For four years Adaptive Planning has been building out its cloud-based financial software. Starting with budgeting, planning and forecasting, it added analytics, data visualization, dashboards and alerting as well as flexible reporting and collaboration tools. It recently announced the general availability of consolidation functionality in its cloud-based suite. This addition eliminates a notable gap in the company’s functionality, giving it a more complete financial performance management suite. The addition of the consolidation capability should increase its appeal to larger companies and broaden usage within its existing customer base. According to Adaptive Planning, already about one-fourth of its customers are organizations or parts of organizations that have annual revenue in excess of US$500 million.

Tools that automate statutory consolidation have been around for three decades. They are most useful for corporations that have ERP systems from multiple vendors and/or multiple instances of a single vendor’s financial software with different charts of accounts. Yet use of consolidation software is not ubiquitous. Our benchmark research Trends in Developing the Fast, Clean Close found that among companies with at least 100 employees, 26 percent use a dedicated consolidation system, 38 percent mainly use their ERP system and 30 percent use spreadsheets. The research also shows that 45 percent of midsize companies (those with 100 to 1,000 employees) and 62 percent of large and very large companies (those with 1,000 or more employees) have multiple ERP system vendors. (Most businesses with fewer than 100 employees have a single ERP vendor.) More companies with multiple ERP vendors use dedicated consolidation software than those with a single vendor (36% vs. 10%); the software speeds up the process of combining data from disparate systems. These organizations often get better results as well, the research reveals. Corporations that use dedicated consolidation software are more satisfied with their ability to manage the close process than those that use their ERP system and considerably more satisfied than those that use spreadsheets. Dedicated consolidation systems typically are more adept at managing the accounting close for companies that have complex ownership structures, which need to report results in multiple jurisdictions that have different accounting standards and different currencies.

At this point, our research finds minor differentiation in basic features and functions among products for consolidation software. Buyers’ preferences most often are shaped by their assessment of how easy it is to use a given vendor’s product, how well the software aligns with their existing business practices, the total cost of ownership, how closely the software fits with their company’s internal IT requirements and the degree to which a company prefers vendor standardization.

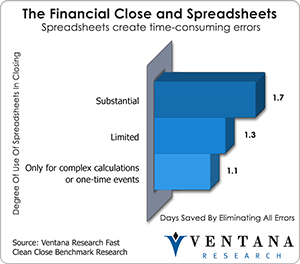

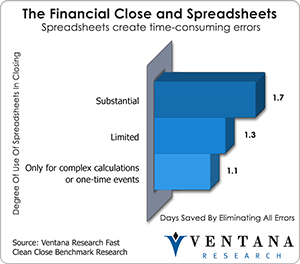

Yet even corporations with a single ERP vendor can shorten the time it takes them to close because process automation features can speed handoffs and quickly identify delays and bottlenecks. As well, using dedicated consolidation software often enables a company to reduce the use of desktop spreadsheets in the closing process because, for example, it can have calculations for common cost allocations built into the system (as Adaptive Planning’s does). Our research has consistently found that heavy use of desktop spreadsheets results in more errors and that resolving these errors consumes time and resources. On average, companies that are substantial users of spreadsheets in their close said they could save 1.7 days if all errors in the close were eliminated, compared to just 1.1 day for those that use spreadsheets infrequently in closing.

takes them to close because process automation features can speed handoffs and quickly identify delays and bottlenecks. As well, using dedicated consolidation software often enables a company to reduce the use of desktop spreadsheets in the closing process because, for example, it can have calculations for common cost allocations built into the system (as Adaptive Planning’s does). Our research has consistently found that heavy use of desktop spreadsheets results in more errors and that resolving these errors consumes time and resources. On average, companies that are substantial users of spreadsheets in their close said they could save 1.7 days if all errors in the close were eliminated, compared to just 1.1 day for those that use spreadsheets infrequently in closing.

Adaptive Planning’s software has a prebuilt connection with NetSuite and can incorporate financial and accounting data from cloud vendors such as FinancialForce, Intacct and Workday, or from on-premises vendors such as Infor, Microsoft Dynamics, Oracle, QuickBooks, Sage and SAP through direct or flat file connectors. As the number of systems deployed increases, especially in larger organizations, Adaptive Planning will be able to demonstrate the ability of its existing users to handle the data loads required by prospective customers.

One significant challenge Adaptive Planning will face in gaining customers is the reluctance of finance department buyers to choose cloud-based systems over on-premises ones. Our research shows that 43 percent of those in the finance function prefer on-premises software compared to 22 percent who prefer cloud-based deployments. One of the top reasons companies still give for avoiding the cloud is security, a concern cited by 59 percent of organizations in our recent research Business Technology Innovation. I think such concerns are short-sighted and expect objections to cloud deployments to subside rapidly over the next several years since, especially for midsize and smaller enterprise buyers, cloud-based systems can be more cost-effective and more secure than on-premises alternatives. One of the bigger opportunities for Adaptive Planning is to increase adoption of consolidation software by midsize companies, which are more likely to be using capabilities in their ERP systems and/or desktop spreadsheets to manage and support the process. These companies may have found on-premises consolidation systems too expensive. In regard to cost, their finance departments may find that automation and reporting capabilities of the software can reduce the resources they are now devoting to purely mechanical functions that have little business value, while they also speed their close and gain more time and resources to provide a strategic perspective on the company’s performance and prospects.

Regards,

Robert Kugel – SVP Research