Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Cloud Computing,

In-memory,

Oracle,

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software

We recently issued our 2013 Value Index on Financial Performance Management. Ventana Research defines financial performance management (FPM) as the process of addressing the often overlapping people, process, information and technology issues that affect how well finance organizations operate and support the activities of the rest of their organization. FPM deals with the full cycle of finance department activities, which includes planning and budgeting, analysis, assessment and review, closing...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

closing,

Consolidation,

contingency planning,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Value Index,

Financial Performance Management

For four years Adaptive Planning has been building out its cloud-based financial software. Starting with budgeting, planning and forecasting, it added analytics, data visualization, dashboards and alerting as well as flexible reporting and collaboration tools. It recently announced the general availability of consolidation functionality in its cloud-based suite. This addition eliminates a notable gap in the company’s functionality, giving it a more complete financial performance management...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Data,

Financial Performance Management (FPM),

Financial Performance Management

I’m wondering whether the rapid rise in earnings restatements by “accelerated filers” (companies that file their financial statements with the U.S. Securities and Exchange Commission that have a public float greater than $75 million) over the past three years is a significant trend or an interesting blip. According to a research firm, Audit Analytics, that number has grown from 153 restatements in 2009 to 245 in 2012, a 60 percent increase. What makes it a blip is that the total is still less...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

Tax,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

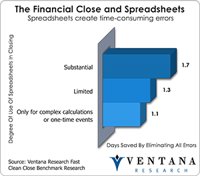

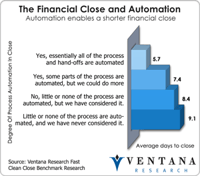

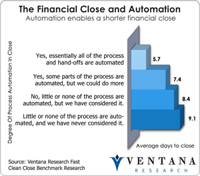

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

If you’re considering purchasing a financial performance management (FPM) suite, you shouldn’t overlook a recent entrant in the category, Tagetik (which sort of rhymes with “magnetic”). The company, which was founded in 1986 and is based in Lucca, Italy, began by focusing mainly on Europe, but has extended its efforts in the United States in the past two years. Tagetik 4.0 is an elegant implementation of a financial performance management suite running on Microsoft’s SharePoint infrastructure.

Read More

Topics:

Big Data,

Planning,

Office of Finance,

Reporting,

Budgeting,

close,

Consolidation,

Controller,

SharePoint,

XBRL,

Business Analytics,

Business Collaboration,

Dashboards,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Tagetik,

Workforce Performance Management (WPM),

FPM

People used to use the phrase “the last mile” solely to refer to a condemned prisoner’s path to execution. Then the telecommunications industry picked it up to describe that part of a circuit between a major trunk line and a subscriber. Later still a defunct software company, Movaris (now part of Trintech), used the phrase in an analogy to refer to the set of activities that take place between when a company closes its books and the point where it finishes its external reporting activities,...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

We recently issued our 2012 Value Index on Financial Performance Management (FPM). Ventana Research defines FPM as the process of addressing the often overlapping people, process, information and technology issues that affect how well finance organizations operate and support the activities of the rest of their organization. FPM deals with the full cycle of finance department activities, which includes planning and budgeting, analysis, assessment and review, closing and consolidation, internal...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

closing,

Consolidation,

contingency planning,

Analytics,

Business Analytics,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Value Index,

Financial Performance Management

What’s a fast, free and reasonably reliable way of gauging the effectiveness of a finance department’s management? It’s the number of days it takes it to close the books. Companies that take six days or fewer after the end of the period to close their monthly, quarterly or semiannual accounts demonstrate a basic level of effectiveness that those that take longer do not. In my judgment, finance executives should regard a slow close as a negative key performance indicator pointing to...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Financial Performance Management

I have commented before on the movement to adopt International Financial Reporting Standards (IFRS) by the United States to replace US-GAAP (Generally Accepted Accounting Principles). Most recently I discussed the drive to harmonize the significant differences between US-GAAP and IFRS on revenue recognition and lease accounting. To those who are interested in but not intimately involved with the subject, I suspect the current situation is a bit confusing, since there are multiple groups...

Read More

Topics:

Reporting,

audit,

Consolidation,

IFRS,

US-GAAP accounting,

XBRL,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

Financial Management,

Financial Performance Management (FPM),

financial standards,

FPM