Ventana Research completed an in-depth benchmark research project on long-range planning recently. As I define it, long-range planning is the formal quantification of the strategic plan and how that strategy is expected to play out over a period of time. The benchmark demonstrated that there’s room for improvement in almost every aspect of the long-range planning process. Almost all (95%) of those participating in the research see the need to advance their process. The research confirmed that long-range planning does not work well in isolation. Greater integration of the annual budget with the long-range plan and deeper integration of individual capital projects and initiatives are two ways to enhance the value of long-range planning process.

One of the main objectives companies have for long-range planning is to assist in the development of the annual budget. This was cited by seven out of 10 participants (69%), the highest percentage among specific five choices provided and ahead of optimally allocating capital or project investments, which was selected by 64 percent. Since almost all company budgets are focused only on a single fiscal year, long-range planning enables executives to look past the current period and get a formal picture of the follow-on years. For that reason, a bit more than half have fully (12%) or mostly (44%) integrated their long-range planning process with operational planning and budgeting. By the same token, almost half have not put them together to any meaningful degree. Our research shows that organizations that have fully or mostly integrated long-range planning with their annual budgeting process get better results. Companies that integrate long-range planning and budgeting react faster to changes in their environment: Two-thirds of those that have fully or mostly integrated the two types can respond to changes immediately or soon enough, compared to just 22 percent of those companies that have little or no integration. The more integrated companies seldom said that it takes them too long to complete their long-range planning process (29%), compared to nearly half (47%) of those that are integrated only somewhat or not at all. Organizations that tightly integrate short- and long-term planning can improve agility if, for example, discussions of near-term allocations include consideration of market or economic contingencies and how best to deal with outcomes, if they establish and follow structured processes that kick in to deal with such changes and if senior executives clearly and consistently communicate long-term strategy and objectives.

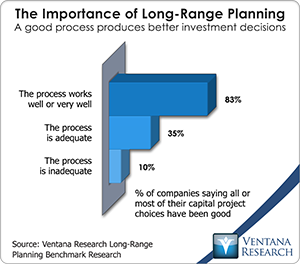

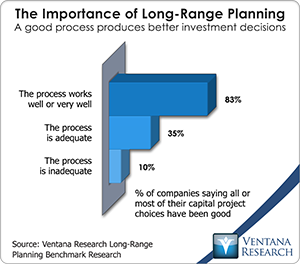

An important objective of long-range planning is deciding on which capital investments to make and which major corporate initiatives to pursue. We asked participants to assess how well their process works and compared these results with the quality of these investment choices and found that there is a positive correlation between the overall quality of the process and the decisions that stem from it. Most companies (83%) with a good process make consistently good choices compared to 35 percent that only have an adequate process and just 10 percent of those that say their process is inadequate. A good planning process is one which addresses key people-related issues (clear communications and training, for example), access to consistently timely and accurate data necessary for planning and software that supports effective process execution, agile response to changing conditions and deeper insight into factors driving results.

which capital investments to make and which major corporate initiatives to pursue. We asked participants to assess how well their process works and compared these results with the quality of these investment choices and found that there is a positive correlation between the overall quality of the process and the decisions that stem from it. Most companies (83%) with a good process make consistently good choices compared to 35 percent that only have an adequate process and just 10 percent of those that say their process is inadequate. A good planning process is one which addresses key people-related issues (clear communications and training, for example), access to consistently timely and accurate data necessary for planning and software that supports effective process execution, agile response to changing conditions and deeper insight into factors driving results.

Companies also differ in the degree to which they explicitly integrate planning for capital projects and initiatives with their long-range plans. This has been more common (though by no means universal) in companies with a project-centric business model (in industries such as engineering and construction, aerospace and shipbuilding, to name three). Or for pharmaceutical and other long-cycle companies that need long-range visibility as, for example, they transition beyond drug trial phases into sales, production and distribution. Increasingly, though, even shorter cycle businesses such as electronics are incorporating capital and project planning to manage their rapidly evolving products and product families. As well, asset-intensive businesses that need more intelligent management of capacity and maintenance can benefit from greater integration of capital project details in their long-range plans.

About one-fourth (26%) of organizations participating in the benchmark research report that their strategic plans are highly integrated with the management of individual projects, while 61 percent integrate the two somewhat and 10 percent say they are not integrated at all. Only 19 percent of very large organizations (those with 10,000 or more employees) have highly integrated the two, likely because their size makes this difficult to manage (especially if they are using spreadsheets in the process). We cross-tabulated companies’ assessment of the quality of their long-term planning process with the degree of integration of capital projects and major initiatives with the long-range planning process and found there is a positive correlation. Integrating capital projects and initiatives with long-range planning results in a better process: nearly all (85%) of those with a highly integrated process say theirs works well or very well, compared to 63% that have a somewhat integrated process and just 22% that have not integrated these at all. There also is a correlation between the degree of integration and the quality of alignment of long-range planning with a company’s strategy. The results were similar to the previous point: 9 out of 10 that have a highly integrated process also create long-range plans that are well aligned with strategy, compared to 7 out of 10 that have somewhat integrated approach and just one-third where there is no integration.

Strategic planning is the formal conceptualization of a corporation’s strategy and its individual supporting elements (such as product strategy, sales and marketing strategy, pricing strategy and financial strategy – to name four). The strategic planning is a high-level process aimed at translating a company’s core approach to its business and environment into words to ensure that everyone has a clear understanding of its strategy. Strategic planning can – and often does – occur in isolation from the details of running a company. Long-range planning cannot. It is the formal quantification of the strategic plan and how that strategy is expected to play out. Our research shows that many if not most types of businesses benefit when there is an iterative approach in the long-range planning process that combines the big picture with the details.

Regards,

Robert Kugel – SVP Research