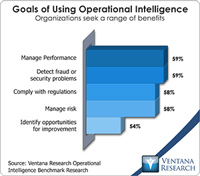

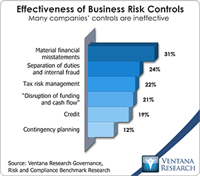

I recently spoke with Oversight Systems, an operational intelligence analytics company that uses predictive analytics and optimization to help companies save money, reduce the risk of loss and fraud, and reinforce corporate governance and compliance efforts. Ventana Research views operational intelligence as an emerging technology with the potential for a high return on investment. By continuously monitoring activities in a company’s IT systems, Oversight’s Web-based software continuously,...

Read More

Topics:

Big Data,

Predictive Analytics,

Fraud,

Governance,

GRC,

Office of Finance,

Operational Performance Management (OPM),

audit,

Analytics,

Business Analytics,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Management (IM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

controls,

Oversight Systems