Oracle’s Modern Finance Experience is Robotic

After more than a decade of steady development, ERP systems today are changing fundamentally, facilitated by the availability of advances such as cloud computing, advanced database architecture, collaboration, improved user-interface design, mobility, analytics and planning. This was evident when Oracle recently held its third analysts-only ERP Cloud Summit in New York to coincide with its Modern Finance Experience event. Oracle now has an increasingly robust set of business applications that reside in the cloud and a growing list of live customers – large and midsize – from a range of industries across the world, both of which were offered as part of the here-and-now technology theme at the event.

This being a gathering of IT analysts, the summit also emphasized Oracle’s future technology direction, which includes four familiar items: artificial intelligence (AI) and machine learning, blockchain distributed ledgers, bots and robotic process automation. Technologies such as these are beginning to change the familiar landscape of ERP and, more generally, business computing in at least three respects.

First, they will alter the mission of the finance organization and the role of the CFO more profoundly over the next 10 years than technology has over the past 50. Their impacts will change the Office of Finance and its relationship with the rest of the organization. However, the adoption of these technologies will be uneven: High-performing finance organizations will be the early adopters and demonstrate the feasibility and value of using these new technologies to support a transformation of the finance function. But many CFOs will struggle to match their performance. Our Office of Finance research confirms that a majority of finance organizations are laggards when it comes to departmental performance: 51 percent of organizations operate at the lowest tactical level of performance while only 10 percent are at the highest innovative level.

Second, the rapid evolution of information technology means that finance organizations must change their approach to adopting technology. In the past, a wait-and-see attitude often was warranted. On-premises software advanced slowly because orchestrating major releases was complex and extensive customizations made it hard for customers to implement these new releases. This leisurely approach aligned well with the department’s typically conservative practices.

Today, the increasing adoption of cloud-based software makes it easier for vendors to make a steady stream of incremental improvements without having to contend with a multitude of customized environments. CFOs don’t have to embrace a bleeding-edge approach to be successful in this new environment, but they must accept the view that being able to quickly exploit technology is a core competence of their department. As I’ve noted, departments today must develop a “fast-follower” approach to technology adoption to operate as efficiently as possible and to be able to extend the scope of the department so it is a more strategic partner with the rest of the company.

Third, the ability of vendors to find ways to apply artificial intelligence, blockchains, bots and robotic process automation to business applications is likely to result in greater product differentiation than has existed in the past two decades.

-1.png?t=1525271591951&width=300&height=300&name=vr_Office_of_Finance_27_finance_lags_innovation(1)-1.png) Oracle’s shift to cloud ERP is in full swing. The company stated that it has more than 5,000 cloud ERP customers (excluding NetSuite users), up 47 percent from a year earlier. Of those, 2,100 have the Oracle products deployed and in use. More than half of all its cloud ERP customers were not previously Oracle ERP customers. The company also stated that 24 percent of its ERP customers have its human capital management software and more than one-third (35%) are using its platform-as-a-service (PaaS). The last figure is significant because I view the strength of its PaaS offering as a competitive advantage as companies augment the core Oracle functionality with customizations relevant to their businesses.

Oracle’s shift to cloud ERP is in full swing. The company stated that it has more than 5,000 cloud ERP customers (excluding NetSuite users), up 47 percent from a year earlier. Of those, 2,100 have the Oracle products deployed and in use. More than half of all its cloud ERP customers were not previously Oracle ERP customers. The company also stated that 24 percent of its ERP customers have its human capital management software and more than one-third (35%) are using its platform-as-a-service (PaaS). The last figure is significant because I view the strength of its PaaS offering as a competitive advantage as companies augment the core Oracle functionality with customizations relevant to their businesses.

The presentations also emphasized the scope of Oracle’s cloud presence in a wide range of business applications, including human capital management, supply-chain management, procurement, logistics, planning and budgeting, risk management and project management.

Oracle’s sales of its cloud ERP software are following a classic adoption pattern that is reminiscent of client-server ERP. Organizations are testing the technology in a risk-minimization mode. In the early days of client-server computing, human resources management systems often served as the test bed because while this type of system is business-critical, it is a less complex undertaking than implementing an ERP system and it also can tolerate short-term outages. In moving to the cloud, larger corporations for the most part are taking a conservative approach by testing it in subsidiaries rather than core ERP.

Early-adopter companies that I’ve interviewed regard the long-term benefits of cloud computing as outweighing short-term costs of adjusting some of their processes to work with the software. The benefits consist chiefly of some combination of a lower total cost of ownership, better performance, greater security and being able to refocus IT efforts from maintenance to strategic initiatives. And as was the case in the early days of client-server, those adopting the cloud are more focused on achieving better business results with technology than on replacing an obsolete or poorly performing system.

As this successful cohort of adopters demonstrates the value of moving to the cloud and reduces the perceived risk of doing so, it continues to move business closer to the point where companies facing the necessity of replacing their core ERP system see as much risk in implementing an on-premises system (for fear that they’re buying an obsolescent technology) as in moving a business-critical system to the cloud.

That noted, I expect that companies will continue to replace their existing ERP systems only when the state of that software threatens their ability to handle daily business activities. The cost and disruption entailed in changing ERP software is such that it’s done infrequently. Our research shows that the average age of the core ERP systems is seven years. However, in coming years replacement may accelerate if vendors can provide compelling reasons to replace existing software sooner.

As to its future roadmap, Oracle, like many software vendors, emphasized the promise that emerging technologies have for the finance function. “Robotic Finance” is a term that I use to describe the integration of machine learning and artificial intelligence (AI), blockchains, RPA and bots into a full range of finance processes. (You can find my webcast on this topic here.)

These four “robotic” technologies already are in use, albeit some in a limited fashion. Finance organizations use RPA to automate data movements and simple tasks as well as orchestrate more complex processes involving multiple systems such as the accounting close. Bots have multiple uses for the finance function, for example as a user interface to facilitate voice interactions with financial systems. Even though establishing the foundational elements is still underway, blockchain is already demonstrating the wide range of uses to which it can be applied. Machine learning and artificial intelligence will redefine white-collar work, especially accounting.

Oracle is well positioned to be a leader in applying robotic technologies to business applications. Moreover, currently Oracle has a broad portfolio of business applications that will enable it to amortize its investments in advanced technologies over a potentially larger set of customers. For now, though, the technologies have not yet advanced to the point where they offer significant capabilities and therefore points of differentiation that influence companies’ buying decisions.

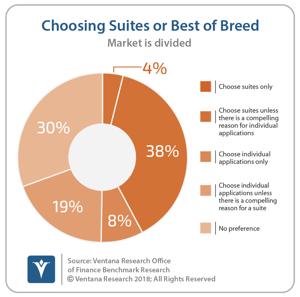

Oracle’s ability to offer a “full stack” of a technology infrastructure and applications in the cloud –servers and storage, database and middleware, and business applications – provides it with competitive advantages. One is that it will appeal to organizations that want to purchase full suites of software from a single vendor. Although our Office of Finance research finds that the market is divided on the issue of buying suites versus individual applications (sometimes referred to as “best of breed”), more prefer full suites (42%) than individual applications or “best of breed” (27%).

Oracle’s ability to offer a “full stack” of a technology infrastructure and applications in the cloud –servers and storage, database and middleware, and business applications – provides it with competitive advantages. One is that it will appeal to organizations that want to purchase full suites of software from a single vendor. Although our Office of Finance research finds that the market is divided on the issue of buying suites versus individual applications (sometimes referred to as “best of breed”), more prefer full suites (42%) than individual applications or “best of breed” (27%).

An important source of differentiation in Oracle’s cloud offering, and its second competitive advantage, is its Adaptive Intelligent Applications approach. Adaptive Intelligent is Oracle’s label for its applications that marry third-party data with real-time analytics as well as machine and behavioral learning. “Adaptive” means that the applications can mold to how organizations behave rather than forcing users to adjust to how the software works. The objective is to embed in its business applications situational awareness that simplifies how individuals perform tasks and provides executives, employees and customers with recommendations tailored to their specific needs in the immediate context. This approach utilizes a key advantage of cloud applications: Vendors are able to bring their expertise and economies of scale to bear in expanding the scope of their services to provide capabilities that, for cost or other practical reasons, most customers couldn’t duplicate on their own premises.

Oracle’s ERP Cloud Summit demonstrated the company’s progress in transitioning its ERP software business to the cloud and in making available robotic technologies that have the potential to transform finance organizations in the coming decade more substantially than has been the case over the past century. All the use cases presented at MFE and the analyst summit highlight practical advantages and many may well be available within five years.

However, Oracle will need to demonstrate more precisely how it’s going to deliver on that promise. And Oracle, like all vendors, will need to show that its offerings and services are so compelling that it will be able to overcome the traditional unwillingness of finance and accounting organizations to change.

Regards,

Robert Kugel

Senior Vice President Research

Follow me on Twitter

and connect with me on LinkedIn.

Robert Kugel

Executive Director, Business Research

Robert Kugel leads business software research for ISG Software Research. His team covers technology and applications spanning front- and back-office enterprise functions, and he runs the Office of Finance area of expertise. Rob is a CFA charter holder and a published author and thought leader on integrated business planning (IBP).