FP&A and business analysts can make reporting more effective by reimagining how, what and when their company does its reporting. They should provide the users of their reports the information they want in a form they want it. They should be thinking about how they can make reporting more effective by rethinking how data is presented, how interactive it is, and what visualizations are used. Rethinking how to combine narratives, data, charts and graphics to everyday communications. How to add...

Read More

Topics:

FP&A,

Office of Finance,

CFO,

financial regulation,

financial reporting,

financial risk management,

financial standards,

tax planning

Ventana Research recently awarded Workday a 2016 Technology Innovation Award for its newly released application, Workday Planning, because it simplifies and streamlines the budgeting and planning processes while facilitating collaboration, deepening visibility into spending and enabling tight fiscal control. These capabilities can help a variety of user organizations in several ways.

Read More

Topics:

Big Data,

Marketing,

Office of Finance,

Budgeting,

In-memory,

CFO,

Workday,

controller,

demand management,

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

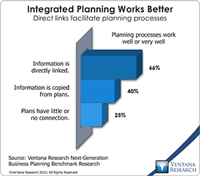

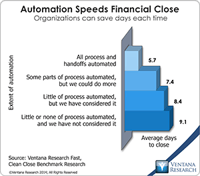

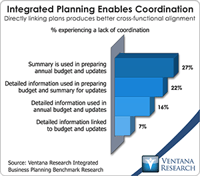

Ventana Research recently released the results of our Next-Generation Business Planning benchmark research. Business planning encompasses all of the forward-looking activities in which companies routinely engage. The research examined 11 of the most common types of enterprise planning: capital, demand, marketing, project, sales and operations, strategic, supply chain and workforce planning, as well as sales forecasting and corporate and IT budgeting. We also aggregated the results to draw...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Sales,

Social Media,

Human Capital Management,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Business Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Workforce Performance Management (WPM),

capital spending,

demand management,

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning,

S&OP

Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

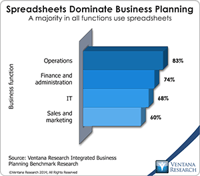

Anaplan, a provider of cloud-based business planning software for sales, operations, and finance and administration departments, recently implemented its new Winter ’14 Release for customers. This release builds on my colleagues analysis on their innovation in business modeling and planning in 2013. Anaplan’s primary objective is to give companies a workable alternative to spreadsheets for business planning. It is a field in which opportunity exists. Our benchmark research on this topic finds...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Operations,

Reporting,

Budgeting,

Controller,

Business Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Sales Planning,

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

Tidemark announced the release of the Fall 2013 version of its eponymous cloud-based application that my colleague assessed earlier in 2013. This new release adds capabilities for labor planning and expense management as well profitability modeling and analysis. These two areas of planning and analysis are common to all businesses. The new release adds features that enhance the software’s ability to do sales forecasting, initiative planning and IT department planning. The company continues to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Tidemark,

Workforce Performance Management (WPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

Business planning is a new software category. These applications enable senior executives to integrate all the plans of business units into a single, integrated view, which helps them have more accurate plans, do more insightful what-if planning, achieve greater agility in reacting to changing business and economic conditions, and execute plans in a more coordinated fashion than was possible. Business planning software is intended for CEOs and COOs, who are not well served by current...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Business Analytics,

Business Collaboration,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Workforce Performance Management (WPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Cloud Computing,

In-memory,

Oracle,

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software

Business planning as practiced today is a relic, a process hemmed in by obsolete conceptions of what it should be. I use the term “business planning” to encompass all of the forward-looking activities in which companies routinely engage, including, for example, sales, production and head-count planning as well as budgeting. Companies need to take a fresh view of all these, adopting a new approach to business planning that while preserving continuity makes a substantial departure from what most...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Supply Chain Performance Management (SCPM),

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

The International Integrated Reporting Council (IIRC) recently published a draft framework outlining how it believes businesses ought to communicate with their stakeholders. In this context the purpose of an “integrated report” is to promote corporate transparency by clearly and concisely presenting how an organization’s strategy, governance, and financial and operational performance will create value for shareholders and other stakeholders in both the short and the long term. Such a report...

Read More

Topics:

Sustainability,

Office of Finance,

closing,

XBRL,

Business Analytics,

Business Intelligence,

Information Applications (IA),

Information Management (IM),

financial reporting,

FPM,

SASB,

SEC