The topic of corporate governance received renewed attention recently after the publication of an open letter signed by 13 prominent business leaders, including Warren Buffett of Berkshire Hathaway and Jamie Dimon of JPMorgan Chase. The first principle the group advocated in the letter is the need for a truly independent board of directors. To achieve that aim, the letter suggests having the board meet regularly without the CEO and that the members of the board should have “active and direct...

Read More

Topics:

Mobile,

Governance,

Human Capital Management,

Office of Finance,

Consolidation,

Reconciliation,

CFO,

CEO,

board of directors,

accounting close

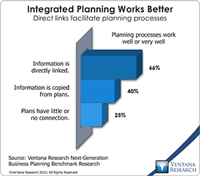

Ventana Research recently released the results of our Next-Generation Business Planning benchmark research. Business planning encompasses all of the forward-looking activities in which companies routinely engage. The research examined 11 of the most common types of enterprise planning: capital, demand, marketing, project, sales and operations, strategic, supply chain and workforce planning, as well as sales forecasting and corporate and IT budgeting. We also aggregated the results to draw...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Sales,

Social Media,

Human Capital Management,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

Controller,

Business Analytics,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Workforce Performance Management (WPM),

capital spending,

demand management,

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning,

S&OP

SYSPRO is a 35-year-old ERP vendor that focuses on products for midsize companies, particularly those in manufacturing and distribution. In manufacturing, SYSPRO supports make, configure and assemble, engineer to order, make to stock and job shop environments. The company attempts to differentiate itself through vertical specialization and its years of ongoing development, which can reduce the need for customization and cut the cost of initial and ongoing configuration to suit the needs of...

Read More

Topics:

Performance Management,

ERP,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

cloud ERP,

container,

Analytics,

Business Analytics,

Cloud Computing,

Collaboration,

Dashboards,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

SCM,

S&OP,

Digital Technology

Financial management software provider Intacct recently held its seventh annual user conference. In addition to a long list of enhancements in current and upcoming product releases, the company used the occasion to announce Intacct Collaborate, a capability built into its software that enables finance and accounting organizations to work together to answer questions or resolve issues while performing a process. Our benchmark research shows that collaboration ranks second in importance behind...

Read More

Topics:

Performance Management,

Salesforce.com,

ERP,

Human Capital Management,

NetSuite,

Office of Finance,

Reporting,

cloud ERP,

Analytics,

Business Analytics,

Business Collaboration,

Chatter,

Cloud Computing,

Collaboration,

Dashboards,

Business Performance Management (BPM),

Financial Performance Management (FPM),

FinancialForce,

Sales Performance Management (SPM),

Intacct

Financial management software provider Intacct recently held its fourth annual user conference. In addition to a long list of enhancements in current and upcoming product releases, the company used the occasion to announce Intacct Collaborate, a capability built into its software that enables finance and accounting organizations to work together to answer questions or resolve issues while performing a process. Our benchmark research shows that collaboration ranks second in importance behind...

Read More

Topics:

Performance Management,

Salesforce.com,

ERP,

Human Capital Management,

NetSuite,

Office of Finance,

Reporting,

cloud ERP,

Analytics,

Business Analytics,

Business Collaboration,

Chatter,

Cloud Computing,

Collaboration,

Dashboards,

Business Performance Management (BPM),

Financial Performance Management (FPM),

FinancialForce,

Sales Performance Management (SPM),

Intacct

Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Cloud Computing,

In-memory,

Oracle,

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software

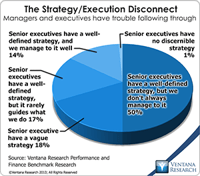

This is the beginning of the season when companies that are on a calendar year begin their strategic and long-term planning. Ventana Research performed an extensive investigation in this area with our long-range planning benchmark research. Strategic and long-range planning is a process and discipline that companies use to determine the best strategy for succeeding in the markets they serve and then ensure they have the capabilities and resources needed to support their strategic objectives.

Read More

Topics:

Big Data,

Master Data Management,

Performance Management,

Planning,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Reporting,

Budgeting,

dashboard,

Analytics,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Data,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

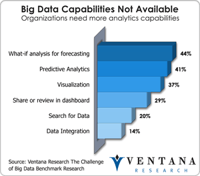

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

costing,

FPM,

Profitability

Profit Velocity Solutions’ PV Accelerator is an analytic application designed to enable capital-intensive companies to consistently achieve substantially wider margins and higher return on assets (ROA). Companies in industries such as specialty chemicals, building materials, integrated steel mills and silicon chip fabrication (to name just four) routinely fail to make the right decisions about pricing, production and sales management because they use analytic methods that, from an economic...

Read More

Topics:

Performance Management,

Sales,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

PV Accelerator,

Analytics,

Business Analytics,

Cloud Computing,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Price Optimization,

Profit Velocity,

Profitability,

Software,

S&OP