In some parts of the world, bribing government officials is still considered a normal cost of doing business. Elsewhere there has been a growing trend over the past 40 years to make it illegal for a corporation to pay bribes. In the United States, Congress passed the Foreign Corrupt Practices Act (FCPA) in 1977 in the wake of a succession of revelations of companies paying off government officials to secure arms deals or favorable tax treatment. More recently other governments have implemented...

Read More

Topics:

SAP,

ERP,

Governance,

GRC,

Operational Performance Management (OPM),

bribery,

Business Analytics,

Governance, Risk & Compliance (GRC),

IBM,

Operational Intelligence,

Oracle,

Business Performance Management (BPM),

CFO,

compliance,

Financial Performance Management (FPM),

FPM,

Oversight Systems

IBM this week announced its pending acquisition of the Star Analytics product portfolio. Star Analytics is a privately held company that offers products designed to provide easy access to and integration with Oracle Hyperion data sources. While Star Analytics has a good product and solid references, it has lacked critical mass to support more effective sales and marketing efforts. Star Analytics’ strategic value to IBM lies in its ability to unlock data held in Oracle Essbase multidimensional...

Read More

Topics:

Reporting,

closing,

Essbase,

Hyperion,

Analytics,

Business Analytics,

Business Collaboration,

Data Integration,

IBM,

Oracle,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Management (IM),

Financial Performance Management,

Star Analytics,

TM1

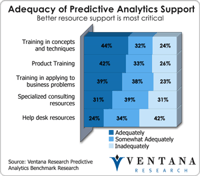

Our benchmark research on business analytics finds that just 13 percent of companies overall and 11 percent of finance departments use predictive analytics. I think advanced analytics – especially predictive analytics – should play a larger role in managing organizations. Making it easier to create and consume advanced analytics would help organizations broaden their integration in business planning and execution. This was one of the points that SPSS, an IBM subsidiary that provides analytics,...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Marketing,

Modeling,

Sales Forecasting,

Analytics,

IBM,

Uncategorized,

SPSS

A main reason why desktop spreadsheets are pervasive in midsize companies (which we define as those with 100 to 1,000 employees) is that these organizations do not have the financial and manpower resources to implement and maintain traditional enterprise business intelligence and performance management systems. To address this gap in the market, several years ago IBM Cognos launched Express, a business intelligence and planning software package designed specifically for midsize companies as...

Read More

Topics:

ERP,

Office of Finance,

Reporting,

Budgeting,

Analytics,

Business Intelligence,

Dashboards,

IBM,

Uncategorized,

CFO,

finance,

Financial Performance Management

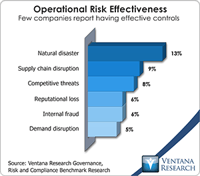

I recently attended Vision 2012, IBM’s conference for users of its financial governance, risk management and performance optimization software. I reviewed the finance portion of the program in a previous blog. I’ve been commenting on governance, risk and compliance (GRC) for several years, often with the caveat that GRC is a catch-all term invented by industry analysts initially to cover a broad set of individual software applications. Each of these was designed to address specific requirements...

Read More

Topics:

Governance,

GRC,

Office of Finance,

Operational Performance Management (OPM),

OpenPages,

Analytics,

Business Collaboration,

IBM,

Business Performance Management (BPM),

compliance,

Financial Performance Management (FPM),

controls,

IT controls

I recently attended Vision 2012, IBM’s conference for users of its financial governance, risk management and performance optimization software. From my perspective, two points are particularly worth noting with respect to the finance portion of the program. First, IBM has assembled a financial performance management suite capable of supporting core finance processes as well as more innovative ones. It continues to build out the scope of this suite’s capabilities to enhance ease of use, deepen...

Read More

Topics:

Performance Management,

close,

closing,

IFRS,

Analytics,

IBM,

Uncategorized,

GAAP

Infor described this year’s Inforum user group meeting as a coming-out party for a large startup company. Such a debut was necessary because Infor had been operating in something of a stealth mode for the past three years: a limited marketing presence, no unified message and a weak, sometimes inconsistent brand identity. It also needed to formally introduce Infor to customers of Lawson, the ERP supplier it acquired last year. The “startup” designation is meant to signal that Infor has been able...

Read More

Topics:

Performance Management,

Salesforce.com,

SAP,

Social Media,

Sustainability,

ERP,

Human Capital Management,

Marketing,

Operational Performance Management (OPM),

Epiphany,

expense management,

Lawson,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Mobility,

Cloud Computing,

Governance, Risk & Compliance (GRC),

IBM,

Operational Intelligence,

Oracle,

CRM,

Customer Performance Management (CPM),

finance,

Financial Performance Management (FPM),

Infor,

Information Applications (IA),

Information Management (IM),

IT Performance Management (ITPM),

Sales Performance Management (SPM),

Supply Chain,

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

Financial Performance Management

I believe that one of the more important analytical applications that a company can implement is profitability management. IBM Cognos offers Profitability Modeling and Optimization as part of its Cognos 10 offering that my colleague has assessed. As I’ve noted, most people in a corporation are focused on profitability, but not necessarily in a way that optimizes results across the organization in a day-to-day, consistent fashion. Those responsible for each component piece that contributes to...

Read More

Topics:

Performance Management,

Forecast,

Modeling,

Office of Finance,

Operational Performance Management (OPM),

enterprise profitability management,

Business Analytics,

IBM,

Business Performance Management (BPM),

Cognos,

Financial Performance Management (FPM),

Sales Performance Management (SPM),

Workforce Performance Management (WPM),

Financial Services,

Profitability

As Workday continues to expand and the likelihood of its IPO becomes a more frequent topic of discussion, so does the movement of ERP systems to the cloud. Thus far, only a minority of companies have chosen to put their ERP and accounting systems in the cloud, but the numbers are growing and there’s evidence of success. NetSuite, for example, reported a 26 percent increase in its revenues to $145 million in the nine months up to Sept. 30, 2011. To be sure, this is not close to Salesforce.com’s...

Read More

Topics:

Microsoft,

Sales,

ERP,

NetSuite,

Office of Finance,

Operational Performance Management (OPM),

Dynamics,

Epicor,

Lawson,

QAD,

Cloud Computing,

IBM,

Oracle,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Infor,

Supply Chain Performance Management (SCPM),

Workforce Performance Management (WPM),

financial software,

Intacct,

PeopleSoft,

Software

In today’s economy, all companies are contending with a dynamic business environment characterized by volatile commodity prices and exchange rates, a shaky global financial system and slow growth in many countries. Many of them rely heavily on desktop spreadsheets to support the data collection and analysis related to their capital-asset planning. However, spreadsheets have inherent limitations that make them the wrong choice.

Read More

Topics:

Big Data,

Planning,

SAP,

Office of Finance,

Operational Performance Management (OPM),

Planview,

Budgeting,

contingency,

IBM,

Oracle,

Business Performance Management (BPM),

Financial Performance Management (FPM),

agile,

capital spending