We recently issued our 2012 Value Index on Financial Performance Management (FPM). Ventana Research defines FPM as the process of addressing the often overlapping people, process, information and technology issues that affect how well finance organizations operate and support the activities of the rest of their organization. FPM deals with the full cycle of finance department activities, which includes planning and budgeting, analysis, assessment and review, closing and consolidation, internal financial reporting and external financial reporting, as well as the underlying information technology systems that support them. We construct the Index through a detailed evaluation of each product’s suitability to task in five categories, as well as the effectiveness of the vendor’s support for the buying process and customer assurance. The resulting index gauges the value offered by a vendor and its products.

Financial performance management is a necessity for running an organization efficiently and effectively. Corporations, small businesses, government entities and nonprofits all must be able to set financial objectives, plan and budget, and review and evaluate their financial performance in a timely fashion to control their fiscal well-being and achieve their strategic objectives. Increasingly, finance organizations also are being asked to play a more strategic role, providing analytic support to operating units in areas such as profit optimization. Rather than being the rear-view mirror on performance, Finance can use advanced analytics to support more forward-looking activities, providing early alerts to executives and managers about opportunities and threats, while making robust contingency planning substantially easier to do.

efficiently and effectively. Corporations, small businesses, government entities and nonprofits all must be able to set financial objectives, plan and budget, and review and evaluate their financial performance in a timely fashion to control their fiscal well-being and achieve their strategic objectives. Increasingly, finance organizations also are being asked to play a more strategic role, providing analytic support to operating units in areas such as profit optimization. Rather than being the rear-view mirror on performance, Finance can use advanced analytics to support more forward-looking activities, providing early alerts to executives and managers about opportunities and threats, while making robust contingency planning substantially easier to do.

Traditionally, managing financial performance has involved well-established processes and analytic techniques. Today, the maturation of information technology systems is adding another dimension. The term FPM was created to encompass the once separate but now interrelated information systems that have transformed financial management, increasing the breadth and depth of financial and operational information that organizations can access and analyze. FPM enables a much deeper understanding of an organization’s historical performance and gives it the tools to dynamically realign future activities to support internal strategy. Increasingly the focus is shifting more to action-oriented analytics.

Using our rigorous benchmark research methodology, Ventana Research examined how organizations execute FPM, which includes exploring their maturity in planning and budgeting, reporting, analysis, consolidation and closing. We also have done extensive research into how companies use spreadsheets to manage and support these activities and how those tools undermine the quality, timeliness and accuracy of core business processes. The research shows that in the major financial performance management processes and capabilities, most organizations are relatively immature, with just 10 to 15 percent at the highest of our four maturity levels. To put it simply, a majority of companies fail to provide financial information on a timely basis.

Having the right technology and using it to its fullest are essential to achieving better execution of FPM processes. For example, our benchmark research on trends in fast closing your financials shows that on average, companies that use consolidation software close their books about one-third faster than those that perform this task using spreadsheets, and companies that use spreadsheets sparingly in the closing process encounter fewer errors in preparing their financial statements than those that use them extensively. Having the right software is vital to a corporation’s ability to manage finance operations and performance.

Our Value Index examines suites of software that comprise a comprehensive approach to FPM. The advantage of using such a suite is that it is usually easier for individuals that have to use more than one piece of it to become proficient in them. For instance, a suite almost always provides a single sign-on, which is probably not the case if an organization assembles various pieces from multiple vendors. As well, those managing the software also will find it easier to learn and work with a single suite, especially in handling administrative functions. In midsize and larger companies, administrators can wear multiple hats, and their responsibilities can shift from one piece of the suite to another over time. Then, too, from an IT perspective suites are usually easier and less expensive to maintain.

In assessing the capabilities of the FPM suites, we evaluate a full range of functionality – think of these software packages as Swiss Army knives. Some of these capabilities cover core functions that every company does, such as statutory consolidations, dashboards and budgeting). Others support tasks that have been adapted to varying degrees by finance organizations, such as profitability management or advanced costing methods. We believe that the finance departments of midsize and larger corporations (those with 100 or more employees) need more tools in their Swiss Army knife these days to fulfill their expanding roles, which is why we score based on the full set of functionality, even if your organization may be looking only for budgeting or consolidation software.

functionality – think of these software packages as Swiss Army knives. Some of these capabilities cover core functions that every company does, such as statutory consolidations, dashboards and budgeting). Others support tasks that have been adapted to varying degrees by finance organizations, such as profitability management or advanced costing methods. We believe that the finance departments of midsize and larger corporations (those with 100 or more employees) need more tools in their Swiss Army knife these days to fulfill their expanding roles, which is why we score based on the full set of functionality, even if your organization may be looking only for budgeting or consolidation software.

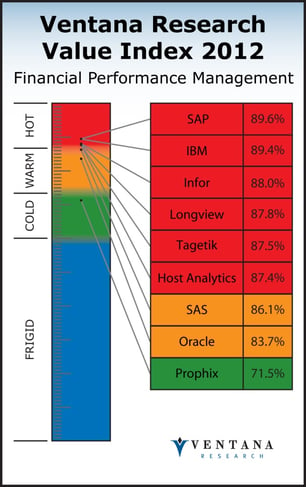

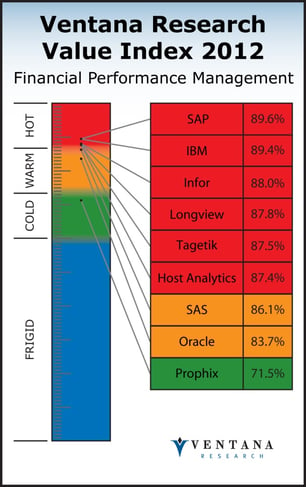

The Financial Performance Management suite category is a mature one, as evidenced by the close and almost uniformly high scores garnered by the software vendors in our Index. The company delivering the highest value in an overall weighted evaluation is SAP, followed by IBM, Infor, Longview, Tagetik and Host Analytics; all of these earned the Hot Vendor rating. They are followed by SAS and Oracle, which earned the next level rating of Warm.

I find that too often finance organizations take too narrow a view when purchasing FPM software. Technology has evolved slowly over the past decade, but the cumulative result had made software offerings that support FPM considerably more sophisticated in their capabilities and easier to use with less direct support from IT organizations. While those working in finance today may not feel a pressing need for mobile access to FPM-generated data and reports, corporate executives and those in certain roles such as sales certainly do. Before acquiring or replacing FPM-related applications, I recommend that executives and managers investigate what’s available and how it can support better management of the finance function.

Regards,

Robert Kugel – SVP Research