From my perspective, Infor’s strategy to accelerate revenue growth is to offer companies more innovation and a lower and more predictable cost of ownership than its rivals in the business software market; its products include the major categories of ERP, human resources and financial performance management. It aims to innovate by focusing on improving the user experience and to lower costs by redesigning its software architecture. The innovation stems from a fresh approach to designing interactions between users and business software: simplifying it and providing a more modern user experience that people have grown accustomed to in their personal software. The better cost-effectiveness rests on designing its software to reduce the expense of integrating and customizing it. One element of this is creating richer functionality for narrowly segmented micro-verticals. Another is offering cloud-based versions built on less expensive open source infrastructure and third-party commodity services. The software markets that Infor serves are mature and offer limited growth. So to be successful the company must increase both its market share and its share of a company’s IT spend (capturing internal IT spending and outlays to third-party consultants and systems integrators). To prove that the company’s strategy is working will require sustained organic growth (excluding new acquisitions) in revenues.

Infor’s transformation to this point has been a significant undertaking, requiring major changes in its product architecture to facilitate innovation and improve cost-effectiveness. Recently, Infor held an analyst meeting at its headquarters in New York. In this context, and being a native New Yorker, I was reminded that it took just one year and 45 days to build the 1,250-foot tall Empire State Building but more than four years to construct a 600-foot tunnel connecting the 51st Street station on the Lexington Avenue line to the 53rd Street IND subway station. The point relevant to Infor is that greenfield construction can happen quickly, but it takes much longer to build something when you also have to restructure a complex set of plumbing and wiring around it. Infor’s product portfolio grew through a long series of acquisitions. Connecting the past (a potpourri of stand-alone applications) with the future (a coherent set of applications and services) has been a lot of work.

Innovation is the more eye-catching aspect of the work in progress. Infor established Hook & Loop as its internal creative agency with a mandate to substantially improve the user experience of its products. This move is reminiscent of industrial design companies like Ideo that thoroughly rethink all aspects of a product to better address customers’ needs. Infor’s strategic approach attempts to achieve differentiation in the crowded and hidebound software categories in which it competes. The company’s software now has a new, compelling and intuitive look and feel. Its user interface, code-named Gramercy Park, is designed to address immediate needs in what the user is doing rather than enforce a hierarchical approach to navigation. Instead of exposing the complexity underlying an application, the UI focuses on what is relevant to the user at the moment and guides navigation in the context of what a likely to want to do next, filtering in only what’s relevant.

As I commented a while back, business software is undergoing a fundamental redesign on the scale of the shift from the command-line interface to the graphical user interface (GUI) that began in the mid-1980s. There are three forces at work. One is the retirement of large numbers of members of the baby boom generation and their replacement by a generation that grew up with computers and computer games from a young age. Also, software and technology vendors have been recognizing the need to “consumerize” business applications as mobile device interactions, gestures and other newer user interface conventions gain prominence, and are incorporating these innovations in their stodgy products. A third factor, “gamification,” is changing the basic approach to routine tasks, making them less tedious and handled more productively, especially for this new generation of users. For the longer term, the user experience will be an important part of business customers’ software evaluation process. For the moment, however, the status quo still dominates in the approach companies take to buying software – but not always. As Infor CEO Charles Phillips put it at the event, “If the CIO is under 45, we win.”

There are three main ways that Infor is attempting to improve the cost of ownership proposition for ERP and HR software. Facilitating integration of the application with other systems and streamlining implementation reduce the amount that has to be paid to systems integration and consulting companies to get the software up and running. A third is to offer a multitenant cloud deployment option, which can reduce implementation and operating costs.

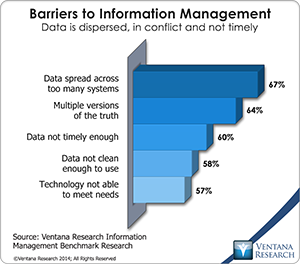

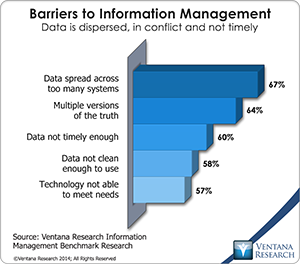

The purpose of transaction systems such as ERP, supply chain  management and human resources management is not simply to collect information but to make it easier to use. Transaction systems aid efficiency when they reduce the administrative burden on collecting information and improve effectiveness by making this information readily accessible for analysis and decision support purposes. Many companies face barriers to efficiency and effectiveness in enterprise systems because of the difficulty of integrating processes across functional silos (particularly when a process requires systems integration) and when data generated by multiple systems and held in multiple locations (including desktop spreadsheets) is difficult or impossible to access. Our benchmark research confirms that this is an issue. Two-thirds of companies said data spread across too many applications and systems is a major challenge in information management. To address this issue, Infor has revamped its applications around its ION middleware and a publish-subscribe approach to integrate applications in a loosely coupled fashion. This approach makes it much easier to integrate applications from any single vendor as well as disparate vendors. All data published by an application is designed to include a robust set of self-explanatory metadata that enables any subscribing application to translate the data into its own terms. It allows companies to phase out silos of information and substantially reduce the time and expense required to maintain links between applications. In creating the user experience, it removes limits on what information or analytics an individual can access in performing a process, thereby providing a richer information context for that process.

management and human resources management is not simply to collect information but to make it easier to use. Transaction systems aid efficiency when they reduce the administrative burden on collecting information and improve effectiveness by making this information readily accessible for analysis and decision support purposes. Many companies face barriers to efficiency and effectiveness in enterprise systems because of the difficulty of integrating processes across functional silos (particularly when a process requires systems integration) and when data generated by multiple systems and held in multiple locations (including desktop spreadsheets) is difficult or impossible to access. Our benchmark research confirms that this is an issue. Two-thirds of companies said data spread across too many applications and systems is a major challenge in information management. To address this issue, Infor has revamped its applications around its ION middleware and a publish-subscribe approach to integrate applications in a loosely coupled fashion. This approach makes it much easier to integrate applications from any single vendor as well as disparate vendors. All data published by an application is designed to include a robust set of self-explanatory metadata that enables any subscribing application to translate the data into its own terms. It allows companies to phase out silos of information and substantially reduce the time and expense required to maintain links between applications. In creating the user experience, it removes limits on what information or analytics an individual can access in performing a process, thereby providing a richer information context for that process.

Infor’s ERP portfolio includes a range of applications that evolved to address the specific needs of vertical (such as automotive original equipment and aerospace) and even micro-vertical (beer and machinery) business segments. Creating versions of ERP software for specific industries has been standard practice for many vendors for decades. It’s attractive for buyers because it reduces the amount of work that must be done during the initial implementation. As targeted functionality is incorporated into the software, it also reduces the need for users to customize their software to get necessary capabilities. Vertical specialization also tends to attract like companies to a vendor, giving the vendor an incentive to invest in additional features and functions needed by this group of customers. This happened to the various ERP packages that Infor acquired. Less customization also means that when an existing customer upgrades to a new release it requires less time, expense and disruption.

In addition to having advantages for on-premises deployments, having built-in functionality available for a specific type of business also better supports a multitenant cloud strategy. Generic multitenant ERP systems are useful for a segment of the market, but many cannot live with the functional compromises, especially those in manufacturing businesses. One of the impediments to deploying ERP systems in the cloud is that multitenant systems do not necessarily provide sufficient configurability to make this approach workable for individual companies.

Infor’s ION middleware architecture, coupled with its data vault, provides companies with a practical way of creating a data store of record that can address most data quality and availability issues. It can facilitate a more sophisticated approach to analytics in applying big data techniques and predictive analytics by making more company data accessible and useful. It can provide a richer and up-to-date set of data for dashboards, scorecards, alerts and decision support analytics.

Infor’s Ming.le architecture also supports collaboration in context – another rapidly evolving requirement in enterprise applications. In a work environment, individuals have multiple tasks in multiple roles. The list of people with whom they collaborate differs depending on the task and role. In some cases, it might be many people – a department, a division or even an entire company. In most others, though, it’s a small and evolving group working on an ongoing process (such as planning benefits or closing the books) or specific projects. Even business functions that initially weren’t thought to need “social” capabilities are fertile ground, especially finance organizations, as I have noted. Stand-alone collaborative software that is disconnected from a specific application can work, but it’s better when collaborative capabilities are built into or fully integrated with a business application. One with good collaborative features “knows” what the user is doing at any moment (a task and its context). It can automatically connect the user with the relevant group in ways that provide context to those brought into the effort (for instance, by pointing to data or providing text or charts) and facilitates the resolution of an issue or a task handoff.

Infor has accomplished a great deal, but will the investment pay off? For the past seven years I’ve been observing the transformation of Infor from a roll-up of a large number of often obsolete software packages into company with rationalized modern business applications. I’ve noted the incremental improvements that have taken place. The company has invested wisely in re-engineering the product line and the underlying architecture to improve the applications’ performance and reduce the cost of ownership. While it continues to support users of older apps as much as possible, it has winnowed its product line to four core applications that will also be the basis of its cloud offerings: healthcare and public sector suite (based largely on what is acquired from Lawson), discrete manufacturing (largely based on its LN application), process manufacturing management (based on M3) and midsize manufacturing and job shop (based on Syteline). By enriching these applications with additional vertical and micro-vertical capabilities to improve their appeal in a multitenant cloud setting, Infor can improve the value proposition for on-premises buyers. So, as a measure of progress, Infor appears to be at the end of the beginning of its transformation. The company’s next important step is to confirm that its strategy is working by accelerating revenue.

This said, however, Infor still faces several major challenges. Successful rebranding takes time, but Infor remains the world’s largest software company nobody ever heard of. Even though the name “Infor” is sensible (short, to the point and easy to pronounce and understand in multiple languages and cultures), it gets in the way of raising the company’s profile. A web search of “Infor” returns a cacophony of results related to information and companies whose names have the same root. I’m not suggesting that Infor go back to the old product names. More money spent on branding and top-of-the-funnel marketing would help, but that’s constrained by Infor’s capital structure. The company has been able to reduce the average interest rate on its debt over the past year, but it is still highly leveraged and has high interest payments.

The leveraged nature of the balance sheet and accounting rules obscures the company’s underlying profitability when measured by earnings before interest, taxes, depreciation and amortization (EBITDA). So Infor is struggling to get into a virtuous cycle: Faster top-line growth would enable it to restructure its balance sheet, replacing debt with equity (most likely through a public offering of shares) and thereby fattening pretax margins. The company isn’t there yet. The lack of name recognition hurts, especially when a sales cycle begins with older executives who have a preconceived short list of vendors that doesn’t include Infor. This stands in the way of an opportunity to sell on value and total cost of ownership, which is an essential part of its sales strategy.

Getting to an “escape velocity” rate of revenue growth in its mature markets will continue to be tough. The average deal size appears to have been increasing as a higher percentage of contracts include multiple products. This is one reason why its license revenues are growing faster than legacy ERP and human resources/human capital management companies such as SAP and Oracle in the large enterprise segment and Sage for midsize companies. But it’s about even with Microsoft Dynamics and lags SaaS vendors such as NetSuite and Workday. Moreover, given Infor’s large installed base, maintenance payments make up about three-fourths of its software revenues and about half of its total revenues, which limits the potential for top-line growth since the percentage increase in the number of users or customers from one period to the next will likely be in the low single digits. Infor can partly offset this by selling more categories of software to existing software customers, convincing them to switch from an on-premises deployment to using their cloud services or both.

Selling software that requires less customization to specific verticals and micro-verticals has been demonstrated to be effective, and Infor has had success in a range of areas. However, it’s not clear that the company has sufficient breadth of business coverage at sufficient depth to appeal to a wide enough range of potential customers. Over time, the company’s continued investment in its products to achieve maximum configurability with a minimum of customization will increase the potential market for on-premises deployments as well as in its multitenant software-as-a-service (SaaS) offerings. Infor’s ability to convert the concept into accelerating sales will serve as the proof point that it is working.

Infor’s approach to the user experience is the most important factor in addressing these challenges. The new generation of users expects software to wrap itself around the needs of the individual and require less effort to do what needs to be done. Their expectations of business software are better aligned to Infor’s approach to enterprise business applications. Companies with aging software that want to lower their information technology costs and enhance the productivity and effectiveness of their employees should look into what Infor has to offer.

Regards,

Robert Kugel – SVP Research