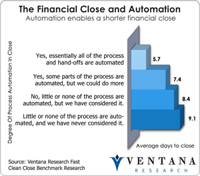

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

Unless you have some combination of a very strong credit rating, a high income-to-debt payment ratio and a relatively low loan-to-value ratio, it’s not especially easy to refinance a mortgage these days. That’s a shame, because there are plenty of people who have stayed current in meeting their credit obligations and whose mortgages are comfortably below current market value who could benefit from today’s record low interest rates. One major reason they can’t refinance is the collapse of...

Read More

Topics:

Office of Finance,

XBRL,

Analytics,

Business Analytics,

Business Performance Management (BPM),

finance,

Financial Performance Management (FPM),

capital markets

If you’re considering purchasing a financial performance management (FPM) suite, you shouldn’t overlook a recent entrant in the category, Tagetik (which sort of rhymes with “magnetic”). The company, which was founded in 1986 and is based in Lucca, Italy, began by focusing mainly on Europe, but has extended its efforts in the United States in the past two years. Tagetik 4.0 is an elegant implementation of a financial performance management suite running on Microsoft’s SharePoint infrastructure.

Read More

Topics:

Big Data,

Planning,

Office of Finance,

Reporting,

Budgeting,

close,

Consolidation,

Controller,

SharePoint,

XBRL,

Business Analytics,

Business Collaboration,

Dashboards,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Tagetik,

Workforce Performance Management (WPM),

FPM

People used to use the phrase “the last mile” solely to refer to a condemned prisoner’s path to execution. Then the telecommunications industry picked it up to describe that part of a circuit between a major trunk line and a subscriber. Later still a defunct software company, Movaris (now part of Trintech), used the phrase in an analogy to refer to the set of activities that take place between when a company closes its books and the point where it finishes its external reporting activities,...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

For several years the U.S. Securities and Exchange Commission (SEC) has mandated that filers apply eXtensible Business Reporting Language (XBRL) tags to their financial statements. XBRL was developed to make it easier for investors to use a company’s financial information. Now XBRL US has kicked off its second annual XBRL Challenge, a contest designed to encourage development of open source analytical tools that can use XBRL-formatted corporate financial data from the SEC’s EDGAR database....

Read More

Topics:

Office of Finance,

Reporting,

closing,

XBRL,

Analytics,

Business Analytics,

Business Performance Management (BPM),

finance,

Financial Performance Management (FPM),

Information Management (IM),

Financial Performance Management,

SEC

What’s a fast, free and reasonably reliable way of gauging the effectiveness of a finance department’s management? It’s the number of days it takes it to close the books. Companies that take six days or fewer after the end of the period to close their monthly, quarterly or semiannual accounts demonstrate a basic level of effectiveness that those that take longer do not. In my judgment, finance executives should regard a slow close as a negative key performance indicator pointing to...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Financial Performance Management

I have commented before on the movement to adopt International Financial Reporting Standards (IFRS) by the United States to replace US-GAAP (Generally Accepted Accounting Principles). Most recently I discussed the drive to harmonize the significant differences between US-GAAP and IFRS on revenue recognition and lease accounting. To those who are interested in but not intimately involved with the subject, I suspect the current situation is a bit confusing, since there are multiple groups...

Read More

Topics:

Reporting,

audit,

Consolidation,

IFRS,

US-GAAP accounting,

XBRL,

Business Analytics,

Business Collaboration,

Business Performance Management (BPM),

Financial Management,

Financial Performance Management (FPM),

financial standards,

FPM

For at least a couple of decades completing the financial close within five or six business days after the end of the period has been accepted as a best practice. As such, that creates an expectation that finance organizations that take longer should work to reduce their closing intervals. In updating our last benchmark research on the closing process, Ventana Research has found this not to be the case. In fact, the latest research shows that many companies are taking longer to close today than...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Information Management (IM),

Financial Performance Management

Host Analytics has added new analytics and reporting resources to its cloud-based performance management suite. Business Analytics will offer a broad set of built-in analytics and reporting capabilities or, for companies with an existing business intelligence infrastructure (from vendors such as IBM, Infor, Oracle or SAP), the option of a self-service approach. I believe these new analytics and reporting capabilities give companies considering only on-premises performance management deployments...

Read More

Topics:

Planning,

Operational Performance Management (OPM),

Reporting,

Budgeting,

closing,

Consolidation,

Host Analytics,

XBRL,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Cloud Computing,

Business Performance Management (BPM),

Data,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Workforce Performance Management (WPM),

benchmark,

Decision Hub,

Financial Performance Management,

SEC

The mandate by the U.S. Securities and Exchange Commission (SEC) that requires its filers to apply eXtensible Business Reporting Language (XBRL) tags to their financial statements has been in effect for several years. (XBRL is a core element of our Office of Finance Research Agenda for 2012.) One of the most important ideas behind this “interactive data” requirement was to make it as simple as possible for investors to be able to consume and analyze corporate financial data filed with the SEC....

Read More

Topics:

Office of Finance,

extended close,

US-GAAP,

XBRL,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

financial reporting,

SEC,

Digital Technology