SAP recently announced its new Fraud Management analytic applications. Currently in “controlled” (limited) release, it’s a promising start for the product and a good example of the type of business process revolution that’s possible when companies can execute complex analytics on big data sets using in-memory and other advanced processing techniques. Over the next several years a wide swath of basic corporate processes will be transformed by the shift to in-memory processing and big data...

Read More

Topics:

SAP,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Analytics,

Business Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Risk,

HANA

This is annual report season, the time of year that a majority of European and North American corporations issue glossy paper documents aimed at investors, customers, suppliers, existing and prospective employees as well as the public at large. (Some countries have different conventions; in Japan, for instance, most companies are on a March fiscal year.) In reviewing some of the annual reports that are available on the Web, I was struck by the absence of advanced reporting technology used on...

Read More

Topics:

Office of Finance,

extended close,

US-GAAP,

XBRL,

Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

financial reporting,

SEC,

Digital Technology

I’m wondering whether the rapid rise in earnings restatements by “accelerated filers” (companies that file their financial statements with the U.S. Securities and Exchange Commission that have a public float greater than $75 million) over the past three years is a significant trend or an interesting blip. According to a research firm, Audit Analytics, that number has grown from 153 restatements in 2009 to 245 in 2012, a 60 percent increase. What makes it a blip is that the total is still less...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

Tax,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

I’ve frequently commented on the artificiality of the emerging software category of governance, risk and compliance (GRC). The term is used to a cover a combination of what were once viewed as stand-alone software categories, including IT governance, audit documentation and industry-specific compliance management, to name three examples. While it’s still common for specific types of software to be purchased piecemeal by different departments, these disparate areas have started a long...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

Risk,

financial risk management,

IT Risk Management,

Sarbanes Oxley,

SOX

I was discussing the United States Securities and Exchange Commission’s (SEC) eXtensible Business Reporting Language (XBRL) mandate with a former head of investor relations at a Fortune 100 company. His take on it is much the same as that of everyone else involved with corporate reporting: it doesn’t produce much value and costs a bundle to comply. I related to him my thoughts on the lack of progress I saw in making the XBRL mandate more useful to corporations and investors alike. Making XBRL...

Read More

Topics:

Office of Finance,

Reporting,

extended close,

US-GAAP,

XBRL,

Analytics,

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

financial reporting,

FPM,

SEC,

Digital Technology

Read More

Topics:

Office of Finance,

extended close,

US-GAAP,

XBRL,

Analytics,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

financial reporting,

SEC,

Digital Technology

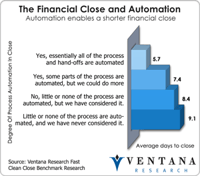

People used to use the phrase “the last mile” solely to refer to a condemned prisoner’s path to execution. Then the telecommunications industry picked it up to describe that part of a circuit between a major trunk line and a subscriber. Later still a defunct software company, Movaris (now part of Trintech), used the phrase in an analogy to refer to the set of activities that take place between when a company closes its books and the point where it finishes its external reporting activities,...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

XBRL,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

SEC

One of the most important trends in business over the past 20 years has been the broadening use of information technology to manage and support activities. In the early decades of business computing, companies developed islands of automation for largely numeric functions such as billing, inventory management and accounting. Each ran on a proprietary system and engaged the time of a relative handful of employees. Today, just about everyone works with an IT system for at least some of their...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

finance,

Financial Performance Management (FPM),

IT Performance Management (ITPM),

Risk,

financial risk management,

IT Risk Management

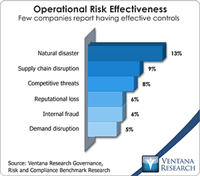

Risk has always been an integral part of business, but our recent Governance, Risk and Compliance (GRC) benchmark research shows that companies deal with risk with varying degrees of effectiveness – especially operational risk. A majority of companies lag in their overall GRC maturity, as I covered in a recent blog post. Operational risk management should be of greater interest to executives today because they can have greater control of it than before. The expansion of IT systems to automate...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Operational Intelligence,

Business Performance Management (BPM),

compliance,

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Information Applications (IA),

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Sales Performance Management (SPM),

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

financial risk management

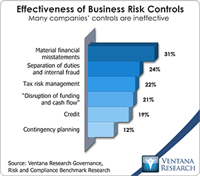

Ventana Research recently completed benchmark research on governance, risk and compliance (GRC), three business activities that are naturally linked. Although managing them requires separate and sometimes very different processes, on the whole these activities affect each other: Effective corporate governance ensures compliances with laws, regulations and company policies, and without governance, there’s no way to control risk. Separately or considered together, managing governance, risk and...

Read More

Topics:

Big Data,

Customer Experience,

Governance,

GRC,

Operational Performance Management (OPM),

Management,

Business Analytics,

Business Collaboration,

Governance, Risk & Compliance (GRC),

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

Information Management (IM),

IT Performance Management (ITPM),

Risk,

Workforce Performance Management (WPM),

financial risk management