Planview recently announced general availability of Planview Enterprise 11. The new release enhances the user experience through a comprehensive redesign of the interface to promote ease of use. The changes are intended to facilitate an integrated approach to long-range planning of capital projects and major corporate initiatives across departments. There’s an important difference between strategic and long-range planning, and this difference is the reason why long-range planning benefits from software specifically designed to support that process. Strategic planning involves the formal conceptualization of a corporation’s strategy and its individual supporting elements such as product, sales, pricing and financial strategy. The strategic planning process is aimed at solidifying ideas and concepts into words to ensure understanding and agreement by the senior leadership team. Strategic planning naturally is done at the highest echelons of an organization. For that reason, it involves a relatively small group of senior executives and deals more in concepts and less in specific numbers. Long-range planning is the next step. It’s the formal quantification of the strategic plan and how that strategy is expected to play out. Translating the company’s strategic plan into numbers should be an iterative process of dialogue between those who set the strategy and those responsible for carrying it out. Being able to get quick answers to these what-if questions makes for a more productive, accurate and fact-based dialog.

One of the key findings of our recently completed benchmark research on long-range planning is the importance of integrating capital projects and major corporate initiatives as discrete elements in a company’s long-range plan. This research, which was conducted with The Financial Executives Research Foundation (FERF) and Planview, shows that companies that explicitly include projects and initiatives have a long-range planning process that is better aligned with strategy. Yet we found that only 26 percent of companies fully integrate projects and initiatives in their long-range plans.

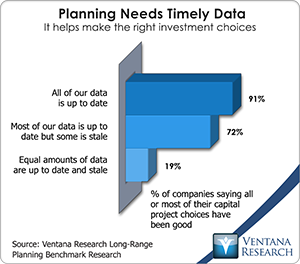

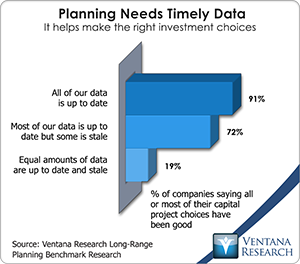

Improving the planning processes in corporations has been central to my research agenda for the past decade. In part this is because it’s one of the core business processes that can benefit most from using more appropriate technology. Capital projects and major corporate initiatives are an important component of the long-range planning process, but many companies find it challenging to incorporate them as discrete items in their long-range planning and review processes because they use spreadsheets, which are not well suited for the task. The benchmark research shows that a majority (52%) of companies use desktop spreadsheets to manage their long-range planning process. Spreadsheets are not a good choice for this type of planning because they have substantial limitations in handling any collaborative, repetitive enterprise-wide activity, especially ones that involve planning and analysis of multiple business units, regions, products and customers. Their shortcomings are especially evident when users try to integrate even moderately complex and discrete business elements such as capital projects and other initiatives into an overall long-range plan. Companies that use dedicated planning applications twice as often said the data they use for long-range planning is up to date (32% vs. 16%). The research also shows a strong correlation between the timeliness of the data used in analyzing and managing long-range planning and the ability of a company to make good investment decisions that we find as issues of stale data in organizations today from where 19 to 72 percent have challenges today.

processes because they use spreadsheets, which are not well suited for the task. The benchmark research shows that a majority (52%) of companies use desktop spreadsheets to manage their long-range planning process. Spreadsheets are not a good choice for this type of planning because they have substantial limitations in handling any collaborative, repetitive enterprise-wide activity, especially ones that involve planning and analysis of multiple business units, regions, products and customers. Their shortcomings are especially evident when users try to integrate even moderately complex and discrete business elements such as capital projects and other initiatives into an overall long-range plan. Companies that use dedicated planning applications twice as often said the data they use for long-range planning is up to date (32% vs. 16%). The research also shows a strong correlation between the timeliness of the data used in analyzing and managing long-range planning and the ability of a company to make good investment decisions that we find as issues of stale data in organizations today from where 19 to 72 percent have challenges today.

Planview Enterprise makes it easier for companies to incorporate the details of investments and initiatives in the long-range planning process. Asset-intensive companies and those that continually invest in offering new products or services will find having this ability useful for planning, analyzing and managing these capital investment and major corporate initiatives. In contrast to ongoing, repetitive aspects of a business, an initiative has a distinct beginning and an end that is reached after the completion of multiple steps. These steps almost always require resources such as people’s time, money and the use of other corporate assets. Planning, analyzing and reviewing the financial aspects of projects or initiatives are difficult because the aspects are subject to change, especially in the time dimension. For instance, a delay in the delivery of a piece of machinery, approval of a building permit or some other discrete element often will delay some or all of the rest of the project’s activities. When that happens, businesses – and especially finance departments – need to be able to calculate the financial impact of that delay on the project (costs will be lower in some months and higher in others) as well as its consequences for expected downstream revenues and expenses related to that capital project or initiative (incoming cash and some costs will be delayed, while some outlays, such as interest and guaranteed payments, will not).

To Enterprise 11 Planview has added an in-memory processing capability that can make planning and review sessions more interactive by speeding up responses to queries and what-if scenario planning. A numbers-driven dialogue about investment choices is more useful when it takes only a couple of seconds to see the impact of, for example, a proposed schedule alteration, different expected profit margins or an increase in interest or exchange rates. The new version supports the requirements of users in different roles and departments. It has enhanced project and product roadmapping that helps the transition from a manual approach to an enterprise system. Time tracking is facilitated by a new mobile time-sheet capability supported on iPhone, Android and BlackBerry 10 devices. As well, Planview has been offering Enterprise in a software-as-a-service (SaaS) configuration. The redesign is aimed at improving the performance and usability of the software in a Web-based environment. In the past, Planview appealed to larger organizations with significant project management requirements. One of the objectives in the Enterprise 11 redesign, especially when used in a cloud environment, is to make the application more accessible by smaller organizations or ones that need to manage a limited set of projects and initiatives.

Enterprise 11 provides companies with an alternative to spreadsheets. Spreadsheets are not adept at combining project or initiative resource details (number of people and specific materials required, for example) with the cost details (cost per hour or cost per unit, respectively) and it can be impossible to get back to this underlying detail when spreadsheets are rolled up into a financial plan. Spreadsheets also are especially lacking in handling the time dimension or even moderately complex dependences that exist in almost any project. Consider, for instance, a factory expansion where the plumbing and wiring work can only begin after machine X is installed, or a national roll-out of product Y will begin only after market trials in multiple cities are completed and a messaging strategy is selected. A delay in the delivery of the machine or ambiguities in the results of the city trials will automatically stretch out the timeline. It’s difficult enough to create a project cost model in a desktop spreadsheet and integrate this into a spreadsheet detailing the long-range plan. It’s even more difficult to reflect actual amounts, compare these to the plan, make changes to the plan over time, assess the impact on the company’s financial statements and cash flow from changes made to the plan and decide how best to effect those changes. Having software that automatically recalculates costs based on schedule changes enables executives and managers to quickly understand the implications and assess the impact of different responses to a change in the schedule.

If we continue the factory expansion example, does it make sense to spend more to expedite the delivery of equipment and materials to accelerate the availability of a capital asset, or should the company just live with the delay? Planview Enterprise helps find a quick and accurate answer to that question. Having accurate data available when assessing capital spending projects and initiatives has an impact on how well a company makes these investments. Our research shows that 90 percent of companies that have accurate information make good investment choices compared to two-thirds (66%) that work with somewhat accurate data and just 30 percent that work with somewhat or mainly inaccurate data. The cumulative impact of consistently making choices about good capital spending and corporate initiatives is likely to be a significant factor in a company’s long-term profitability and competitiveness.

Planview Enterprise also helps companies assess their investment options, especially organizations that have ongoing needs to choose between substantial capital spending programs, funding new product development projects or doing both. Being able to model each investment as a discrete unit, to change assumptions about how, when and under what conditions they will be performed and to alter when and under what circumstances to fund these investments gives executives a more complete understanding of their options. Having a clearer picture should enable them to make better decisions about these investments more consistently. Moreover, since Planview is able to automate the collection of data about the actual execution of the investments, senior executives will be able to track their performance faster, more accurately and with much less effort. Having this level of accountability is likely to promote more consistently better investment decisions.

Larger organizations are likely to find a switch from spreadsheets to Planview Enterprise to be beneficial because they have more people and more ongoing investments. Our research shows that in 67 percent of companies in which more than 20 people are involved in long-range planning, spreadsheets make it more difficult to manage the process, and they also make it harder in 41 percent that fewer people engaged in the process. The research gives all companies a reason to rethink their use of spreadsheets because they were consistently rated lower than other alternatives for executing a wide spectrum of analytical and process management tasks associated with long-range planning.

Competence in long-range planning is vital to the success of any business. Being able to select the best alternatives for capital projects and major corporate initiatives promotes long-term competitiveness and the ability to achieve necessary returns to sustain a company’s financial health. Being able to examine the ongoing performance of these investments and make necessary adjustments to ongoing plans gives a company needed flexibility and agility in today’s turbulent economic and financial environment. Especially for corporations that now use spreadsheets to manage their long-range planning, I recommend they look at Planview Enterprise as an alternative to support a more effective long-range planning process.

Regards,

Robert Kugel – SVP Research