Because of its impact on the Office of Finance, I’ve written in the past about the proposed timeline and IT implications of the convergence of U.S. Generally Accepted Accounting Principles (U.S. GAAP) and the International Financial Reporting Standards (IFRS). While the bottom-line differences between U.S. GAAP and IFRS are likely to be minimal for most businesses, some aspects of the convergence promise to be significant and problematic. One important change is how companies account for leases. The process of arriving at these rules has been contentious because it represents a major change that will entail substantial process and accounting challenges for U.S. GAAP companies. These changes are likely to go into effect as part of U.S. GAAP well ahead of any adoption of IFRS in the U.S. IT systems also will be affected, but software could smooth the transition if vendors provide a workable product.

The proposed change to lease accounting involves a sweeping conceptual change from the operating lease model, which simply records lease payments as they occur, to a right-of-use model, which reflects the present value of the future lease payments as a liability along with a corresponding asset on the balance sheet. The objective is to more accurately reflect a company’s financial position by presenting a more complete calculation of its financial liabilities. Although future material lease payments must be disclosed, currently this information is found in the footnotes.

The new approach to lease accounting will increase the workload of the accounting function, as it involves two phases: the initial posting of all existing lease liabilities and the posting of ongoing transactions related to recording leases and amortizing them over time. Gathering all relevant information about all leases will be problematic because the information may be scattered and details may be missing, and getting it into existing accounting systems will add to the burden. Moreover, on an ongoing basis, those entering into a lease will need to capture the corresponding  information at the time of the initial transaction and transmit it to the accounting department.

information at the time of the initial transaction and transmit it to the accounting department.

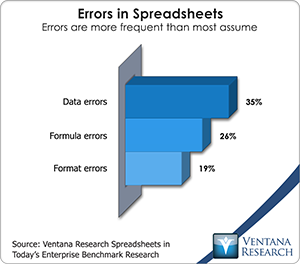

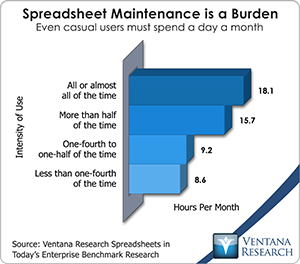

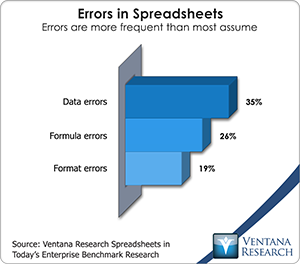

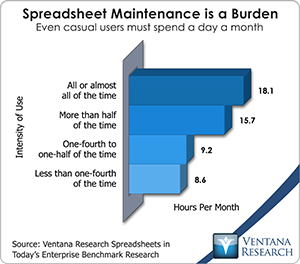

As things stand, it’s very likely companies will default to using desktop spreadsheets for data collection and even for period calculations, which is a shame because they certainly are not the best solution. Given that the data in these spreadsheets is likely to be copied and rekeyed, it is prone to error. Indeed, our research confirms that this issue is common with 35 percent of organizations have data errors compared to formula errors (24%). Maintaining spreadsheets is also likely to be time consuming, which is another common problem where organizations spend up to 18.1 hours per month on these tasks. Spreadsheets are not the best means of tracking the various lease terms or the forward-term and variable rent assumptions an organization needs to  store and track to accurately compute the value of assets, establish the initial lease liability and calculate its amortization over time. Moreover, the current guidance envisions a requirement that companies regularly reassess lease terms to determine if conditions that affect the valuation or amortization of the lease have changed. For instance, if economic incentives to renew the lease term change following the initial contract, that must be reflected in the valuation. If, say, a contract for a two-year lease is amended to include attractive options for renewals extending out an additional eight years, the liability on the balance sheet (and corresponding right-of-use asset) will increase.

store and track to accurately compute the value of assets, establish the initial lease liability and calculate its amortization over time. Moreover, the current guidance envisions a requirement that companies regularly reassess lease terms to determine if conditions that affect the valuation or amortization of the lease have changed. For instance, if economic incentives to renew the lease term change following the initial contract, that must be reflected in the valuation. If, say, a contract for a two-year lease is amended to include attractive options for renewals extending out an additional eight years, the liability on the balance sheet (and corresponding right-of-use asset) will increase.

Those entering into and managing leases are not necessarily accountants with access to core financial systems. Rather than having to rely on spreadsheets or make extensive changes to their ERP and financial systems, what companies need is a lightweight lease application that could be used by accountants and non-accountants alike. Such an app would serve as a distributed data entry vehicle to capture and update all relevant lease information, as well as an analytical tool for managing lease-related calculations. The software would need to provide the low-cost and ease-of-use characteristics of a spreadsheet but offer data connectivity and the controls of an enterprise application. It might even use a spreadsheet interface to give users a familiar environment in which to work. However, unlike a spreadsheet, the application would enable both flexible and consistent data entry for even the most complicated leases. The characteristics of individual leases could vary, but in almost all cases their basic structure, terms and conditions would follow a straightforward model. Rather than relying on uncontrolled email-enabled workflows, the process of entering information about a lease, reviewing and approving it as well as handling periodic reviews and updates would be handled by defined and auditable workflows. Rather than having to re-key information from a spreadsheet into financial systems, such an application would automate the process of posting information to financial systems.

The coming changes to lease accounting will present companies with substantial business challenges. Although there will be no real change to their economic condition, the increase in assets and liabilities may affect some companies’ credit rating or require changes to loan covenants. Recording and tracking leases will become a greater burden than before – in some cases considerably so. Therefore, it would be great if vendors could provide a low-cost, low-maintenance application to help corporations and their finance departments manage leases, reduce workloads and ensure accuracy.

Regards,

Robert Kugel – SVP Research