Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

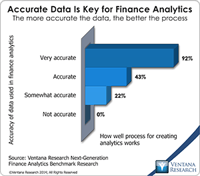

Our research consistently finds that data issues are a root cause of many problems encountered by modern corporations. One of the main causes of bad data is a lack of data stewardship – too often, nobody is responsible for taking care of data. Fixing inaccurate data is tedious, but creating IT environments that build quality into data is far from glamorous, so these sorts of projects are rarely demanded and funded. The magnitude of the problem grows with the company: Big companies have more...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Applications (IA),

Risk,

Workforce Performance Management (WPM),

CEO,

Financial Performance Management,

FPM

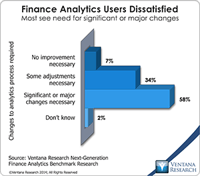

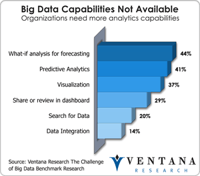

Business computing has undergone a quiet revolution over the past two decades. As a result of having added, one-by-one, applications that automate all sorts of business processes, organizations now collect data from a wider and deeper array of sources than ever before. Advances in the tools for analyzing and reporting the data from such systems have made it possible to assess financial performance, process quality, operational status, risk and even governance and compliance in every aspect of a...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Information Management (IM),

Risk,

CEO,

Financial Performance Management,

FPM

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

Data,

Document Management,

Financial Performance Management (FPM),

Financial Performance Management,

FPM

A core objective of my research practice and agenda is to help the Office of Finance improve its performance by better utilizing information technology. As we kick off 2014, I see five initiatives that CFOs and controllers should adopt to improve their execution of core finance functions and free up time to concentrate on increasing their department’s strategic value. Finance organizations – especially those that need to improve performance – usually find it difficult to find the resources to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Office of Finance,

Budgeting,

close,

dashboard,

PRO,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

In-memory,

Business Performance Management (BPM),

CFO,

Customer Performance Management (CPM),

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

CEO,

demand management,

Financial Performance Management,

FPM,

S&OP

Senior finance executives and finance organizations that want to improve their performance must recognize that technology is a key tool for doing high-quality work. To test this premise, imagine how smoothly your company would operate if all of its finance and administrative software and hardware were 25 years old. In almost all cases the company wouldn’t be able to compete at all or would be at a substantial disadvantage. Having the latest technology isn’t always necessary, but even though...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

CIO,

Cloud Computing,

Governance, Risk & Compliance (GRC),

In-memory,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

CEO,

Financial Performance Management,

FPM

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Cloud Computing,

In-memory,

Oracle,

Business Performance Management (BPM),

CFO,

compliance,

Data,

Financial Performance Management (FPM),

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software

For four years Adaptive Planning has been building out its cloud-based financial software. Starting with budgeting, planning and forecasting, it added analytics, data visualization, dashboards and alerting as well as flexible reporting and collaboration tools. It recently announced the general availability of consolidation functionality in its cloud-based suite. This addition eliminates a notable gap in the company’s functionality, giving it a more complete financial performance management...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Data,

Financial Performance Management (FPM),

Financial Performance Management

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Business Performance Management (BPM),

CFO,

Financial Performance Management (FPM),

Risk,

costing,

FPM,

Profitability

I’m wondering whether the rapid rise in earnings restatements by “accelerated filers” (companies that file their financial statements with the U.S. Securities and Exchange Commission that have a public float greater than $75 million) over the past three years is a significant trend or an interesting blip. According to a research firm, Audit Analytics, that number has grown from 153 restatements in 2009 to 245 in 2012, a 60 percent increase. What makes it a blip is that the total is still less...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

Tax,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC