Configure, price and quote (CPQ) software has been around for decades. Lately, I’ve been using the term “Dynamic CPQ” to apply to a variant of this software category that explicitly aims to produce a quote that optimizes the trade-off between the profitability of a deal and the probability of closing a sale. Dynamic CPQ software is a hybrid of price and revenue optimization (PRO) software and CPQ, providing companies with the ability to better execute their market share and pricing strategies. It’s designed especially for business-to-business (B2B) relationships that involve sales agents in the pricing process.

CPQ software first appeared in the 1990s, intended to enable companies to reduce the time it took for their salespeople to create a workable contract proposal. It initially targeted corporations that offered complex products made from multiple major components. For example, buyers of Class 8 trucks (18-wheelers) typically can select from a list of specific engines, transmissions and suspensions. Buyers can choose different configurations of these options but not all of them work together. CPQ software was designed to allow sales agents to create only valid configurations and pull pricing data from an up-to-date common database to rapidly create a valid quote for the buyer. Software could do this much faster than was possible using paper- or spreadsheet-based processes. Speed in responding to a prospective customer’s inquiry often is a competitive advantage; some in sales claim that more often than not the first reasonable offer wins. Over the years, CPQ offerings have multiplied, aiming at the specific business needs of buying segments, for instance, web-based configurators for business-to-consumer self-service transactions.

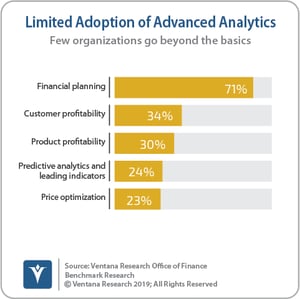

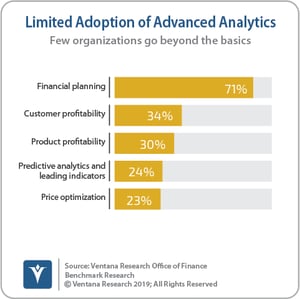

Dynamic CPQ evolved from the development of B2B price and revenue optimization algorithms. These algorithms were initially used commercially in revenue management approaches in the 1980s by the travel and hospitality industries for dynamically pricing airline tickets and hotel rooms based on demand. Price optimization that’s embedded in dynamic CPQ is an important capability for B2B sellers. It enables them to set prices dynamically according to individual buyers’ preferences, price sensitivity and profitability. Yet comparatively few companies employ price optimization: Our Office of Finance benchmark research reveals that only 23 percent of companies use this approach.

B2B pricing software is distinct from the revenue management used in travel and hospitality businesses in two key ways. First, the price-setting process for airlines and hotels is largely agentless. Today, most transactions are done on the web or other links to the carrier reservation system, often by individuals. Even if an agent is involved, he or she likely has no discretion and is quoting the price directly from the reservation system. In contrast, much of B2B commerce is handled by sales agents who have some degree of pricing latitude, which requires controls to ensure that agents stay within limits.

A second significant difference is that travel and hospitality revenue management has always been integrated with the sales process via the reservation system. Originally, B2B pricing software was a discrete analytical application. However, to be effective, pricing guidance must work as an integral part of the sales process rather than a discrete function. B2B price and revenue management wasn’t practical until this past decade, when algorithmically driven dynamic price setting was incorporated into CPQ software.

Dynamic CPQ software, used mostly in business-to-business transactions that involve sales agents, dynamically sets pricing based on the characteristics of the buyer and past interactions. It does this by using big data analytics or other methods to predict the price sensitivity (or elasticity) of the buyer and then establishes pricing parameters for sales agents.

Typically, price negotiations are based on the discount from the list price. Those in purchasing often are evaluated on their ability to achieve high discounts on the core purchase. Buyers may be sensitive to this metric but much less sensitive about the cost of ancillary items. Dynamic CPQ enables sales agents to present offers that make concessions on the items of greatest price sensitivity while reducing concessions on less important items and adding revenue from ancillary items, often with a limited discount from list price. This approach, partly offsetting the discount demanded by the buyer through the sale of complementary items — usually without a discount — is designed to yield higher revenue and profitability.

Configuration is an important part of the B2B pricing process because all but the simplest sales have multiple components, each of which can be priced in ways that fit the price sensitivity of the buyer. Using this approach, sales agents can suggest complementary goods such as accessories, consumable materials or a service plan to add to the sale and enhance the profitability of the overall transaction. To assist the sales agent in maximizing the profitability of the transaction, the software uses historical data to identify the items that the buyer or similar buyers have selected in the past. This is similar to techniques many consumer-facing e-commerce vendors use.

Organizations also can control profitability by adjusting what’s included in the terms and conditions of the sale. For example, purchases usually entail some sort of transportation and handling charges. Software can control whether the agent can or cannot offer these for free. Also, dynamic CPQ software can automatically flag undesirable prospects based on past interactions. These include infrequent buyers who negotiate a steep discount using a large deal as bait but are only trying to “shop a bid” to negotiate with the buyer’s preferred supplier. Dynamic CPQ software can provide salespeople with the knowledge to enable them to avoid wasting time on longshots or less profitable business.

Dynamic CPQ software also can be configured to modify the sales agent’s behavior by giving him or her incentives to limit discounting or other concessions. To do this, companies set pricing bands that determine the levels of review that will be applied to a proposal. The proposal can automatically bypass the deal desk (which reviews and approves pricing, terms and conditions) if the pricing and other parameters of a proposed transaction make a review unnecessary. A dynamic CPQ system sets these pricing parameters more effectively than a CPQ system with static pricing bands because the limits are determined based on the specific characteristics of the buyer and the transaction. Moreover, the parameters are continuously adjusted based on buyer behaviors rather than reviewed intermittently.

The market for dynamic CPQ software is now mainstream. The technology is there to develop reliable algorithms and to manage big data analytics. However, there are two challenges that continue to retard adoption. One is data: Companies need clean, consistent and robust enough data sets to properly segment buyers and deals according to their price sensitivity. Recent advancements in data preparation tools and data management generally have helped organizations work with historical data. Methods to streamline data gathering and facilitate ongoing data collection have mitigated this issue. Usually, though, organizations lack the complete range of information needed to assess the buyer’s price sensitivity or his or her propensity to buy ancillary or complementary  goods. So, most often organizations must perform a considerable amount of remediation to ensure that the data necessary to accurately assess price sensitivity is in place. This often requires organizations to implement new processes and procedures to ensure that the data the system requires is available.

goods. So, most often organizations must perform a considerable amount of remediation to ensure that the data necessary to accurately assess price sensitivity is in place. This often requires organizations to implement new processes and procedures to ensure that the data the system requires is available.

A second challenge is that responsibility for profitability management is dispersed across a corporation. Essentially, companies manage overall profitability by forecasting sales (the responsibility of the sales organization) and constraining spending in business units (managed at the business unit level and overseen by Finance) to achieve a profit objective. Companies typically don’t focus on ways to optimize the profitability of specific products and customers as part of their management reviews. Our research shows that only a minority of finance organizations engage in routine customer and product profitability analysis. Our Office of Finance benchmark research found that just one-third (34%) of organizations said they analyze customer profitability and only 30 percent routinely assess product profitability. As noted, just 23 percent of organizations reported applying price optimization of any sort.

Adoption of Dynamic CPQ software should be a strategic priority for the C-suite, and especially for CFOs. Data-driven pricing is a proven way to boost sales and profits that requires no change in products, customers or channels. I recommend that CFOs, financial planning and analysis leaders and heads of sales operations in B2B businesses familiarize themselves with the technology and evaluate its use.

Regards

Robert Kugel

goods. So, most often organizations must perform a considerable amount of remediation to ensure that the data necessary to accurately assess price sensitivity is in place. This often requires organizations to implement new processes and procedures to ensure that the data the system requires is available.

goods. So, most often organizations must perform a considerable amount of remediation to ensure that the data necessary to accurately assess price sensitivity is in place. This often requires organizations to implement new processes and procedures to ensure that the data the system requires is available.