SAP recently announced its new Fraud Management analytic applications. Currently in “controlled” (limited) release, it’s a promising start for the product and a good example of the type of business process revolution that’s possible when companies can execute complex analytics on big data sets using in-memory and other advanced processing techniques. Over the next several years a wide swath of basic corporate processes will be transformed by the shift to in-memory processing and big data...

Read More

Topics:

SAP,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Risk,

HANA

I’m wondering whether the rapid rise in earnings restatements by “accelerated filers” (companies that file their financial statements with the U.S. Securities and Exchange Commission that have a public float greater than $75 million) over the past three years is a significant trend or an interesting blip. According to a research firm, Audit Analytics, that number has grown from 153 restatements in 2009 to 245 in 2012, a 60 percent increase. What makes it a blip is that the total is still less...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

Tax,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

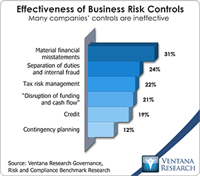

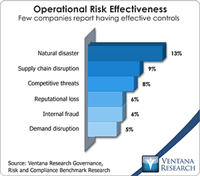

I’ve frequently commented on the artificiality of the emerging software category of governance, risk and compliance (GRC). The term is used to a cover a combination of what were once viewed as stand-alone software categories, including IT governance, audit documentation and industry-specific compliance management, to name three examples. While it’s still common for specific types of software to be purchased piecemeal by different departments, these disparate areas have started a long...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

Risk,

financial risk management,

IT Risk Management,

Sarbanes Oxley,

SOX

Taxes – both indirect (sales or value added taxes, for example) and direct (income taxes) – are one the largest expense items on the corporate income statement. In recent years it has become common for large and even midsize companies to automate their indirect tax management process, but direct tax management has remained a bastion of manual processes built on a heap of desktop spreadsheets. In previous blog posts I discussed this issue and the role of the tax data warehouse as a necessary...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Tax,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Vertex,

FPM

Banking giant JP Morgan raised eyebrows in 2012 when it revealed that it had lost a substantial amount of money because of poorly conceived trades it had made for its own account. The losses raised questions about the adequacy of its internal controls, and broader questions about the need for regulations to reduce systemic risk to the banking system. At the heart of the matter were the transactions made by “the London Whale,” the name given to a JP Morgan’s trading operation in the City by its...

Read More

Topics:

Sales,

GRC,

Office of Finance,

Operational Performance Management (OPM),

error,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance Management (BPM),

Data,

Financial Performance Management (FPM),

Information Management (IM),

Sales Performance Management (SPM),

controls

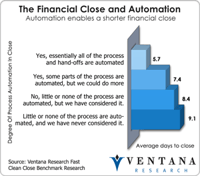

Businesses always see a lag between when technology makes some advance possible and when a majority of companies actually adopt it. There’s even a longer lag between the emergence of an advance in a business process or technique and the time it takes to become mainstream. When we write our research agendas at the top of each year, we have to strike a balance between focusing on the new and different, which is still many years away from general acceptance, and the mainstream, which has been...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

Sales Performance Management (SPM),

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

Increasingly, global financial markets compete on speed, so much so that high-speed trading capabilities have become a performance differentiator for the largest financial services firms and some investment funds. Transmitting messages with quotes, prices and trade data is a core capability for currency dealers. Informatica recently introduced Ultra Messaging, which is designed to offer global currency traders an efficient, high-throughput, lower-latency (that is, faster) and more secure method...

Read More

Topics:

Sales,

GRC,

Operational Performance Management (OPM),

credit,

currency,

LAN,

Informatica,

Business Performance Management (BPM),

finance,

Financial Performance Management (FPM),

WAN

Many people enjoy mystery stories or crime thrillers; in the same vein of savoring the whodunnit and howdunnit, I like a good accounting scandal. My fascination with cooking the books started when I was young with the “great salad oil swindle”, which wound up causing losses in excess of $1 billion in today’s money and even threatened a Wall Street collapse. This disaster was averted by the assassination of President Kennedy, which kept markets closed on Monday, November 25, 1963, and gave the...

Read More

Topics:

Fraud,

Governance,

GRC,

Office of Finance,

audit,

IFRS,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

Financial Performance Management (FPM),

Hewlett Packard,

Meg Whitman,

SEC

One of the community groups to which I donate my time is an organization that puts on a Concours d’Élegance – a vintage car show. Such Concours date back to seventeenth-century France, when wealthy aristocrats gathered to see who had the best carriages and most beaudacious horses. Our Concours serves as the centerpiece to a broader mission of raising money for several charities. There a many such events in the United States and elsewhere, but this one, which has been held every year since 1956,...

Read More

Topics:

Big Data,

GRC,

Operational Performance Management (OPM),

Business Analytics,

Business Intelligence,

CIO,

Operational Intelligence,

Business Performance Management (BPM),

CFO,

finance,

Financial Performance Management (FPM),

Information Management (IM),

IT Performance Management (ITPM),

Talent Management,

FPM

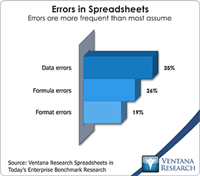

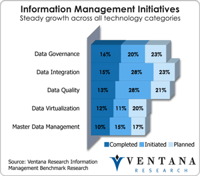

Our research consistently finds that defects in data are the root cause of a wide range of problems encountered by modern corporations. The magnitude of the problem correlates with the size of the company: Big companies have bigger headaches than midsize ones. Data issues diminish productivity in every part of a business as people struggle to correct errors or find workarounds. Issues with data are a man-made phenomenon, yet companies seem to treat bad data as some sort of force of nature like...

Read More

Topics:

Big Data,

Predictive Analytics,

GRC,

Operational Performance Management (OPM),

Business Analytics,

Business Intelligence,

CIO,

Operational Intelligence,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Information Management (IM),

IT Performance Management (ITPM),

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

FPM