Oracle Adapts Business Applications Intelligently in the Cloud

The annual Oracle OpenWorld user group meeting provides an opportunity to step back and take a longer view of business, industry and technology trends affecting the company. Last year, after listening to Larry Ellison’s and Mark Hurd’s vision for the future of IT, I wrote that Oracle had to continue shifting its focus to business applications because the accelerating shift to cloud computing would lead corporations to outsource their IT infrastructures, services and security to third parties. Eventually, this would substantially shrink the market for corporate IT departments, which has been Oracle’s strength. At this year’s conference the company demonstrated how it is applying its technology strengths to create a competitive advantage that it can apply to its broad business applications portfolio.

Adaptive Intelligent Applications is Oracle’s term for its new applications that marry third-party data with real-time analytics, machine- and behavioral learning. “Adaptive” means that the applications are able to mold themselves to how organizations actually behave rather than forcing users to adjust to how the software works. The objective is to embed in its business applications situational awareness that simplifies how individuals perform tasks and provides executives, employees and customers with recommendations tailored their specific needs in the immediate context. This approach utilizes a key advantage of cloud applications: Vendors are able to bring their expertise and economies of scale to bear in expanding the scope of their services to provide capabilities that, for cost or other practical reasons, most customers couldn’t duplicate on their own premises. The ability to significantly improve business performance in this manner is the primary reason why Ventana Research awarded Oracle’s Adaptive Intelligent Applications its 2016 Technology Innovation Award for  overall business technology innovation. Intelligent Applications have the potential to reimagine business software generally, going beyond data capture and simple process automation to support more informed and intelligent decision-making.

overall business technology innovation. Intelligent Applications have the potential to reimagine business software generally, going beyond data capture and simple process automation to support more informed and intelligent decision-making.

Oracles’ Adaptive Intelligent Applications take advantage of the company’s Oracle Data Cloud, which contains more than five billion consumer and business profiles, each with a rich set of attributes. Companies can use this data and analytics to continuously adapt to understand the behaviors and needs of a specific organization’s users, customers and employees. For example, this data trove could be used by purchasing departments to negotiate better prices and terms, by finance organizations to prioritize payables if forecasted cash flows are tight, by HR departments to identify best-fit candidates faster and by supply chain managers to identify the best options in designing distribution networks.

In addition, this year’s OpenWorld keynotes fleshed out Oracle’s cloud infrastructure strategy, which is multifaceted:

- It repurposes its database, tools and IT infrastructure strengths to address the new cloud-based information technology economy.

- It continues to restructures its broad set of applications and functionality to operate well in a multitenant software-as-a-service (SaaS) environment.

- It provides the ability to more easily integrate, enrich and extend these applications in the cloud, which can help Oracle retain existing application customers by providing a practical migration path to the cloud as well as differentiated services and applications.

Over the past few years Oracle has refined its cloud strategy in a way that builds on its technology strengths to adapt to an epochal shift in how companies consume business applications. IT departments won’t disappear, and for the time being they will remain a key source of revenue for Oracle. But in most organizations they will shrink considerably over the next decade as their “keep the lights on” workloads are reduced substantially. This will happen as the bulk of maintenance work shifts to the cloud application vendors and as line-of-business departments embrace more easily configured applications to take charge of the software that runs their business. Oracle’s cloud infrastructure strategy provides it a way to give existing and prospective customers the flexibility to adapt to the shift to the cloud in a way that best fits their circumstances and needs.

We are well into a fundamental restructuring of how organizations source and use information technology that generally comes under the heading of “the cloud.” Just as the shift to client/server computing a generation ago was more than just that computing structure (it coincided with broad adoption of relational databases and event-driven programming, for example), the cloud is better understood as a maturation of underlying technologies that significantly reduce the need for customizing applications, facilitate their implementation and make it easier to integrate them. In other words, the artisanal nature of IT that dominated the first half century of the Information Age is moving at an accelerated pace to an “off the rack” mode.

Technology also is creating opportunities for  specialization and economies of scale that alter the calculus of rent-vs.-buy decisions for buyers in a way that favors the former. The new model is making outsourcing of computing capabilities by renting services such as memory and processing power a more attractive alternative for most companies. It will continue to change spending patterns for information technology and create winners and losers. Internal IT, vendors that serve internal IT staffs and systems integrators will have smaller shares of IT spend. Although this will in part disadvantage Oracle, the company will likely increase its share of applications spend and offset some of the revenue lost from its existing database and tools business with outsourcing revenue.

specialization and economies of scale that alter the calculus of rent-vs.-buy decisions for buyers in a way that favors the former. The new model is making outsourcing of computing capabilities by renting services such as memory and processing power a more attractive alternative for most companies. It will continue to change spending patterns for information technology and create winners and losers. Internal IT, vendors that serve internal IT staffs and systems integrators will have smaller shares of IT spend. Although this will in part disadvantage Oracle, the company will likely increase its share of applications spend and offset some of the revenue lost from its existing database and tools business with outsourcing revenue.

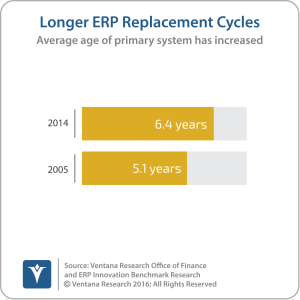

That said, the transition to the cloud will not be abrupt because corporations have existing investments that they will replace only when the benefits are compelling. In some cases, this will take place very slowly: Our Office of Finance benchmark research finds that ERP and financial consolidation systems, for example, are replaced on average every six and seven years, respectively. And while attitudes are shifting in favor of the cloud, outside of the San Francisco Bay Area and technology hubs around the world, reservations about the cloud persist. For these reasons, technologies that facilitate managing hybrid cloud and on-premises computing environments will be popular because this approach allows organizations to choreograph their migration paths to the cloud in ways that suit their  needs. Vendors that can offer companies flexibility in how they evolve their computing environments will have a market advantage.

needs. Vendors that can offer companies flexibility in how they evolve their computing environments will have a market advantage.

In our research 46 percent of organizations said that they still favor on-premises deployment of ERP, 44 percent said that for financial consolidation and 43 percent for planning, but “no preference” is a growing trend. Personally, I would rather entrust my company’s critical systems to people whose only job is to ensure security, rather than those in an IT department who have less sharply focused skills and priorities. As a business executive, I would prefer to have nearly certain immediate and full recovery from system failures. Nonetheless, the world will continue to shift to the cloud at a measured pace because it is impractical for many companies to migrate core applications for financial or operational reasons.

One notable change from past OpenWorld events was that business applications were front and center in Larry Ellison’s Sunday night keynote. They are an integral part of the company’s positioning itself as offering a three-layer cake of software as a service, platform as a service and infrastructure as a service. Providing this range of services can enable Oracle to retain its customer base as these companies transition to the cloud by offering a range of options in how they transition from on-premises IT to the cloud.

Offering a full technology stack that spans infrastructure to packaged applications, Oracle has a differentiated product portfolio that provides value to business users. It gives companies flexibility in choosing deployment options over time. For example, it can make it easier to implement Oracle’s ERP, CRM and human capital management suites in a hybrid fashion, choosing which platform is best for the company, or to create extensions to these applications in the cloud to extend their capabilities or adapt to specific business requirements. Both platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS) offerings are likely to provide Oracle with a significant revenue stream as its on-premises database license and maintenance business wanes.

Offering a common platform enabled Ellison to highlight a “full” integration of its business applications (notably ERP, CRM and HCM) in the keynote. Yet when it comes to integrating applications, the devil is in the details. At the very least full integration will make it simpler (but probably not simple) to share data, stitch together processes and potentially simplify authentications and sign-ons. Offering easier integration has some potential for increasing Oracle’s share of a company’s spending on applications, but one shouldn’t overestimate this appeal. Our Office of Finance research finds that a plurality of companies prefer to purchase suites of functionality. However, all larger companies (and most midsize ones) already have some or all of these components implemented and are unlikely to drop an incumbent application because integration is easier. Moreover, these three application categories are purchased by different groups within a company. In the past, cross-functional purchasing has been limited by emphasis on the suitability of each piece of software to address business requirements.

Various breakout sessions showed that Oracle continues to make progress in reworking its on-premises business applications for the cloud, especially E-Business Suite, performance management and financial consolidation. Just about all on-premises ERP and performance management vendors have had to rewrite their applications to be able to offer them in a multitenant environment for two main reasons. One is that the vendors could not afford to operate their on-premises software profitably as it was written or achieve levels of performance to make them viable at scale.

The other, somewhat related reason is that software vendors also recognized that they needed to clear out the mare’s nest of code that has accumulated over the years to address bugs, add a feature or two or address some architectural flaw. Often, the objective in writing these fixes is expedience, not elegance. As we enter a more mature phase of the business software industry, it may become common practice to rewrite applications every, say, seven years. While code doesn’t physically deteriorate, usually there’s an opportunity to revamp and rewrite the business, data and process models that undergird the application’s functionality, while also clearing out the digital deadwood that piles up in the code base.

The slow, steady transitions of Oracle and other vendors to offering multitenant cloud versions of their software indicate the magnitude of the effort that’s needed. While established vendors have had to slog through rewriting their code to work in a multitenant SaaS environment, the “legacy vendors are dinosaurs” pundits overlooked the steep hill new vendors have had to climb to create their software. ERP and statutory consolidation, for example, are complex applications. Writing and rewriting them appear to be difficult and time-consuming tasks.

The most significant takeaway from this year’s OpenWorld is that far from being a dinosaur, Oracle has positioned itself to maintain a leading share in the business applications business. The addition of adaptive Intelligent Applications as well as creating a well-architected infrastructure and platform for the cloud positions it well for the ongoing evolution of the business software market. The business applications business will continue to be highly competitive, but Oracle appears to be heading in the right direction.

Regards,

Robert Kugel

Senior Vice President Research

Follow Me on Twitter @rdkugelVR and

Connect with me on LinkedIn.

Authors:

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for Ventana Research, now part of ISG. His team covers technology and applications spanning front- and back-office enterprise functions, and he personally runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).