Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

eDiscovery,

Exterro,

Data Governance,

Data Management,

Governance, Risk & Compliance (GRC),

Informatica,

Business Performance Management (BPM),

compliance,

Data,

Financial Performance Management (FPM),

Information,

Information Applications (IA),

Information Management (IM),

Risk,

Sales Performance Management (SPM),

Workforce Performance Management (WPM)

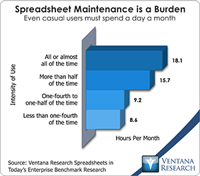

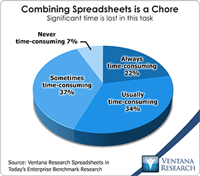

The spreadsheet is one of the five most important advances in business management over the last 50 years. It has changed all aspects of running an organization. It was the original “killer app” that made people go out and buy personal computers. So you see I’m enthusiastic about spreadsheets, but I realize they have limits that must be respected to work efficiently. One of the more important findings from our benchmark research Spreadsheets for Today’s Enterprise was about the time spent in...

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Reporting,

enterprise spreadsheet,

Analytics,

Business Analytics,

Visualization,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

Financial Performance Management

At this year’s Inforum user group conference, Infor representatives showed the progress the organization has made since last year in transforming itself from a ragbag of mostly small, often obsolete software companies to a competitive vendor of a modern enterprise management software suite. Infor was created by private equity investors employing a “rollup” strategy, aimed at combining smaller companies within an industry to form a single larger company that could achieve economies of scale and...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

GRC,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

closing,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Collaboration,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Infor,

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

FPM,

SEC

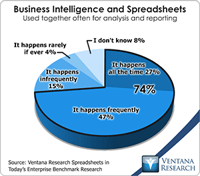

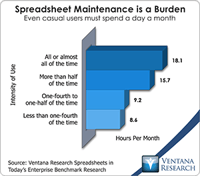

I’ve been using spreadsheets for more than 30 years. I consider this technology tool among the five most important advances in business management of the 20th century. Spreadsheets have revolutionized many aspects of running an organization. Yet as enthusiastic as I am about them, I know the limits of desktop spreadsheets and the price we pay if we fail to respect those limits. The essential problem arises when people use desktop spreadsheets for purposes beyond what they were originally...

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Reporting,

enterprise spreadsheet,

Analytics,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Visualization,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

Financial Performance Management

A recent news release by Robert Half, a staffing company that specializes in accounting and finance personnel, covered what it sees as the most important attributes required for auditors in the 21st century. “7 Attributes of Highly Effective Internal Auditors” covers the people dimension of the profession and focuses on the non-technical requirements of the role, including relationship-building, teamwork, and diversity. No doubt these skills are a must for just about anybody working in a modern...

Read More

Topics:

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Infor,

Risk,

HANA,

Oversight Systems

SAP recently announced its new Fraud Management analytic applications. Currently in “controlled” (limited) release, it’s a promising start for the product and a good example of the type of business process revolution that’s possible when companies can execute complex analytics on big data sets using in-memory and other advanced processing techniques. Over the next several years a wide swath of basic corporate processes will be transformed by the shift to in-memory processing and big data...

Read More

Topics:

SAP,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Risk,

HANA

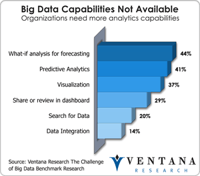

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

costing,

FPM,

Profitability

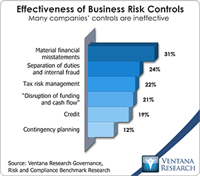

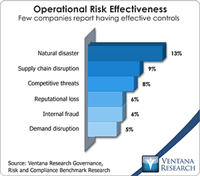

I’ve frequently commented on the artificiality of the emerging software category of governance, risk and compliance (GRC). The term is used to a cover a combination of what were once viewed as stand-alone software categories, including IT governance, audit documentation and industry-specific compliance management, to name three examples. While it’s still common for specific types of software to be purchased piecemeal by different departments, these disparate areas have started a long...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

Risk,

financial risk management,

IT Risk Management,

Sarbanes Oxley,

SOX

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Reporting,

enterprise spreadsheet,

Analytics,

Visualization,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

Financial Performance Management

I’ve been using electronic spreadsheets for more than 30 years. I consider this technology among the 20th century’s top five most important advances in business management. Spreadsheets have revolutionized every aspect of running any organization. A spreadsheet (specifically, VisiCalc) was the original “killer app” that made business people feel the necessity to buy a personal computer.

Read More

Topics:

Office of Finance,

Operational Performance Management (OPM),

Reporting,

enterprise spreadsheet,

Analytics,

Business Analytics,

Visualization,

Business Performance Management (BPM),

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

benchmark,

Financial Performance Management