Recurring revenue is a term applied to business models that involve three types of selling and billing structures: a one-time transaction plus a periodic service charge; subscription-based services involving periodic charges; or a contractual relationship that charges periodically for goods and services.  Telecommunications was the first major industry to use it, but recently the model has gained popularity in others. It is a major trend in information technology as an increasing number of companies offer software and hardware technology accessed as a service through cloud computing. Recurring revenue also has been transforming the entertainment business, as customers subscribe to rent movies, music and other creative digital products instead of owning them; this is part of the so-called “sharing economy” whose social impacts are wide-ranging.

Telecommunications was the first major industry to use it, but recently the model has gained popularity in others. It is a major trend in information technology as an increasing number of companies offer software and hardware technology accessed as a service through cloud computing. Recurring revenue also has been transforming the entertainment business, as customers subscribe to rent movies, music and other creative digital products instead of owning them; this is part of the so-called “sharing economy” whose social impacts are wide-ranging.

The increasing importance of the recurring revenue model reflects a shift in buying preferences for both businesses and consumers. For them, renting assets may be easier and less expensive than buying them. For providers, recurring revenue is attractive because it establishes a regular, predictable income stream as long as the customer continues to use the service. To ensure that, though, they must build an ongoing relationship in which they handle interactions smoothly and maintain customer engagement throughout the life cycle.

Ventana Research recently completed benchmark research into recurring revenue. The research shows that companies  adopt the model to create strategic business opportunities. They like it for generating more income immediately, but they also see potential to sustain a long-term income stream by offering services of ongoing value to their customers. The most commonly cited business drivers for using a recurring revenue business model are increasing the top line (selected by 51%), enhancing the customer experience (also 51%) and increasing customer loyalty (46%). The model provides companies with an ongoing opportunity for satisfying customer interactions that drive customer loyalty. However, they had better be sure to follow through on it; companies that fail to provide competitive services or fall short in service delivery will lose customers with little hope of ever getting them back.

adopt the model to create strategic business opportunities. They like it for generating more income immediately, but they also see potential to sustain a long-term income stream by offering services of ongoing value to their customers. The most commonly cited business drivers for using a recurring revenue business model are increasing the top line (selected by 51%), enhancing the customer experience (also 51%) and increasing customer loyalty (46%). The model provides companies with an ongoing opportunity for satisfying customer interactions that drive customer loyalty. However, they had better be sure to follow through on it; companies that fail to provide competitive services or fall short in service delivery will lose customers with little hope of ever getting them back.

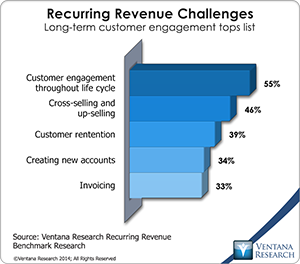

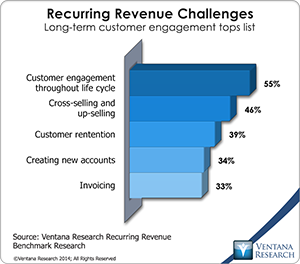

The research also identified the most significant challenges companies encounter when they adopt recurring revenue strategies. These mainly concern customer retention.

encounter when they adopt recurring revenue strategies. These mainly concern customer retention.

- The most common, cited by 55 percent, is maintaining customer engagement. Having ongoing positive interactions can be an important determinant of renewal rates. Renewals in turn are a key driver of profitability in these businesses because of the relatively high cost of adding a customer. Along those lines, customer retention was cited as an impediment by 39 percent of participants. Moreover, since a company’s costs related to its recurring revenue business are relatively fixed in the short term, almost all the impact of lost revenue drops to the bottom line, depressing profits.

- Nearly half (46%) said cross-selling and up-selling are difficult. This may be because they can’t engage effectively with existing customers. There may be multiple internal factors at play such as a poorly designed marketing program for existing customers, a lack of people or incentives for performing ongoing interactions, or technology limitations that prevent a company from creating or executing an effective customer nurturing program. Finding it difficult to up-sell or cross-sell also may be a reflection that the primary service is of limited importance to customers who don’t want to consider a more expensive, deluxe version or add-ons. Understanding which customers fall into this category is important so that up-sell and cross-sell efforts are focused on those who are most receptive.

- More than one-third (35%) of research participants said creating new accounts is problematic. Often the source of this issue is inadequate technology, either using inappropriate software or struggling to acquire and integrate the data necessary for this function.

None of these impediments is impossible to address. However, companies planning to enter or expand a recurring revenue business must anticipate or focus on addressing them to ensure successful execution.

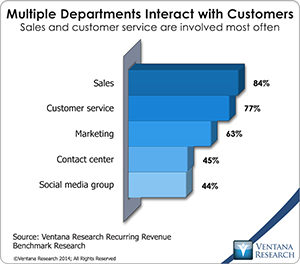

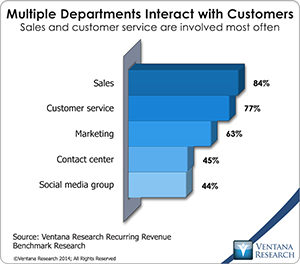

Overcoming difficulties in engaging customers positively and profitably usually involves having capable systems, processes and people to sustain ongoing interactions with the right customers at multiple touch points within the organization. Having multiple touch points is common: Four out of five (79%) companies reported that three or more business units interact proactively with customers; the three that do so most often are Sales (84%), Customer Service (77%) and Marketing (63%).  One-fourth (26%) said that five or more business units work directly with customers. Because there must be multiple touch points with customers, it’s essential to maintain a single authoritative source of information accessible by all business units. This helps to prevent annoyances when, for example, customers have to provide information to one group that they already provided to another, or when a company representative at one touch point tries to sell the customer a service he or she already has.

One-fourth (26%) said that five or more business units work directly with customers. Because there must be multiple touch points with customers, it’s essential to maintain a single authoritative source of information accessible by all business units. This helps to prevent annoyances when, for example, customers have to provide information to one group that they already provided to another, or when a company representative at one touch point tries to sell the customer a service he or she already has.

Sustaining mutually satisfactory interactions with customers has become a bigger challenge for recurring revenue businesses because, in addition to multiple touch points, there has been a proliferation of communications channels that people routinely expect to use for interactions with businesses. Some companies have been successful in engaging with customers seamlessly across multiple communications channels, and this raises expectations for others. Our research quantified the magnitude of this challenge. Companies on average use 6.4 separate channels to engage with customers; one-third employ eight or more. Supporting multiple channels seamlessly is another important technology issue, affecting more than half (57%) of participants. Today, customers expect to be able to contact a company using whatever communication channel suits their specific circumstances, needs and preferences at any given moment. Beyond having the means to manage multiple channels, having uniform, accurate and timely information at each point of contact is essential for sustaining customer satisfaction.

The recurring revenue model is an increasingly attractive choice for consumer and industrial businesses, offering many potential benefits for companies and their customers. Done well it can increase revenue, decrease costs, stabilize cash flow and ultimately enhance profitability. However, businesses that adopt this model are likely to find that it requires a different approach to selling, billing and support. In particular, we recommend that they adopt dedicated systems necessary to support the recurring revenue model and institute training that is often required to make the most of this opportunity.

Regards,

Robert Kugel

SVP Research

Telecommunications was the first major industry to use it, but recently the model has gained popularity in others. It is a major trend in information technology as an increasing number of companies offer software and hardware technology accessed as a service through cloud computing. Recurring revenue also has been transforming the entertainment business, as customers subscribe to rent movies, music and other creative digital products instead of owning them; this is part of the so-called “sharing economy” whose social impacts are wide-ranging.

Telecommunications was the first major industry to use it, but recently the model has gained popularity in others. It is a major trend in information technology as an increasing number of companies offer software and hardware technology accessed as a service through cloud computing. Recurring revenue also has been transforming the entertainment business, as customers subscribe to rent movies, music and other creative digital products instead of owning them; this is part of the so-called “sharing economy” whose social impacts are wide-ranging.