The Office of Finance Research Agenda for 2017

Senior finance executives and finance organizations that want to improve their performance must recognize the value of technology as a key tool for doing high-quality work. Consider how poorly your organization would perform if it had to operate using 25-year-old software and hardware. Having the latest technology isn’t always necessary, but it’s important for executives to understand that technology shapes a finance organization’s ability to improve its overall effectiveness.

Finance must use technology to support improvements to processes and to enable its people to focus on work that provides the most value to the operating results of the company. Technology underpins the department’s ability to be proactive, action-oriented and strategic in providing analyses and methods that enhance its capabilities and improve the performance of the entire corporation. For example, analytics can enhance understanding and visibility, giving executives the ability to make better decisions consistently. Finance professionals also should recognize that the role of technology is ever more important as a result of the cumulative impact of a decade’s worth of technology evolution and the demographic shift from executives and managers of the baby boom generation to those who grew up with computer technology. These demographic shifts will drive demand for a new generation of software that emphasizes easier collaboration, mobility and agility.

On the horizon is the practical application of data science to the finance functions. Much of the department’s workload involves repetitive processes that require the application of rules. Today, individuals are required to apply their training and judgment to perform these processes. In the future finance applications increasingly will apply machine learning to these tasks, substantially reducing human workloads. Machine learning employs data science algorithms that have the capability to adapt (that is, learn) as the system observes more data and more outcomes. Business applications increasingly will incorporate artificial intelligence - the application of machine learning algorithms – in ways that mimic how a human might respond to or manage a process. The result should be a significant increase in departmental efficiency and, with those savings of time and effort, the ability to shift the department’s focus from processing transactions to doing more analytical work.

Of course, technology by itself cannot transform a finance organization. Traditionally, finance and accounting departments have been viewed as passive and reactive. For the department to take maximum advantage of technology it must take an active, forward-looking role in managing the company. Yet most of the longstanding issues that Finance must address to improve its performance can be fixed only by using information technology as the keystone in addressing interrelated people, process and data issues in a comprehensive fashion.

Our research agenda for the Office of Finance in 2017 emphasizes three broad technology-related themes:

- Applying a continuous accounting approach to promote greater departmental efficiency, which in turn enhances finance department effectiveness

- Adopting technology that promotes action-oriented continuous planning – that is, using rapid, short planning cycles to promote agility, coordination and accountability

- Using software and other information technologies to achieve continuous optimization to promote ongoing organizational alignment across departments and business units.

We will take various approaches to investigate and expand on each of these themes.

Continuous Accounting

We use the term “continuous accounting” to identify three areas where our research consistently finds tactical roadblocks to achieving a more strategic finance organization. By focusing on these three areas, finance executives can achieve steady gains in effectiveness.

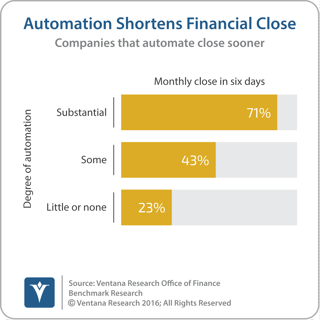

The first area concerns how the organization uses technology and manages information. To enhance its effectiveness, finance departments must use software to automate all mechanical, repetitive accounting processes in a continuous, end-to-end fashion. Automation improves efficiency by eliminating the need to have people perform repetitive tasks. End-to-end process automation improves departmental efficiency. For example, our Office of Finance benchmark research shows that most (71%) companies that automate substantially all of their financial close complete the close within six business days of the end of the quarter, compared to 43 percent that automate some of the process and just 23 percent that have automated little or none of it. Using software enables the department to manage the flow of data through its processes in a continuous fashion. This ensures data integrity. Data integrity is undermined every time data is re-entered manually or when a spreadsheet is used in a process – for example, when data from one system is manually transferred to another, when the same information is entered twice in two different systems or when a spreadsheet is used to perform some allocation or a set of calculations. Ensuring data integrity eliminates the need for checks and reconciliations that can consume valuable time.

The first area concerns how the organization uses technology and manages information. To enhance its effectiveness, finance departments must use software to automate all mechanical, repetitive accounting processes in a continuous, end-to-end fashion. Automation improves efficiency by eliminating the need to have people perform repetitive tasks. End-to-end process automation improves departmental efficiency. For example, our Office of Finance benchmark research shows that most (71%) companies that automate substantially all of their financial close complete the close within six business days of the end of the quarter, compared to 43 percent that automate some of the process and just 23 percent that have automated little or none of it. Using software enables the department to manage the flow of data through its processes in a continuous fashion. This ensures data integrity. Data integrity is undermined every time data is re-entered manually or when a spreadsheet is used in a process – for example, when data from one system is manually transferred to another, when the same information is entered twice in two different systems or when a spreadsheet is used to perform some allocation or a set of calculations. Ensuring data integrity eliminates the need for checks and reconciliations that can consume valuable time.

The second element of continuous accounting involves distributing workloads continuously to flatten spikes, whether in the month, quarter, half-year or year. Distributing workloads eliminates bottlenecks and optimizes when tasks are executed. It reduces stress on department personnel and can eliminate the need for temporary help and its associated expenses. Much of the traditional accounting cycle and related departmental practices are artifacts of paper-based bookkeeping systems. They dictated the need to wait until the end the month, quarter or year to take accountants off line to perform aggregations, allocations, checks and reconciliations because that rhythm represented the best trade-off of efficiency and control. Today’s systems offer flexibility that enables departments to spread workloads more evenly over time.

The third aspect of continuous accounting is instilling a departmental culture of continuous improvement. This counters the tendency of any organization – but especially finance – to embrace a “we’ve always done it this way” mindset that resists needed change. Continuous improvement acts as a mission statement designed to instill a departmental culture that sets increasingly rigorous objectives.

Used as an organizing principle for the department, continuous accounting frees time and therefore the resources needed to implement changes that will produce performance improvements in a sustained and steady fashion. Adopting a continuous accounting approach enables CFOs and finance executives to reduce the amount of time spent “fighting fires,” many of which are the result of using unwieldy technology. A continuous accounting approach can help the department become more strategic, forward-looking and action-oriented.

The Transformation of ERP

In most companies, ERP systems are the backbone of the accounting function, and this software category will continue to be an important area of our research focus for 2017. The ERP software market is set to undergo a significant transformation over the next five years. At the heart of this transformation is the decade-long evolution of a set of technologies that allow for a major shift in the design of these systems – and it amounts to the most significant change since the introduction of client/server computing in the 1990s. Vendors are seizing on technologies such as in-memory computing, improving the user interface and user experience, adding more in-context collaboration and extending the use of mobility to differentiate their applications from rivals. Those with software-as-a-service (SaaS) subscription offerings are investing to make their software suitable for a broader variety of users in multitenant clouds. We will release the results of our next-generation ERP benchmark research soon.

Financial Performance Management

We’ll also continue to look at the application of financial performance management (FPM) to improve results. Ventana Research defines FPM as the process of addressing the often overlapping issues that affect how well finance organizations support the activities and strategic objectives of their companies and manage their own operations.

FPM deals with the full cycle of the finance department’s functions, including corporate and strategic finance, planning, budgeting forecasting, analysis, closing, reporting and statutory  filing. In each of these areas, not using the appropriate technology has a negative impact on how well a company performs.

filing. In each of these areas, not using the appropriate technology has a negative impact on how well a company performs.

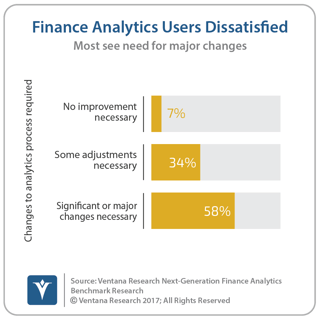

We will continue to highlight the importance of using analytics. For example, our Office of Finance research finds that on average, companies that are heavy users of spreadsheets in their closing process take longer to close their books than those that limit them or don’t use them at all. Our next-generation finance analytics research exposes a lack of satisfaction with finance analytics in participating organizations: 58 percent said that significant or major changes are necessary while just 7 percent stated no improvements were necessary. Other findings show that the heavy use of spreadsheets for all forms of analysis is at the heart of this dissatisfaction.

Financial planning and analysis groups should be using FPM software to facilitate planning. A continuous planning approach uses frequent, short planning cycles to increase agility, coordination and accountability in organizations’ operations. Such an approach includes establishing an ongoing dialogue between finance, line-of-business managers and executives to track current conditions as well as changes in objectives and priorities driven by markets and the business climate.

To manage planning in such a comprehensive way requires dedicated software that substantially enables members of the FP&A organization to focus more of their time on analysis and modeling. Technology also enhances the quality of plans, forecasts and budgets. In particular, in-memory computing makes it feasible to rapidly process computation of even complex models with large data sets. Consequently, it can expand the range of planning, budgeting, forecasting and reviewing performed in rapid cycles. It enables organizations to run more simulations to understand trade-offs and the consequences of specific events, as well as change the focus of reviews from what just happened to what to do next.

Another element in FPM is “composite documents,” in which text is created and edited collaboratively by multiple contributors and which incorporates tabular and numerical data from multiple sources in a controlled process. Almost all finance departments create and use composite documents. They often have formats defined by law, regulation or contract and must be created at periodic intervals. Using software to automate and control the creation of composite documents for external or internal users can substantially cut the risks of errors and missed deadlines. This software can be used broadly to address multiple regulatory and legal requirements in the finance, legal, internal audit and other departments.

In 2017 we’ll publish the next installments of our Value Index for Financial Performance Management and for Business Planning and present new insights on business planning and on the financial close.

Price and Revenue Management

More businesses are using software to implement and support a strategic pricing strategy designed to optimize revenue and margins in business-to-business (B2B) transactions because it can help them improve results at the bottom line. “Optimize” in this instance means managing the trade-off that usually exists between revenue and profitability objectives in order to support a company’s strategy and capabilities in a given market. Business-to-business price and revenue management is Ventana Research’s term for such processes and applications. Software built for this purpose centralizes control and enforces consistency in pricing while assisting sales agents in negotiating prices that achieve desired business objectives. It provides agents with data-driven guidance that can increase the revenue from a transaction, the margin on the sale or the probability of closing the sale.

The use of analytics to manage pricing became established in the 1980s in the travel and hospitality industries. More recently it has gained acceptance in financial services and in retailing. B2B price and revenue management software is gaining acceptance, but the market is at the early stages of penetration. Our Office of Finance benchmark research finds that just 15 percent of companies use analytics to optimize their pricing, that only one-fourth (26%) use analytics to manage customer profitability and that fewer than one-third (29%) manage product profitability that way.

Our research coverage of price and revenue management software will expand in 2017. We will publish a Value Index assessing software offerings for this market.

Sales and Operations Planning for Finance

Companies that deal in physical goods that are manufactured or sourced and then sold directly or into distribution channels often benefit from using sales and operations planning (S&OP). The process of orchestrating the flow of parts and materials through the production process to meet expected customer demand involves many functional units, each of which make plans, as well as the finance organization, which assesses the financial impact.

Sales and operations planning is a discipline aimed at aligning and optimizing the plans of several business units. There are sales plans, product plans, demand plans and supply chain plans. Within a corporation, the performance of each of the functional units that produce these plans is assessed through different, often conflicting metrics. Information technology enables corporations to manage their inventories more skillfully and achieve a more optimal balance of minimizing their working capital investment while maximizing their ability to fulfill demand.

S&OP is designed to align a company strategically so that it can execute tasks more effectively. The ultimate goal is to determine how best to manage company resources, especially inventory and cash, to be able to profitably satisfy customer demand with the lowest incidence of stock-outs. The output of an S&OP group is a SKU-level demand forecast that is used to create a detailed inventory plan. This quantitative plan is a major driver of a process that guides the purchasing an optimal amount of inventory (the one that best balances desired fulfillment rates while minimizing the investment in inventory) from the best set of suppliers (balancing a range of considerations including goods availability, pricing, discounts, economic order quantities and supply chain constraints). To enhance their strategic value, the financial planning and analysis group should play an integral role in the sales and operations planning process. Look for new insights from us on S&OP in 2017.

Tools for Promoting Productivity and Effectiveness

The Office of Finance practice will continue to focus on software categories that can improve corporate efficiency, increase visibility and enhance agility. The main objective is to enable finance organizations to be more effective by eliminating the root causes of low-value activities that waste time.

For example, companies increasingly are adopting a subscription business model, especially in technology services but increasingly as service add-ons to industrial products. While some ERP systems have the ability to handle a subscription revenue business model, not all do. Moreover, larger companies may find that a dedicated subscription billing application is necessary to deal with their complex requirements. Companies need to automate contract-to-collect as a unified end-to-end process to control the flow of data from the initial configuring, quoting and pricing of the subscription contract all the way to billing and collection. Using this type of automation to ensure data quality enables companies to achieve two usually conflicting goals: substantially reducing finance and accounting department workloads while still enabling sales and marketing to offer their customers flexibility in setting special offers and terms.

Managing Taxes More Intelligently

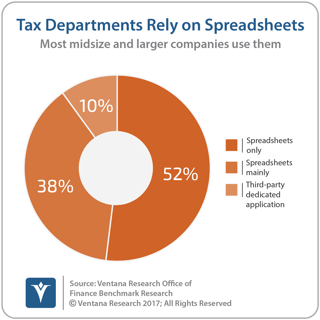

Taxes are one of the biggest expenses corporations face. Most of them manage income tax provision and analysis in long-outdated ways using inflexible technology tools. Our research confirms that most companies use spreadsheets to manage their tax provision and analysis: Half (52%) rely solely on spreadsheets, and another 38 percent mainly use them. The issue with using spreadsheets in the tax function is that they consume time, limit visibility for senior executives and pose unnecessary risks through errors. We recommend to corporations that operate in multiple countries and that have even a moderately complex legal entity structure consider using tax provision software that is supported by what we call a tax data warehouse of record. This type of data store maintains a corporation’s tax-sensitized data as it was originally recorded, along with all of the year-to-year adjustments. A dedicated tax data warehouse also makes preparing country-by-country reporting far more reliable than using spreadsheets and supports more robust tax analytics and planning.

International companies are facing intense scrutiny of their tax positions and can benefit from using dedicated software to manage their taxes more intelligently. In addition, there are indirect taxes. These include sales and use taxes, and value-added taxes. In the United States, sales taxes are notoriously complex to administer. We recommend that any company with 100 or more employees doing business in more than a handful of states should use a sales tax service for the same reason those companies almost always use a payroll service: It’s not worth the time, hassle and potential liability to do it in house.

The Impact of Changes to Accounting Rules

The Office of Finance practice at Ventana invests a great deal of time researching software applications and related information technology. Uniquely among analyst firms, though, we also read accounting bulletins. The world of accounting is undergoing a substantial change during the next three years as a result of the adoption of accounting rule changes for revenue recognition and, to a lesser extent, lease accounting. The impact of changes on revenue recognition will be profound because it is built on a different conceptual framework than classical accounting. Systems must account for revenue and expenses in a parallel fashion rather than in a balancing one. This type of approach would have been extremely problematic in paper-based systems. It’s feasible only because of the nearly universal use of computerized accounting systems. Almost all ERP vendors are gearing up to support the new accounting rules, but it’s important for companies to plan ahead to make the transition as smooth as possible. And it’s important to be sure that sales contracts and documentation are designed to make accounting for them as efficient as possible.

Technology’s Role in the Office of Finance

One major reason for investing in technology is to help senior executives achieve better results through more effective business management techniques. For example, our benchmark research on long-range planning demonstrates that better management of technology and information can improve alignment between strategy and execution. And when it comes to cloud computing, far from simply being a technology concern, it enables corporations to cut costs and gain access to more sophisticated technology than they could feasibly support in an on-premises deployment. Using technology can boost performance. The improper use of spreadsheets as seen in our research continues be an unseen killer of corporate productivity because they have inherent defects that significantly reduce users’ efficiency in performing these tasks. Time wasted on spreadsheets makes it impossible to find the time to improve performance. Companies now have inexpensive options that are easier to use and enable more advanced, reliable modeling, analysis and reporting.

Information technology is an essential element of business management and promotes a discipline of continuous optimization, a term we use to emphasize the importance of improving alignment of organizations to a company’s strategy. Yet many senior executives and managers have insufficient understanding of IT’s full potential, much as those managing corporate information technology usually don’t appreciate business issues and how IT can address them. The business/IT divide is a barrier that prevents many companies from achieving their performance potential, but this divide need not exist. Business executives don’t have to be able to write Java code or master the intricacies of an ERP or sales compensation application. However, CEOs and executives should master the basics of IT just as they must understand the fundamentals of corporate finance, the production process and – at least at a high level – the technologies that support that process.

Our research practice addresses the significant business issues that technology plays an important role in addressing. Because business is dynamic, optimization must be continuous to adapt to changes in markets, the competitive landscape and customer demands. Continuous optimization requires companies to operate with faster cycles and real-time visibility in order to improve responsiveness and agility. Information technology can remove the barriers that prevent companies from achieving more optimal results. Please follow our efforts throughout this year to identify powerful software and explain how it can help the finance department and its entire corporation prosper.

Regards,

Robert Kugel

Senior Vice President Research

Follow me on Twitter @rdkugelVR

and connect with me on LinkedIn.

Authors:

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for Ventana Research, now part of ISG. His team covers technology and applications spanning front- and back-office enterprise functions, and he personally runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).