The theme of transforming the finance organization is hot again. The term “finance transformation” refers to the longstanding objective of shifting the focus of finance departments from transaction processing to more strategic activities such as providing the rest of the organization with forward-looking analysis. I focus on the technology and data aspects of this type of business issue in these analyst perspectives because they are usually essential to achieving some business objective. However, technology rarely fixes a problem by itself. If it were a simple matter of just buying software or having better data stewardship, it would be relatively easy to achieve finance transformation. But it’s not simple at all. When it comes to changing how the finance and accounting organization operates, there’s no substitute for leadership. Doing that requires changes in the habits of the department, which include the CFO changing how the department works with the rest of the company.

Our benchmark research on the Office of Finance confirms that most company executives want their finance department to take a more strategic role in running the company. It also shows little progress in achieving finance transformation. To be sure, there are enough examples of the finance organization taking the lead to provide trade publications and vendors with case histories, but for the majority progress has been slight. When we compared the attitudes of executives and managers about the finance department’s performance generally, we found a big disconnect between how well people in Finance think they’re doing and what the rest of the company believes: Half of research participants who have finance titles said that the department plays an important role in their company’s success, but just one-fourth (24%) of the rest of the company said that. In fact, most people outside of the department said that Finance is doing only an adequate job.

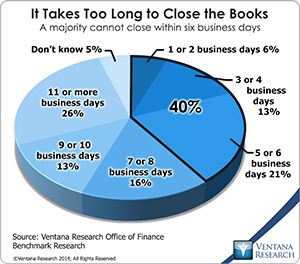

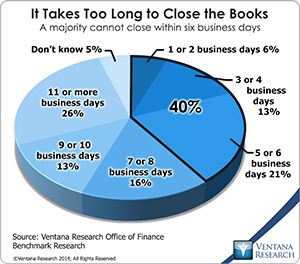

As with most situations in business, there are multiple factors that prevent finance departments from becoming more strategic. The accounting close illustrates the range of challenges that finance executives may have to overcome in improving the department’s performance. Closing the books within one business week is generally acknowledged to be a best practice in finance. Yet our research finds that only 40 percent of companies complete the quarterly close in six or fewer business days and 53 percent close monthly in the same period. To accelerate the close, finance executives often must address multiple issues to improve performance.

that prevent finance departments from becoming more strategic. The accounting close illustrates the range of challenges that finance executives may have to overcome in improving the department’s performance. Closing the books within one business week is generally acknowledged to be a best practice in finance. Yet our research finds that only 40 percent of companies complete the quarterly close in six or fewer business days and 53 percent close monthly in the same period. To accelerate the close, finance executives often must address multiple issues to improve performance.

Technology plays an important role in accelerating the close. Our research correlates using more automation and fewer manual spreadsheets in the close process with closing the books sooner. But that might not be the only thing that’s holding up the close. Another factor – one that’s hard to measure – is the impact of other parts of the business on preventing the department from finishing the process in a timely fashion. For example, nonfinance processes (such as doing inventory) that aren’t completed until the second or third week of the following month may hold up completion. The accounting organization has no direct control over when work performed in other departments is done. And those outside the finance organization may resist making these changes, which may seem to them arbitrary or unwarranted burden-shifting.

Some issues that hold up the close or create avoidable work in finance and accounting departments are not always easy to spot. For example, I recently wrote that companies that have even slightly complicated revenue recognition requirements under the new accounting rules ought to write and manage their contracts with customers with the explicit aim of minimizing the workload of the accounting department. Contracts that are poorly or inconsistently drafted or that do not enforce common language will make finance departments hire additional staff or temporary accountants and potentially delay the quarterly close. In addition, those working outside of the accounting department often don’t realize that they are doing things that complicate the accounting process. This is especially the case when, for instance, data is collected in spreadsheets rather than in a dedicated enterprise system or when the data entered is incomplete, inconsistent or not collected at all. Often, it’s less burdensome to address the source of the accounting hassle at the source. Here is another situation in which leadership matters. Unless the senior leadership team understands the ultimate impact of, say, people not following procedures or neglecting to fill in a couple of fields on a form, it’s unlikely they will be motivated to enforce the changes that must be made. It’s even harder if the CFO does not have a good working relationship with the rest of the organization or cannot effectively communicate the need for change.

A truly strategic finance organization is one that embraces continuous improvement, uncovering the root causes of time wasting activities, addressing them methodically and investing the time saved into finance transformation projects. Addressing the sources of time-wasting finance and accounting processes requires a CFO who is unwilling to accept the status quo and has sufficient interpersonal skills to drive change. The senior leadership team also has to support a more strategic finance department. For example, the CEO needs to make it clear that closing sooner is everyone’s business and with good reason. How soon after the end of a period the finance organization closes its books affects the timeliness of the information it provides to the rest of the organization: In our research, half of companies that complete their monthly close within four business days said the information the finance department provides is timely, compared to just 29 percent of those that take five to eight business days and 19 percent of those that take nine or more business days.

Implementing change in business is never easy. Finance transformation almost always requires fixing information and technology issues, especially those that automate and enhance control of finance and accounting processes. Without leadership by the CFO, though, very little will happen.

Regards,

Robert Kugel – SVP Research