Artificial intelligence using machine learning has passed through the bright, shiny object stage and software vendors are well into the process of making the concept a reality in their offerings. Ventana Research defines AI as the use of technology to process information in much the way humans do, including improving accuracy in recommendations, actions and conclusions as more data is received. I like the alternative term “augmented intelligence” because it emphasizes that these systems enhance – rather than replace – the capabilities of the humans employing them, especially through improved decision-making and eliminating the need to perform repetitive work.

Ventana Research asserts that by 2025, all vendors of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. For cloud software applications, the transition will be accomplished with a stream of enhancements that become available when vendors are convinced they are sufficiently robust to provide value and will not frustrate customers. From a market perspective, AI will provide a considerable opportunity for product differentiation for vendors that are most successful in introducing a steady stream of significant, useful advancements.

Ventana Research asserts that by 2025, all vendors of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. For cloud software applications, the transition will be accomplished with a stream of enhancements that become available when vendors are convinced they are sufficiently robust to provide value and will not frustrate customers. From a market perspective, AI will provide a considerable opportunity for product differentiation for vendors that are most successful in introducing a steady stream of significant, useful advancements.

There are five general areas where AI has immediate potential to be valuable to finance departments, especially the financial planning and analysis group.

- Forecasting and planning: AI improves accuracy and enhances agility in responding to change by automating time series analysis to rapidly develop predictive models for more accurately forecast revenue and costs as well as balance sheet items and cash flows. AI also continuously monitors model accuracy and relevance to signal when it’s necessary to retrain models as conditions evolve. This same analytical capability can identify factors useful for driver-based planning and forecasting, which facilitates the integration of operational and financial planning.

- Analytics: AI accelerates production through automation as well as providing assistance to supplement users’ analytical skills.

- Task supervision: Using machine learning, a system can constantly monitor inputs and results to spot potential anomalies, inconsistencies, outliers, errors and omissions in data entry without specific programming.

- Recommendations: The system can suggest a next best step or options for the next step, or a range of values to input that represent a best fit under the circumstances.

- Automated commentary: Notation is already possible, but will increasingly become a standard feature in reporting software, offering richer and more meaningful narratives.

Strategic, high business-impact uses of AI are the goal. I expect the capabilities offered by software vendors will start with the most straightforward tasks because these are the easiest to get right and will build the trust necessary for user acceptance. Vendors must be sure that the features work reliably as advertised. In this context, the word performant, meaning “working well or as expected,” must be achieved in AI offerings. This means vendors must have the analytics and data that make this state possible.

-png.png?width=300&name=Ventana_Research_Benchmark_Research_Office_of_Finance_19_36_Limited_Adoption_of_Advanced_Analytics%20(1)-png.png) Improving the accuracy of financial and operational forecasts is high on executives’ wish lists. Predictive analytics can enhancing forecast accuracy, yet our Office of Finance Benchmark Research shows the technique has limited adoption: Only 24% of organizations use predictive analytics. This is likely the result of the difficulty FP&A groups face in acquiring and managing data necessary for usefully accurate projections, a lack of skilled analysts and not enough time to apply these techniques. Vendor-supplied AI-enabled applications have the potential to overcome resource issues by building data science automation into an offering as well as providing the means of acquiring and staging the necessary data.

Improving the accuracy of financial and operational forecasts is high on executives’ wish lists. Predictive analytics can enhancing forecast accuracy, yet our Office of Finance Benchmark Research shows the technique has limited adoption: Only 24% of organizations use predictive analytics. This is likely the result of the difficulty FP&A groups face in acquiring and managing data necessary for usefully accurate projections, a lack of skilled analysts and not enough time to apply these techniques. Vendor-supplied AI-enabled applications have the potential to overcome resource issues by building data science automation into an offering as well as providing the means of acquiring and staging the necessary data.

Some examples of relatively straightforward tasks for AI include spotting outliers in entries, outcomes and results, highlighting them and suggesting alternatives. Or, recommending values or a range of values to those filling in forms or creating forecasts and budgets. Some of these capabilities already exist in the market but will become pervasive and increasingly robust and performant. In reporting, AI can identify anomalies and highlight significant factors behind results or variances.

AI can rapidly identify the most useful statistical relationships in a data set faster and more accurately than most humans, and it can do so on a continuous basis, ensuring statistical models reflect the most recent experience and conditions. Identifying situations where multiple variables result in a better prediction of likely outcomes is an example of a more complex analytical task that requires a different level of machine learning and a richer and more diverse data set – such as operational and external data (like economic and market conditions). Using AI to identify a richer set of factors can significantly improve the accuracy of forecasts, especially when identifying breaks in trends or assessing why events diverged from plan.

AI can support an early warning system that continuously monitors conditions to promote keener situational awareness and performance while simultaneously providing recommended actions and their likely outcomes. The main challenge for vendors in this situation is in managing false positives and false negatives – training the system well enough so that it doesn’t generate too many spurious alerts or miss obvious signals with significant outcomes. Failing to do so risks frustrating users with analyses, assessments and prescriptions that are either trivial, blindingly obvious or just plain wrong. The opposite effect delivers results not reliable enough to be trustworthy.

For commentaries in reports, AI will improve the context and clarity of observations, and reduce the time analysts spend writing them. Future systems will automatically generate more in-depth, insightful commentary in self-service reports, independent of an analyst.

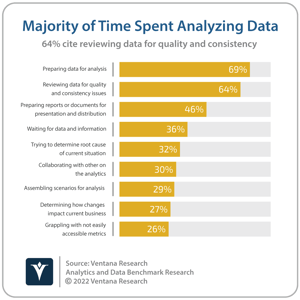

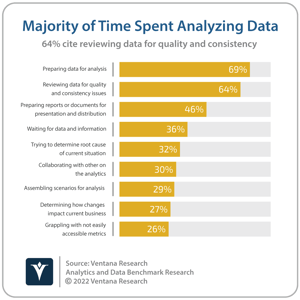

Planning and forecasting software that incorporates AI using machine learning can be far more intelligent than programmed systems because it learns and adapts over time. However, the quality of intelligence, analysis and recommendations is completely dependent on the available data, especially the quality and scope of data it absorbs over time. Yet most finance organizations find it challenging to compile the necessary data for training the system. And organizations may rely heavily on manual data extraction, transformation, enrichment and movement. This approach cannot scale to the needs of a machine learning system because, with manual systems, there isn’t enough time available to make machine learning practical. Our Analytics and Data Benchmark Research reveals that 69% of participants find preparing data for analysis very time-consuming, and 64% say reviewing data for quality and consistency issues requires significant time.

Planning and forecasting software that incorporates AI using machine learning can be far more intelligent than programmed systems because it learns and adapts over time. However, the quality of intelligence, analysis and recommendations is completely dependent on the available data, especially the quality and scope of data it absorbs over time. Yet most finance organizations find it challenging to compile the necessary data for training the system. And organizations may rely heavily on manual data extraction, transformation, enrichment and movement. This approach cannot scale to the needs of a machine learning system because, with manual systems, there isn’t enough time available to make machine learning practical. Our Analytics and Data Benchmark Research reveals that 69% of participants find preparing data for analysis very time-consuming, and 64% say reviewing data for quality and consistency issues requires significant time.

Even when reliable data is available, it may not be stored in a way that facilitates rapid machine learning for a specific use case or set of related use cases, such as demand forecasts or expense planning. It’s likely that general purpose structures like data warehouses or data lakes present processing time issues that degrade the usability of a machine learning system, especially for larger operations.

A data store that is an integral part of an application and designed for a targeted set of users and use cases is necessary for the comprehensive training of machine learning systems that are efficient and scale in performance so operations can be completed within time constraints. I’ve referred to this type of data structure – tongue in cheek – as a “data pantry” because, like a pantry, everything needed is immediately at hand with labels that are immediately understood. Stocking the data pantry is hands-free because operations use application program interfaces to handle data movements, transformation and enrichment on a continuous basis. All data is extracted directly from the authoritative system of record so that it is as reliable as possible. While kitchen pantries tend to be cozy, data pantries must be able to handle large volumes of data, especially if highly granular information is required to achieve the desired result.

The practical application of AI using ML has substantial potential to improve the performance of the finance department, especially the FP&A group, and with it the entire organization. Based on decades of experience with technology adoption, achieving that potential is bound to be fraught with a string of challenges, false steps, lessons learned and the harrumph of nay-sayers. Simple tasks are likely to work reasonably well in the short term, while more complex analytical and planning processes pose greater challenges and requirements to develop implementation and training techniques for different types of customers. Although the technology is already at work in a wide range of industries for different purposes, AI is in its infancy for finance and accounting departments. Expense report automation and invoice automation are useful steps already in use, but more will be coming. Vendors that demonstrate practical AI solutions soonest are likely to achieve market share gains over the next five years. Organizations that have a strategy of adopting practical, proven AI solutions quickly will have an operational advantage over those that wait.

Regards,

Robert Kugel

Ventana Research asserts that by 2025, all vendors of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. For cloud software applications, the transition will be accomplished with a stream of enhancements that become available when vendors are convinced they are sufficiently robust to provide value and will not frustrate customers. From a market perspective, AI will provide a considerable opportunity for product differentiation for vendors that are most successful in introducing a steady stream of significant, useful advancements.

Ventana Research asserts that by 2025, all vendors of software aimed at the office of finance will differentiate offerings by the capabilities and accuracy of AI functionality. For cloud software applications, the transition will be accomplished with a stream of enhancements that become available when vendors are convinced they are sufficiently robust to provide value and will not frustrate customers. From a market perspective, AI will provide a considerable opportunity for product differentiation for vendors that are most successful in introducing a steady stream of significant, useful advancements.-png.png?width=300&name=Ventana_Research_Benchmark_Research_Office_of_Finance_19_36_Limited_Adoption_of_Advanced_Analytics%20(1)-png.png) Improving the accuracy of financial and operational forecasts is high on executives’ wish lists. Predictive analytics can enhancing forecast accuracy, yet our Office of Finance Benchmark Research shows the technique has limited adoption: Only 24% of organizations use predictive analytics. This is likely the result of the difficulty FP&A groups face in acquiring and managing data necessary for usefully accurate projections, a lack of skilled analysts and not enough time to apply these techniques. Vendor-supplied AI-enabled applications have the potential to overcome resource issues by building data science automation into an offering as well as providing the means of acquiring and staging the necessary data.

Improving the accuracy of financial and operational forecasts is high on executives’ wish lists. Predictive analytics can enhancing forecast accuracy, yet our Office of Finance Benchmark Research shows the technique has limited adoption: Only 24% of organizations use predictive analytics. This is likely the result of the difficulty FP&A groups face in acquiring and managing data necessary for usefully accurate projections, a lack of skilled analysts and not enough time to apply these techniques. Vendor-supplied AI-enabled applications have the potential to overcome resource issues by building data science automation into an offering as well as providing the means of acquiring and staging the necessary data. Planning and forecasting software that incorporates AI using machine learning can be far more intelligent than programmed systems because it learns and adapts over time. However, the quality of intelligence, analysis and recommendations is completely dependent on the available data, especially the quality and scope of data it absorbs over time. Yet most finance organizations find it challenging to compile the necessary data for training the system. And organizations may rely heavily on manual data extraction, transformation, enrichment and movement. This approach cannot scale to the needs of a machine learning system because, with manual systems, there isn’t enough time available to make machine learning practical. Our

Planning and forecasting software that incorporates AI using machine learning can be far more intelligent than programmed systems because it learns and adapts over time. However, the quality of intelligence, analysis and recommendations is completely dependent on the available data, especially the quality and scope of data it absorbs over time. Yet most finance organizations find it challenging to compile the necessary data for training the system. And organizations may rely heavily on manual data extraction, transformation, enrichment and movement. This approach cannot scale to the needs of a machine learning system because, with manual systems, there isn’t enough time available to make machine learning practical. Our